Which investment strategy is better for beginners, growth or value? That’s the burning question when you’re standing at the crossroads of building a financial future. As you map out your investment journey, you’ll find these two paths vying for your attention. Growth investing is like a speedboat, racing towards high earnings with companies that are the talk of the town.

On the other hand, value investing is the sturdy sailboat, finding stocks at a discount that others have overlooked. But hey, don’t just pick your ship and set sail blindly. You need to understand what’s beneath the surface, what powers each strategy, and how they can weather the market’s storms. It’s not just about the rate of return. It’s about matching your moves to who you are as an investor. Are you ready to dive in? Let’s break it down and make sure your choice not only makes cents but sense too.

Understanding Growth and Value Investment Strategies

Defining Growth Stocks and Value Investing

Let’s cut to the chase: what are growth stocks? Growth stocks are shares in companies that grow at a rate above the average for the market. They are the ones making waves, expanding fast, with profits expected to rise at an above-average rate. When you look for growth stocks, you are looking for the stars of tomorrow.

On the flip side, what is value investing? This is a strategy where one looks for stocks that trade for less than their intrinsic values. Think of it as finding hidden gems. Value investors seek out these diamonds in the rough. They hunt for stocks that the market has overlooked.

So, how do you pick between these two paths? It comes down to your financial goals and how much risk you’re up for. Growth stocks can shoot up fast, offering high returns. But watch out, they can also drop just as quickly. They’re like the fast cars of investing – thrilling, but with more risk.

Value stocks are more like sturdy, reliable trucks. They might not dash ahead, but they often do well over time. They might have been battered by the market for reasons that don’t match their true worth. As a result, they can give solid returns once the market smartens up and sees their real value.

