What is the difference between growth and value stocks? You might think it’s just financial jargon, but understanding this can shape your wealth’s future. Growth stocks are like rockets—they soar high, fast, powered by earnings that can leave you breathless. Value stocks, on the other hand, are the hidden gems mined from market overlooks. These are steady ships, steering through market storms, often mispriced gold bars in the stock world. In this post, I’ll guide you through each type, slice through the complex stuff, and show you how to use both to power up your portfolio. Whether you’re aiming for the stars or digging for buried treasure on Wall Street, let’s unlock the power of growth and value stocks—together.

Understanding Growth and Value Stocks

Defining Growth Stocks and Their Key Characteristics

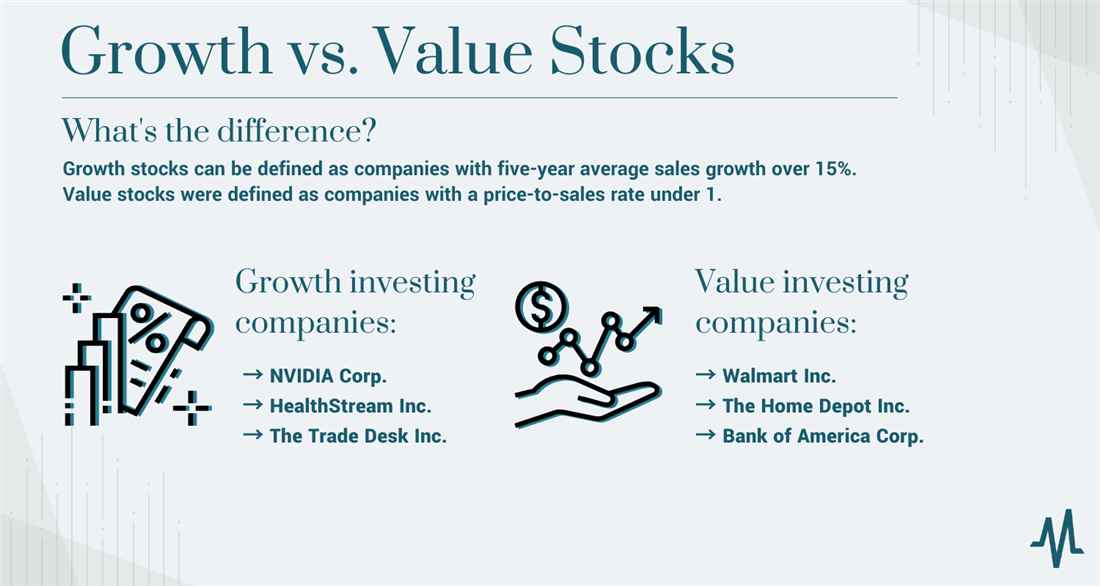

What are growth stocks? They’re shares in companies that grow at an above-average rate. When you think of growth stocks, picture companies like trendy tech startups. They might not make a profit yet. But, they could offer big growth potential. Key signs of growth stocks include:

- High earnings growth records.

- Reinvesting profits over paying out dividends.

- Expectations of above-market average returns.

Growth stock investing fits risk-takers wanting big gains. It can be a roller coaster ride, with ups and downs. Growth vs value investing? Growth seeks quick, often hefty returns. It bets on a company’s potential.

Understanding Value Stocks and Identifying Marks of Value

Now, what about value stocks? Imagine the seasoned players of the market. Companies considered value stocks have established businesses. They sell for less than their worth. How can we spot them? Look for:

- Low price to earnings ratios.

- High dividend yields.

- Prices below their historical norms.

Value stocks are the “buy low sell high” game. They offer steady dividends. And? They could be safer bets than growth stocks, especially in a bear market. They lure investors keen on bargains.

Key takeaway: growth stocks aim for the stars, while value stocks keep it real. Both can win. It depends on how you like to play the stock investment game. Choose the side that fits your risk profile best!

Analyzing Growth vs. Value Investing Strategies

High-Growth Stocks Characteristics and Investor Profiles

Let’s dive into high-growth stocks. They’re exciting! Imagine a rocket zooming up. That’s like these stocks. They grow fast. Their earnings shoot up quicker than others. Young companies often fall in this group. Many work with cutting-edge tech or new ideas. They put all their cash into growing.

