The Effect of Monetary Policy on Interest Rates: Steering the Economic Ship

Imagine the economy as a massive ship, and the captain? Central banks. They turn the wheel, pulling levers to guide us through storms and calm seas. One of their key tools? The effect of monetary policy on interest rates. This powerful move can make loans cheap or pricey, influencing everything from home purchases to how much businesses invest. Stick with me, and we’ll dive into how these choices shape your wallet—and the world. Let’s decode this financial journey, one ripple at a time.

Decoding Monetary Policy: The Core Levers and Their Impact on Interest Rates

How Central Bank Rate Decisions Shape the Cost of Borrowing

Central bank rate decisions are like the steering wheel of our economy. They can turn the ship towards calm seas or rough waters. Imagine you want to buy a house or start a business. You need a loan, right? Well, the interest you pay on that loan depends a lot on what the central bank does with interest rates.

Let’s break it down. The central bank, like the Federal Reserve, sets a target for the federal funds rate. This is the rate banks charge each other for overnight loans. It’s really important because it affects other rates. When the Fed raises or lowers this rate, it’s like pressing the gas or brake pedal on the economy.

Exploring the Tools: Federal Funds Rate and Discount Rate Influence

Now, the Fed also helps banks in a pinch with the discount rate. This is the rate banks pay when they borrow directly from the Fed. These tools together, the federal funds rate and the discount rate, they make sure banks have enough money to lend to people like you and me.

One more term to know is ‘open market operations’. This is how the Fed buys and sells things to control the money supply. It might sound complicated, but just think of it like watering a garden. Too little and your plants dry up. Too much and they get soggy. The Fed’s job is to give just enough water for the economy to thrive.

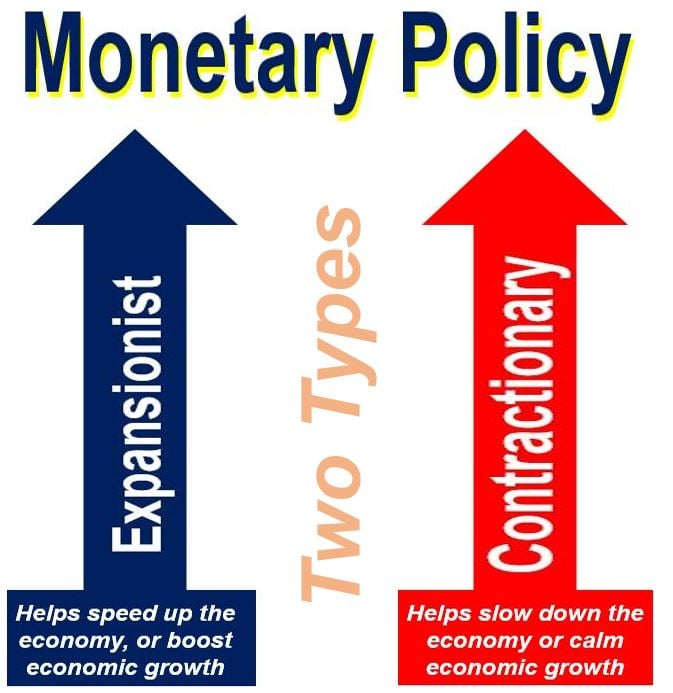

Sometimes, the goal is to cool things down. That’s when we see contractionary monetary policy. The Fed might raise rates to slow borrowing and spending. But other times, if things are looking grim, we get expansionary measures. That’s like giving the economy a cup of coffee – a little energy boost. This might mean lower rates to encourage more spending and investing.

Remember, all of these tools affect interest rates – from your credit card to your mortgage. And when the central bank tweaks these tools, it sends ripples through the economy. For workers, shoppers, and business owners, the central bank’s moves matter a lot. They impact how much it costs to borrow money and how much you earn on savings too.

So next time you hear about the Fed changing rates, know that it’s not just some mysterious financial move. It’s about making sure our economy has just what it needs to grow strong and steady without running too hot or too cold. And that’s how the cost of borrowing for folks like us gets shaped by those at the helm.

Untangling the Relationship Between Inflation Targeting and Interest Rates

Quantitative Easing Effects on Long-Term Interest Rates

When central banks want to boost the economy, they buy a lot of bonds. This move is called quantitative easing. It can help make long-term interest rates go down. Why do lower rates matter? Imagine wanting a loan to buy a home. When interest rates drop, you pay less over time to borrow that money. So, lower rates can encourage folks to spend more. When more people buy homes, or start projects, they help the economy grow.

Central banks use this power to keep things balanced. They watch the economy closely. If things slow down too much, they step in to warm things up. They buy bonds and increase the money out there. But if inflation starts acting up, going too high, they may stop. High inflation can be like a kid eating too much sugar – way too hyper.

Consequences of Policy Rate Adjustments on Inflation and Lending

Now, let’s talk about things from another angle. Picture a central bank as a smart captain of a big ship – the economy ship. They have important tools to steer it right. One key tool is setting the cost of overnight loans between banks. This cost is known as the federal funds rate.