Historical Market Returns for Growth and Value Stocks

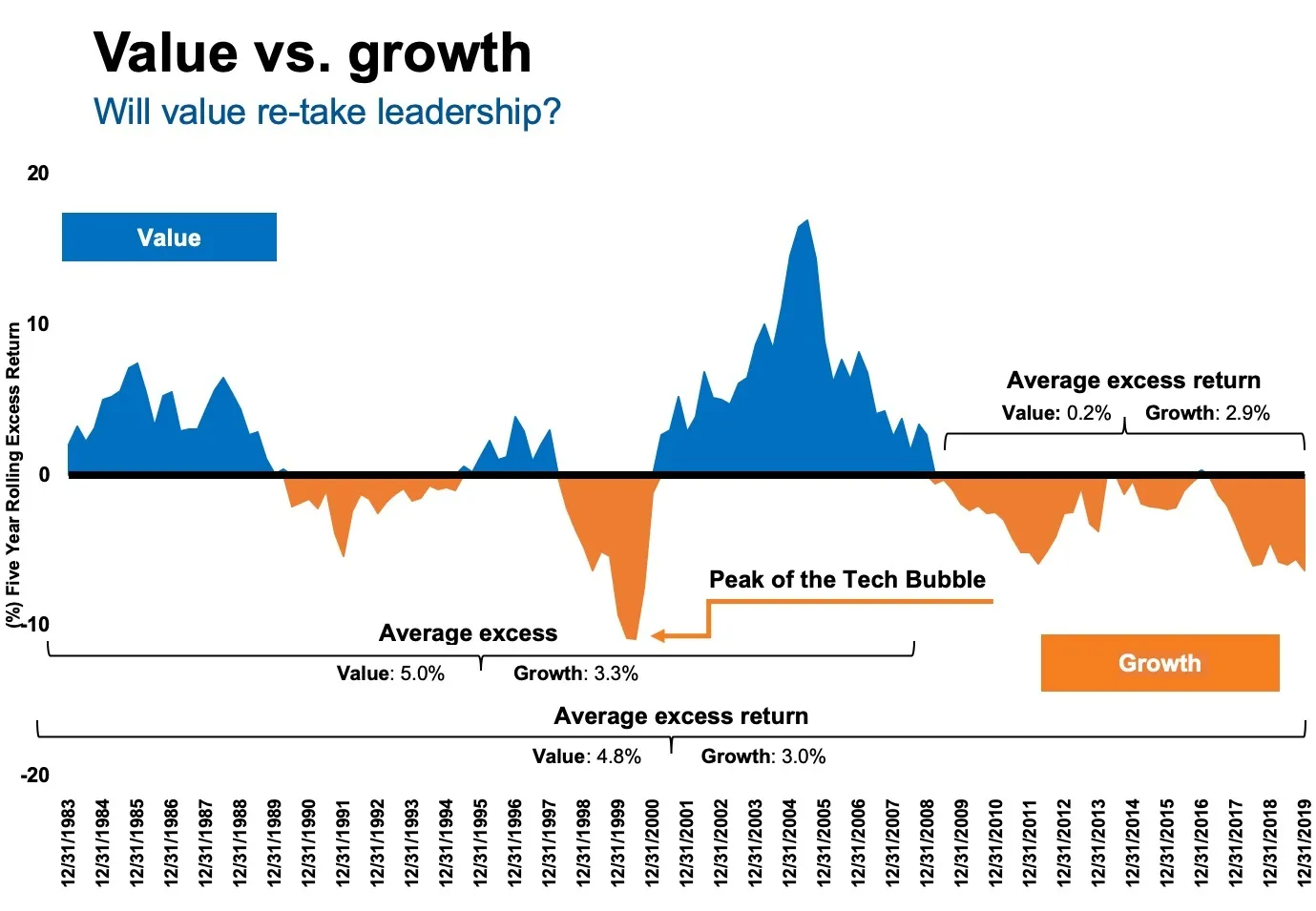

Now, if we peek back in history, we can learn a lot. History shows us that growth and value stocks have had their moments in the sun. Sometimes growth shines, sometimes value. But knowing when each will surge is tricky.

It’s helpful to look at the performance of these stocks against something stable like the S&P 500 index. Historically, value stocks have had periods of outperforming the market. They tend to shine when growth stocks are stumbling.

For example, during tech busts, when those high-flying growth stocks have taken nasty spills, value stocks often stood strong. They kept chugging along, and investors who backed them reaped rewards when growth was in the dumps.

But don’t count out growth easily. There have been times when growth stocks leap ahead. They sprint forward leaving value stocks inching along. When the market is hungry for innovation, and investors are willing to take risks for big rewards, growth stocks are the names on everyone’s lips.

The game is all about balance and timing. For beginners trying to navigate these waters, remember this: check the historical market returns. They are your compass as you set sail in the vast ocean of the stock market. They help you see how growth and value stocks have played out in the past. And while history is not a crystal ball, it can sure give you some clues.

To sum things up, beginners need to think about their comfort with risk, and the speed at which they want their money to grow. Growth and value investing are two sides of the same coin. They both have their perks and pitfalls. Knowing which strategy feels right for you is a big step on your investment journey. And remember, the stock market is a long game, so choose wisely, pace yourself, and stay informed.

Determining Your Investment Approach

Assessing Risk Tolerance and Financial Goals

As you start investing, think hard about your comfort with risk. Are you okay seeing the value of your investments go down sometimes? This will happen, but it’s normal. Also, figure out why you want to invest. Is it to buy a house, retire early, or maybe pay for school?

Asset Allocation and Diversification Strategy for Beginners

Choosing where to put your money is a big deal. Don’t put all your eggs in one basket. Mix it up with different kinds of investments. Start with things that don’t cost a lot, like index funds that copy parts of the market, like the S&P 500. These funds have lots of different stocks in them.

Now let’s get real about growth and value investing. People like to talk about growth stocks because they can make you money fast. These are companies that grow quick, like tech ones. They’re exciting but can be up and down.

Value investing is more chill. It’s about finding companies that cost less than they’re truly worth. This could mean they’ve been around a while and are steady, like companies that make things we always need.

So, what’s better for new investors? There’s no one answer. Each person is different. Think about those goals we talked about and what you’re cool with when it comes to risk.

Some famous investors have made a name for themselves using these methods. Warren Buffett loves value investing. He looks for solid companies with a good price. Peter Lynch is another big name. He mixed it up, buying both growth and value stocks.

Don’t rush. Take your time learning the stock market basics before jumping in. Watch out for common beginner investor mistakes, like falling for trends without doing enough homework.

Get your head around some numbers too. Things like price-to-earnings ratio can show if a stock’s a good deal. Also learn about dividends. In value investing, dividends can be a way to make money while you wait for the stock’s price to go up.

Long-term investments are usually better for beginners. The market goes up and down, but over time, it often goes up more than down. So when you’re starting, your goal is often to build wealth over many years.

Remember to check up on your investments. But don’t freak out and sell if things dip a bit. Staying put can be smart. Your money can grow more if you let it sit.

And hey, everyone makes mistakes. Even big-time investors mess up sometimes. Learn from those slip-ups. Maybe you choose a bad stock. That’s okay. Find out why it wasn’t great, and use that for next time.

Getting the hang of investing is like learning to ride a bike. It’s wobbly at first, but once you get it, you’re set. Start slow, learn lots, and don’t be afraid to ask for help. That’s how you’ll rock the investment world!

Key Principles in Stock Selection and Portfolio Management

Fundamental Analysis and Stock Valuation Methods

When you pick stocks, think like a shop owner. Would you buy a shop without knowing what it earns or what it’s worth? No, right? That’s what fundamental analysis is—looking under the hood of a company. You check how much money the company makes and what could affect its earnings. It’s like checking a car’s engine before you buy.

Stock valuation methods help you figure out how much to pay for that “engine.” Think of it as a comparison. If two cars, car A and car B, have the same engine, but car A is cheaper, you’d pick car A, right? That’s what we do with stocks. We compare prices to earnings and other numbers to pick the best deal.