You won’t get dividends here. Instead, you hope the stock price goes way up. Then you sell and make a profit. It’s a bit like betting on the star athlete while they’re still in high school. You think they’ll hit the big leagues.

This is for you if you can handle ups and downs. If you love new tech and big dreams, you’re in. But you must take risks. Sometimes, the stocks don’t pan out. Other times, they become the next big thing. Remember, it’s not for the faint of heart.

Now, who invests here? Folks who seek thrills in the market. They’re okay with risk for big rewards. Often, they’re younger. They’ve got time to bounce back if things go south. But even some older investors with a chunk of change might fancy a flutter here. It’s about your risk profile, really. Do you have the stomach for it? If yes, high-growth might be for you.

Reliable Value Stocks and Their Role in Long-Term Wealth Building

Now let’s chat about value stocks. These are the steady Eddies of the stock world. They’re often older companies, solid and stable. Think of brands you’ve known since you were a kid. They won’t zoom like the high-growth ones. But they offer something else – reliability. They’re like a good old tree in your yard. Not the tallest, but firm and there for you year in, year out.

Value stocks are often underpriced. Maybe people overlook them. Or they’re not flashy. It’s like finding a $10 bill on sale for $6. You grab it, right? These stocks may have a low price to earnings ratio. That can mean you get more bang for your buck. They also might pay you dividends. That’s a piece of the company’s profit, handed right to you. It feels pretty good.

Long-term, value stocks can help you build wealth. They might not give you a quick hit of cash. But over time, they grow your money like a wise old garden. You’ll want these if you’re thinking about your future. Maybe you’re saving for a house or retirement. Value stocks can be your solid ground. They’re good for folks who like to sleep at night, knowing their money is tucked in safe.

So, growth vs value investing? It’s not one or the other. Think of your favorite meal. You want a bit of zest, a bit of comfort, right? Same here. A smart portfolio might have both. Some high-growth for excitement, some value for peace of mind. Checks and balances, friend. Mix it up for your best shot at winning.

Key Financial Metrics for Stock Evaluation

Stock Valuation Methods: Price to Earnings Ratio and More

When deciding which stock to buy, looking at numbers is key. One number you hear a lot about is the price to earnings ratio, or P/E for short. Imagine a company that makes $1 per share and has a stock price of $15. Its P/E ratio is 15. That’s like buying $1 of profit for $15. Simple, right?

But wait, there’s more to it. A high P/E could mean a stock is overvalued, or it might signal that people believe the company will grow a lot. On the other hand, a low P/E might mean the stock is a bargain. But it could also mean the company is not expected to do well in the future.

Talking about stock valuation, we shouldn’t stop at P/E ratios. There are other important numbers like the price to book (P/B) ratio, which compares the stock’s price with the company’s book value. Then there’s the price to sales (P/S) ratio, which looks at how the stock price measures up to the company’s sales.

All these methods help us figure out if a stock is priced right or not. And that’s super important for picking stocks, trust me. We can’t just buy low and hope to sell high without understanding why a stock is low in the first place. And if you’re into growth vs value investing, these numbers become even more important.

The Importance of Market Capitalization in Classifying Stocks

Another big idea in picking stocks is market capitalization. That’s a fancy term for how much the total shares of a company are worth. You get it by multiplying the current stock price by the total number of shares. Market cap tells us if a company is a big deal or a smaller player in the market.

Why does size matter? Large caps are often seen as more stable and safe. They’re usually well-known companies that have been around a long time. Small caps can be the total opposite. They are often less stable but can grow fast. That can mean more risk but also more reward.

So, when you think about your investor risk profile, market cap plays a huge role. If you can stand a bumpy ride and hope for big growth, small caps might be your thing. If you prefer a smoother journey with steady wins, look at larger companies.

Whether we like quick, big wins or slow, steady growth, we need to look at the numbers. And that means checking out the P/E ratios, P/B ratios, P/S ratios, and market caps. Remember, investing without these numbers is like driving with your eyes closed – not a good plan!