When a central bank lowers the funds rate, it’s like adding fuel to the ship. It gets businesses and people excited to borrow and spend money. But if they boost the rate, borrowing costs more. Sometimes, this is needed to keep the ship sailing smoothly without tipping over. When prices start climbing too high, increasing the rate can help.

When the central bank tinkers with rates, it sends signals to everyone. Banks understand these signals and may change how much it costs to get a loan. This change can reach all kinds of loans, like for buying houses or cars. If these are cheaper, people are more likely to borrow cash. But if loans get pricier, people might think twice. They might save their money instead of spending it.

Each move can make waves across the economy. That’s where the big picture comes in. How do we keep the ship moving just right? Central banks try their best. They aim for not too fast or too slow, called macroeconomic stability. It keeps businesses running and people with jobs.

Steering the economy ship needs a light touch and a sharp eye. Rates up or down, it’s about balance. Think of Goldilocks – not too hot, not too cold. Central banks have a big goal to keep things just right. They work towards stable prices and full employment. And they try to make sure when you want that home or car, you can go for it without worry.

Making these choices isn’t easy, and it’s all pretty connected. If you’re curious, keep an eye on what your own central bank does next. It might just signal which way the economy ship will turn.

Understanding the Mechanics: How Policy Shifts Move the Market

The Role of Open Market Operations in Setting Short-Term Rates

Think of the economy as a giant ship. The captain is the central bank, using tools to steer it. These tools move rates to keep our money’s value steady and our jobs safe. One of the main tools is called open market operations. It’s like the wheel of our ship, guiding us.

What are open market operations? Well, it’s when the central bank buys or sells government bonds. This affects how much money is out there. Selling bonds takes cash out of the economy. Buying bonds puts more cash in folks’ hands.

Why do this? It’s all about the federal funds rate. That’s the interest banks charge each other for overnight money. Open market operations make sure this rate stays on target. When banks have more money, rates go down. When money is tight, rates creep up.

Expansionary vs. Contractionary Approaches During Economic Cycles

Now, the economy goes through cycles; it grows and shrinks. When times are tough, and growth slows, the central bank acts like it’s giving the ship’s engine a boost. They cut rates by buying more bonds. This makes it easier to borrow and spend. We call this expansionary policy.

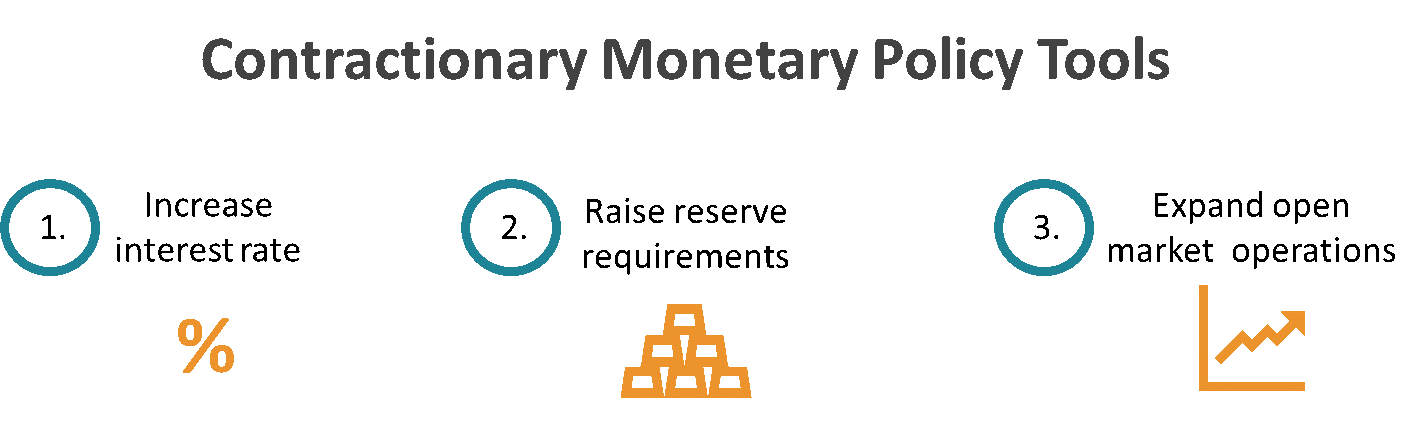

But when the ship speeds up too much and inflation climbs, the central bank needs to slow things down. It sells bonds, pulling cash from the economy. This is contractionary policy, lifting rates and taking a little power from the engine to avoid a crash.

In the end, it’s all about balance. We want enough growth to enjoy smooth sailing but not so much that we risk high waves of inflation. We count on the central bank’s skill to read the sea and to adjust the sails through interest rate policy. This way, the central bank keeps our economic ship steady for us all.

From Global Trends to Personal Wallets: The Real-World Effects of Monetary Policy

Evaluating the Connection Between Central Bank Decisions and Mortgage Rates

When central banks change rates, it shakes up our lives. Think of it like turning the steering wheel on a huge ship – the economy. When they hike rates, it’s like pulling back on the throttle. They’re saying, “Let’s slow things down a bit.” When they lower them, it’s like pushing the throttle forward to speed up.

