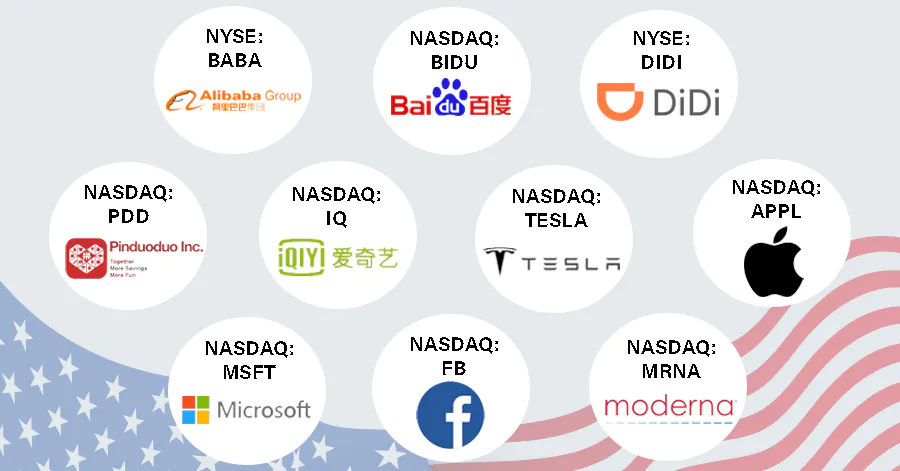

Top 10 Stocks Poised to Skyrocket in 2024: Smart Investors’ Picks

Looking for the Top 10 stocks to invest in for 2024? You want picks that promise growth and value, right? Well, you’re in luck. My expertise has uncovered a list you can’t ignore. From tech giants that redefine innovation to biotech firms pushing life-saving boundaries, these stocks are set for a big year. But it’s not just the flashy names you’ll find here. Sturdy blue-chip stocks and those comfy dividend payers make the cut too, providing that sweet balance of risk and reward. And let’s not forget the industries on the verge of a breakout—renewable energy and electric vehicles—are revving for investor attention. Strap in, as we take a deep dive into emerging tech like AI and cybersecurity, and connect with pioneers of the 5G revolution. Plus, for those looking to spread their bets, there’s real estate, financial strength, and ETFs to round out your portfolio. I’ve done the legwork, so you can make moves that matter. Let’s explore what 2024 has in store for the savvy investor.

Unveiling Top Growth and Value Stock Contenders for 2024

Growth Stock Standouts: Tech and Biotech Sectors on the Rise

Look at tech stocks for 2024. They’re hot! Big gains are what smart investors see here. Why? Tech shapes our future. Look at AI technology stocks and electric vehicle stocks. They’re changing how we live. We see this in how we work and move around. AI is smart and fast. It helps companies do more with less. Electric cars are clean and cool. They’re fighting pollution too. These are growth stocks 2024 winners for sure.

Now, let’s peek at biotech stocks for investment. They’re making waves! Biotech firms work on new meds. They tackle tough sicknesses that hit us hard. These companies take big risks. But the pay-off? It can be massive. When they win, they win big. Investors who take the chance can win big too. Biotech is a top stock performer prediction. Why? Because health matters to everyone!

Finding Value: The Stability and Potential of Blue-Chip and Dividend-Yielding Stocks

Blue-chip stocks 2024 are the big guys. They’ve been around and know the game. They have strong foundations. Look at financial sector stocks. Banks and insurers are solid as rocks. They help folks save and protect what they have. These stocks are stable. Many give dividends too. What’s a dividend? It’s cash the company pays you for owning their stock. Sweet deal, right?

High-dividend stocks 2024 appeal to many. They give you cash on a regular schedule. It’s like getting a paycheck for holding the stock. These dividends add up. And they give you a safety net if stock prices dip.

But how do you pick the right ones? Stock portfolio diversification is key. Don’t put all your eggs in one basket. Spread out. Pick different industries. Like tech, health, and energy. This helps you not lose too much if one area dips. Smart, right?

So, we find growth in tech and biotech. They’re riding the wave of the future. Value lives in blue-chip and high-dividend friends. They offer stability and steady cash. Pick smart and watch your money grow. That’s the game plan for 2024. Keep these tips close when choosing the best stocks for 2024.

Sector Spotlight: Industries Set for a Boom in 2024

Renewable Energy and Electric Vehicle Stocks: Harnessing the Power of Innovation

Let’s dive into two exciting sectors. They’re set to make a big splash in 2024. First up: renewable energy stocks. These are not just good for our planet. They’re also great for our wallets. Think about how the wind and sun can power up your investment returns. Firms that turn these into energy are working on cool, new tech. They are growing fast. So what are the best stocks 2024 for renewable energy? Look for companies that are leading in solar and wind tech. The ones getting big projects running around the world.