Market Timing and Stock Selection

Navigating Bear and Bull Markets with Growth and Value Stocks

When a bear market hits, it’s a tough time for investors. Stocks drop and fear rises. But smart moves can still lead to gains. In such markets, value stocks often shine. They’re seen as safe havens with steady dividends and strong histories. Growth stocks, on the other hand, may lose more as investors shy away from risk. But when the market shifts to a bull run, those same growth stocks can leap in value. They ride the wave of investor confidence and high-spending markets.

So, how can you use this in your stock investment strategies? First, know your own risk profile. Are you okay with potential drops for bigger gains later? If you’re more cautious, value stocks might be your match. They often cost less than they’re truly worth. How do you find them? Look for low price to earnings ratios and solid fundamentals.

Leveraging Historical Stock Performance to Inform Investment Decisions

Think about history when choosing stocks. Past trends can help predict future results. In the long term, certain sectors like tech or healthcare often see strong growth. This is because innovation and ongoing need drive their markets. But don’t forget energy or consumer goods. They have a history of steady performance too.

Let’s say you’re picking stocks for the future. Do you focus on new companies set to pop, or ones with a history of slow but steady growth? Here, historical stock performance helps. It shows which stocks have stood strong over time. Both high-growth and reliable value stocks have a place in a balanced portfolio.

When you check a stock’s past, you’re looking for more than just ups and downs. Consider the why behind the moves. Did a tech stock soar due to a new product? Or did a value company stay steady during a crash? This is critical. It tells you about the company’s strength and its managers’ skills.

So, finding balance in your long-term investments is key. Mix growth for future gains with value to protect and steadily build your wealth. Use financial ratios and stock valuation methods to find which stocks are right for you. And always look back before moving forward. What worked in the past might just work again.

We’ve walked through the traits of growth and value stocks, vital for smart investing. From zeroing in on high-flyers with potential to spotting undervalued gems, we understand their place in the market. We’ve also looked at essential metrics like P/E ratios and market cap. You now know how to match your investor profile with these stock types and use market trends to your advantage. Keep these tips in mind, and you can make better, informed decisions for your portfolio. Remember, knowledge is your best tool in the investing world. Use it, and watch your investments grow!

Q&A :

What distinguishes growth stocks from value stocks?

Growth stocks are typically characterized by their potential for high earnings growth, often in newer industries or markets. Investors in growth stocks expect that these companies will generate substantial revenue and earnings increases over time, resulting in higher stock prices. Conversely, value stocks are often associated with established companies perceived to be undervalued by the market. Value stock investors seek out stocks trading for less than their intrinsic value, often based on financial metrics like low price-to-earnings or high dividend yields.

How do growth and value stocks perform in different market conditions?

In general, growth stocks tend to perform better during periods of economic expansion when investors are willing to take on more risk for the possibility of higher returns. In contrast, value stocks often perform well during economic downturns or periods of market volatility, as they are considered to be more stable, income-generating investments. However, there are exceptions, and the performance of individual stocks can be influenced by a variety of factors.

What are the typical characteristics of a growth stock investment?

Growth stock investments are usually defined by a few key characteristics: above-average earnings growth, high price-to-earnings (P/E) ratios, and often, lower dividend yields, as these companies tend to reinvest profits back into the business for further growth. These stocks are often associated with innovative and high-tech sectors and can have significant price volatility.

Can a stock be classified as both growth and value?

While growth and value stocks are typically distinct categories, it’s possible for a stock to exhibit characteristics of both. This might happen when a company that has been growing rapidly (a typical attribute of growth stocks) starts to slow down, creating an opportunity for investors to purchase it at a lower price (an attribute of value investing). These stocks, sometimes referred to as “growth at a reasonable price” (GARP), offer a blend of both investment styles.

How do I decide if growth or value stocks are more suitable for my portfolio?

The decision to lean towards growth or value stocks for your portfolio depends on individual investment goals, risk tolerance, and investment horizon. Growth stocks may be more suitable for investors seeking high capital appreciation and who are comfortable with higher risk and volatility. Value stocks may be more appropriate for those seeking stocks that potentially are undervalued by the market and may carry less risk but also potentially lower returns. Diversification across both types of stocks can also be a way to balance a portfolio’s risk and returns. Consulting with a financial advisor can provide tailored advice based on individual circumstances.