Now, what does that do to mortgage rates? Well, when the central bank raises its rates, it gets more costly for banks to borrow money. Banks then charge us more for loans, and that includes mortgages. So, if you’re looking to buy a home, central bank rate moves matter a lot!

Monitoring Central Bank Communications for Forecasting Rate Changes

Figuring out what central banks will do next is key. It’s like trying to predict the weather. We track what central banks say and do, because it gives us clues. They might drop hints about being worried over rising prices, that’s inflation. Or they might show they’re ready to help the economy grow more.

By keeping an eye on them, we can guess if rates will go up, down, or stay put. And that helps everyone from big investors to regular folks make smart money choices. Understanding their chatter can prep us for a sunny day or an upcoming storm in our finances.

In this blog post, we uncovered how central banks use tools like the federal funds rate and the discount rate to steer the economy. They mold the cost of loans, which affects how much it costs us to borrow money. We saw how actions like quantitative easing can push down long-term interest rates. We also discussed how rate changes can curb or boost inflation and impact lending.

We explored market mechanics, showing how open market operations can control short-term rates and how the economy feels these effects. We compared expansionary and contractionary policies and how they play out over economic cycles.

Finally, we connected the dots between the high-level actions of central banks and our own finances. Changes in policy ripple out to what we pay on mortgages and how we can predict interest rate movements.

Understanding these concepts helps us grasp why our monthly payments shift and anticipate what might come next in our financial lives. With knowledge comes power—the power to plan better for our future.

Q&A :

How does monetary policy influence interest rates?

Monetary policy, primarily implemented by a country’s central bank, affects interest rates through the adjustment of the money supply and setting benchmark interest rates. Expansionary policy, aimed at increasing the money supply, generally lowers interest rates to stimulate borrowing and investment. Conversely, contractionary policy, intended to reduce inflation and slow down economic growth, often involves raising interest rates. Changes in these rates can influence a wide range of other interest rates across the economy, including those for mortgages, savings accounts, and loans.

What are the tools used in monetary policy to control interest rates?

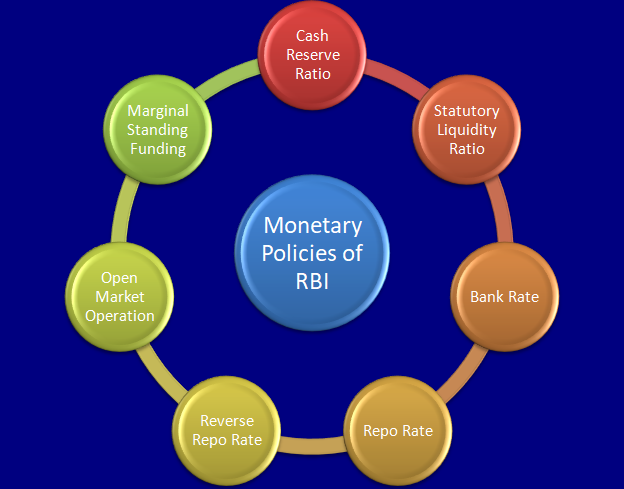

The central bank employs several tools to manipulate interest rates as part of its monetary policy. The most prominent among these tools are open market operations, where the central bank buys or sells government securities to influence the level of bank reserves; the discount rate, which is the interest rate charged to commercial banks for short-term loans from the central bank; and the reserve requirement ratio, which dictates the amount of reserves a bank must hold against deposits. Adjusting any of these tools can help the central bank to achieve its desired interest rate level.

Can you explain the relationship between the federal funds rate and other interest rates?

The federal funds rate is the interest rate at which depository institutions trade federal funds—reserves held at Federal Reserve Banks—with each other overnight. This rate is crucial because it is used as a benchmark for a variety of other interest rates, including the prime rate, mortgage rates, and savings account rates. Changes in the federal funds rate can directly affect the cost of credit for borrowers and the return on savings for savers, thus influencing overall economic activity.

How do changes in interest rates affect consumer behavior?

Interest rates can significantly impact consumer behavior. Lower interest rates make borrowing more attractive, encouraging consumers to take out loans for big-ticket purchases like homes and cars and to use credit cards more freely. This increase in borrowing can lead to greater spending and stimulate economic growth. On the other hand, higher interest rates increase the cost of borrowing, which may deter consumers from taking on new debt and instead incentivize saving, as the returns on savings accounts and other fixed-income investments tend to rise.

What long-term effects can monetary policy have on the economy?

Over the long term, monetary policy can help stabilize an economy by controlling inflation, influencing the unemployment rate, and promoting moderate long-term interest rates, which can promote economic growth. However, if not managed carefully, it can also lead to prolonged periods of inflation or deflation, high unemployment, and economic instability. Therefore, central banks must consider the long-term implications of their policies, balancing their actions to support sustainable growth without causing significant market distortions or financial imbalances.