What about electric vehicle stocks 2024? Electric cars are the future, and they’re here to stay. The companies that make these cars are working on better batteries and more models. They need to be on your radar for long-term stock picks. The key players are racing ahead. They’re making cars that go further and charge faster. Some are even working on electric trucks.

Now, what’s really cool is when these industries join forces. Picture this: cars that charge using solar power from panels on your roof. That means your car could be pulling juice from the sun! This is not a far-off dream. It’s happening now, and it’s a game-changer.

Healthcare and Pharmaceutical Prospects: Investing in Life-Science Evolution

Moving on to the healthcare and pharmaceutical sector. This field saves lives and it’s a smart place to put your money in. Why? Because people will always need medicine. Companies in this field are working hard to find cures and treatments for all kinds of ailments. We’re talking about the next big thing in medicine. Breakthroughs that could change our lives. That makes these stocks really worth watching.

When I say pharmaceutical stock opportunities, think about biotech stocks for investment. These can be game-changers. They work on stuff like gene editing and personalized medicine. This is the stuff of sci-fi movies, but it’s also real. And it’s here today. These companies might just have the next big drug that everyone will need. That’s why they hold promise for growth stocks 2024.

We’ve just looked at two awesome areas set to take off. Renewable energy blends cool tech with green living. It’s a win-win for everyone. Electric vehicles are not just stylish but also help cut down on pollution. And in healthcare, we find companies daring to fight diseases in new ways. They aim to keep us all healthy. Smart investors will want a piece of these sectors as they boom. Be one to watch these industries. They’re gearing up for some big leaps come 2024. Keep your eyes peeled for analyst stock recommendations 2024 for these sectors. The right picks could rocket your portfolio into new heights.

Exploring High-Performance Stocks in Emerging Technologies

AI and Cybersecurity: A New Era of Tech Investment Opportunities

It’s a thrilling time for tech lovers and smart investors alike. Picture this: you’re in a world where AI powers everything, from your coffee maker to big city traffic lights. It’s not a scene from a sci-fi movie, it’s real, and it’s happening now.

So, what’s the deal with AI technology stocks? They’re hot! These stocks are like seeds. You plant them now, water them, and soon, they may grow into huge money trees. We’re talking about robots that make cars, software that helps doctors, and systems that keep hackers away from your precious info.

Cybersecurity is just as cool, folks. Think of it as your personal online bodyguard. It stops the bad guys from stealing your secrets. Thus, the demand for these cyber guards is soaring, making cyber security stock picks a wise move.

Now, what should you look out for? Companies that are big on ideas and strong on skills. They need to have a plan to build stuff we all want and find ways to keep it safe.

Remember, smart investing doesn’t mean putting all your eggs in one basket. Mix it up! Throw in some reliable tech names and some exciting up-and-comers.

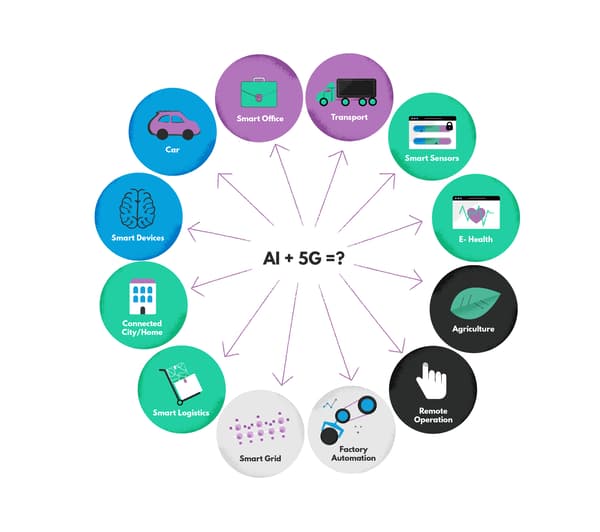

The 5G Revolution and Semiconductor Growth: Connecting the Future

5G is the future’s fast lane. It’s what will let you download movies in a snap and play games without those pesky lags. It’s not just fast phones, though; it’s about connecting cities, cars, and even your fridge. That’s why 5G technology stocks are on investors’ radars.

Then there’s the world of tiny tech- semiconductors. They’re the brains inside everything electronic. If it beeps, blinks, or buzzes, a semiconductor is behind it. We need them, and we need a lot.

So, semiconductor stocks forecast? Sunny, with a chance of big gains. The more gadgets we use, the more we need those tiny brains to run them.

When eyeing these growth stocks for 2024, think who’s making waves and who’s got the know-how to keep doing so. Look for companies with a finger on the pulse and a foot in the door of tomorrow’s tech.

In summary, picture yourself as the captain of a spaceship. In your control room are screens with AI, cybersecurity, 5G, and semiconductor gauges. Each button you press could launch your investments into orbit. But choose wisely – not all spaceships are built the same. Look for top stock performers’ predictions that muster confidence and promise a ride to the stars.