Learning from Warren Buffett and Benjamin Graham

You’ve probably heard of Warren Buffett, the wise investor guy with billions. He learned from another smart fellow, Benjamin Graham. Graham taught that a stock is part ownership in a business. And a smart business owner doesn’t panic when prices drop for no good reason. They know what they own and its true worth.

Buffett also says that it’s not just about buying cheap. It’s about buying good companies at fair prices. Imagine buying the best bike in town. If it’s at a price that makes sense, you’ll ride happily for years. That’s buying a blue-chip stock—a fancy name for a strong, well-known company.

Now, imagine saving money and putting it into a bunch of different bikes. So, if one breaks, you’re still okay. That’s diversification, and it reduces the risks.

Finally, buying value stocks means you’re looking for deals—companies priced lower than their real worth. And growth stocks are like seeds that can grow into big trees—companies that can earn more in the future.

Remember, investing is not just about picking stocks. It’s about knowing how much they’re worth, understanding your own mind with money, and spreading your bets. With these skills, you can build a money-garden that could bloom for years to come. But it takes practice, so start learning these principles, and little by little, you’ll get there.

Tailoring Strategies to Market Conditions and Personal Goals

Recognizing the Role of Market Capitalization and Dividends

Picking stocks isn’t just about price tags. Market cap tells us company size. Bigger isn’t always better, but it can mean more stability. Think of market cap like a boat in the ocean. Big ships, like blue-chip stocks, handle waves better.

Now, let’s chat about dividends. Dividends are your share of a company’s profit. Value stocks often pay them. They are like getting paid while you wait for the stock to rise.

Dividends matter. Why? They offer income, even if the stock’s price doesn’t jump much. For new investors, they’re a double win. You get steady cash and a chance for stock price hikes. It’s crucial in choosing value investing for the long haul.

Identifying High-Growth Opportunities and the Importance of Earnings Growth

Growth stocks are the hotshots of the stock world. They don’t usually pay dividends because they reinvest profits. This stirs fast growth and, that’s right, high growth potential. But these stocks are a bit like race cars. They go fast but can crash hard.

Earnings growth is the fuel for these race cars. When companies earn more, the stock usually goes up. That’s good for you. It’s the main draw of picking growth stocks.

When you look for growth, check the earnings growth. It tells you if a company keeps growing fast or if it’s slowing down. It’s crucial to know, especially for stock selection criteria. Remember, fast earnings growth often leads to high stock prices down the road.

For novice investors, understanding market cap and dividends sets the stage for value investing. Spotting earnings growth leads to growth stock wins. Choose wisely, with your goals and the current market in mind. Diversify, and you’re on your way to smart investing!

We’ve dived deep into growth and value investment strategies, exploring how to spot growth stocks and understand value investing. We learned that each has its place in the market, with historical data showing varied returns. You must weigh these facts when you create your investment plan.

Investing is not one-size-fits-all. It’s crucial to know your risk comfort and financial aims. With asset mix and diversification, even a beginner can invest wisely.

The way you pick stocks and handle your investments matters. We looked at how to analyze a stock’s true worth and learned from the greats like Buffett and Graham. They teach us that a solid investment choice is more math than magic.

Finally, we matched strategies to the current market and personal goals. Size and dividends matter, and spotting companies with strong earnings growth is key.

Investing can seem tough, but with these insights, you’re better equipped. Go out there and make smart choices that align with your goals and the market’s pulse. Your portfolio will thank you.

Q&A :

What is the difference between growth and value investment strategies for beginners?

Growth investment strategies focus on acquiring stocks of companies that have the potential for above-average earnings growth, while value investment strategies seek out undervalied stocks with good fundamentals that are priced below their true market value. Beginners need to weigh their risk tolerance and long-term goals when deciding which strategy suits them best.

Which investment strategy typically offers higher returns, growth or value?

Historically, both growth and value investment strategies have periods where they outperform each other. Growth stocks can provide higher returns due to their potential for rapid earnings expansion, but they also present greater risk. Value stocks can be more stable and may offer steady returns over the long term. Beginners should consider their investment horizon and their comfort with volatility when choosing an investment strategy.

How do market conditions affect growth versus value investment strategies?

Market conditions play a significant role in the performance of growth and value investments. Growth stocks tend to perform well during economic expansions where innovation and consumer spending are high. Conversely, value stocks may hold up better during economic downturns, as investors seek out stable companies with reliable dividends. It’s important for beginners to monitor market trends and economic indicators when managing their investments.

Is it possible for beginners to combine growth and value investment strategies?

Yes, beginners can combine both growth and value investment strategies to diversify their portfolios. This approach balances the potential high returns of growth stocks with the stability of value stocks, potentially reducing risk. Beginners might consider mutual funds or exchange-traded funds (ETFs) that blend both investment styles.

Are there any specific tools or resources recommended for beginners to help choose between growth and value investments?

Beginners should consider utilizing financial news sources, stock screening tools, and educational resources from reputable investment platforms to understand the nuances of growth and value investments. Consulting with a financial advisor or attending investment workshops can also provide valuable insights to help make informed decisions between these two strategies.