In vesting is like building a puzzle. You need the right pieces to see the big picture. Our mission is to find those pieces – the best stocks for 2024. We want growth stocks that burst through clouds and value stocks that stand like mountains.

So, friends, let’s gear up for some space exploration in the stock universe of emerging technologies. May our portfolios shine bright like constellations in a clear night sky.

Strategic Portfolio Management: Balancing Risk and Opportunity

Diversifying with Real Estate and Financial Sector Picks

Diversifying your stock picks is smart. It’s like not putting all eggs in one basket. In 2024, mixing it up with real estate and financial stocks is a good move. Real estate stocks are often steady. They can also give you cash from rent. For example, firms that own lots of apartments or office buildings. They make money from tenants. And that’s just one part of why they make the list for best stocks 2024.

Financial sector stocks include banks and insurance companies. In 2024, they could see growth too. These companies can grow with the economy. Look for those with strong past performance. They hold power in our wallets and our world.

Now, let’s talk growth stocks 2024. People love them. They can soar high, make you smile. But they can be risky. So, always check their health. Ask questions: Are they making money? Do they have a plan? Good answers mean they might be a good pick for you.

Leveraging ETFs and S&P 500 Standouts for Long-term Stability

What about safety and growth over a long time? ETFs and S&P 500 stocks can be key. ETFs are baskets of stocks. They let you own a slice of many companies. So, if one stock dips, you’re not sunk. And they’re perfect for ‘set and forget’ investing. Just pick a solid ETF and watch it. No need to trade every day.

When I say S&P 500 stocks, I mean the big names. They’ve been here, done that. And they’ll likely keep growing. Not as fast as the hot new tech stock. But they offer peace and quiet for your cash. They are like a rock in a storm. They’re often dubbed blue-chip stocks 2024 for this reason. They bring calm to your stock picks.

Remember, you want to sleep at night. So, long-term stock picks should be stable. They should grow with time, like a tiny seed to a big tree. Look for high-dividend stocks 2024 too. They pay you just for holding them. That’s more cash in your pocket.

So, think of it this way. You want a mix. Some fast runners like tech and biotech. And some steady friends like real estate and big company names. Keep it a mix of youth and wisdom. That’s how you play it smart with your 2024 investments. Stock portfolio diversification is not just a fancy term; it’s your money’s best friend.

In this post, we’ve looked at some hot stocks for 2024. From tech and biotech growth stories to strong, stable blue-chips, we know where to look. We shone a light on key sectors like renewable energy and healthcare, set to make big moves. We didn’t miss emerging tech like AI and 5G either, showing you where the future is headed.

We wrapped with smart tips on portfolio management, mixing real estate and financial gems with ETFs for a solid balance. Remember, picking stocks is part art, part science. It pays to keep an eye on trends but never forget the basics: diversify and plan for the long game. Here’s to making smart, informed choices in the market – here’s to your success in 2024!

Q&A :

What are the most promising stocks to buy for 2024?

In anticipation of 2024, investors are looking for stocks with strong growth potential. Some factors to consider include technological innovation, market leadership, financial stability, and potential for long-term growth. While specific stock recommendations require up-to-date market analysis, sectors such as green energy, technology, healthcare, and e-commerce often feature companies with promising prospects for future growth.

How can I identify the top 10 stocks to invest in for 2024?

To pinpoint the top 10 stocks for investment in 2024, investors should conduct thorough research, including analyzing financial statements, keeping an eye on industry trends, and assessing economic indicators. Utilizing investment tools and resources, consulting financial advisors, and considering both fundamental and technical analysis will aid in making informed decisions about which stocks have the potential to perform well in the upcoming year.

What investment strategies should I consider for the top stocks in 2024?

Different investment strategies, such as value investing, growth investing, and dividend investing, can be considered to capitalize on the top stocks for 2024. Value investors might look for undervalued stocks with strong fundamentals, whereas growth investors focus on companies with high potential for revenue and earnings growth. Dividend investors may prefer businesses with a strong dividend yield and a history of dividend growth. Diversification and a balance between risk and potential returns should also play a key role in deciding on an investment strategy.

Are tech stocks still a good investment for 2024?

Tech stocks have historically provided substantial returns, but they also carry a higher risk due to market volatility. For 2024, the tech sector could still be appealing, especially for companies at the forefront of innovation, such as artificial intelligence, cloud computing, and cyber security. However, investors should be mindful of market cycles and valuation levels to ensure the timing aligns with their investment goals.

What are the risks of investing in stocks for 2024?

Investing in stocks always carries risks, such as market volatility, economic shifts, and company-specific events which could impact stock prices. For 2024, potential risks include changes in government policies, interest rates, geopolitical tensions, and industry disruptions. Maintaining a well-diversified portfolio and staying informed about market trends can help mitigate some of these risks.