As an expert in economic patterns, I keep a keen eye on the Signs of a Global Recession. Trust me, it’s not a storm that hits without warning. There are clear red flags that suggest trouble ahead—red flags that you can learn to spot early. Let’s dive straight into the tell-tale signs, from the obvious numbers dip in GDP to the stealthy shifts in job and trade markets. We’ll unravel the complex yarn of financial markets and decode what plummeting investment really means for consumer confidence. Roll up your sleeves; it’s time to get smart about economic downturn indicators and practical strategies for navigating through potential rough financial tides.

The Harbingers of Economic Decline: Understanding Economic Downturn Indicators

GDP Shrinkage and Its Implications

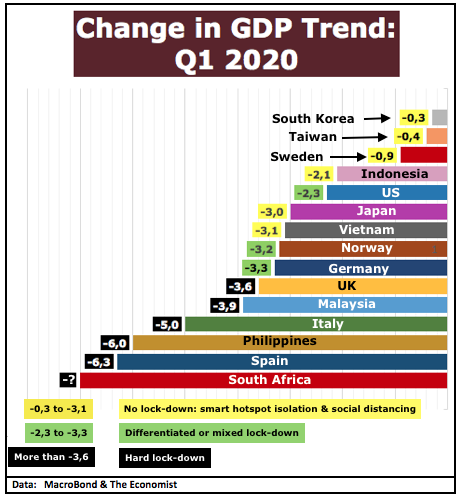

When our economy hits a rough patch, GDP, or Gross Domestic Product, is like a warning light. It tells us how our country’s economy is doing by showing the value of goods and services made. If GDP starts to shrink, it’s a clear sign, an alarm really, that our economy could be heading for trouble.

What is GDP shrinkage exactly? It’s when the total goods and services our country makes go down. This drop means we’re earning less, and it’s bad news for jobs and our wallets.

Inflation Spike: An Alarming Sign

Now, there’s another big red flag we watch for: inflation spike. Think of inflation as a balloon that keeps getting bigger, but here, it’s prices that puff up, not air. When prices jump up quickly, things like bread and milk cost more. This can make life tough for families trying to make ends meet.

The thing about inflation is that it chips away at what you can buy. Say you can usually buy 10 apples with $1. With high inflation, that same dollar might only get you 5 apples. This tells us that the money in your pocket isn’t stretching as far as it used to.

Inflation doesn’t just hit your grocery bill. It affects how much you spend on gas, clothes, and much more. When prices fly up across the board, and fast, that’s a big warning that the economy might take a dive. It means our money buys less, and everyone feels the squeeze.

Understanding these signs, GDP shrinkage and inflation spikes, is key. They’re like the ‘check engine’ light for the economy. Spotting them early can help us prep for tough times ahead. We need to keep our eyes peeled on these things to steer clear of the bumps and, hopefully, keep cruising along to better days.

Labor and Trade: Uncovering Job and International Market Trends

Rising Unemployment Rate: Beyond the Numbers

When jobs vanish, it’s a loud alarm for tough times ahead. You see, a rising unemployment rate is often a clear sign of trouble in the economy. More people out of work means less money in folks’ pockets. And when people have less to spend, businesses suffer too – they sell less and make less money. This can start a bad cycle where businesses then cut more jobs.

Unemployment rate tells us how many people can’t find a job. But the story goes deeper. We look at job market trends to see where jobs are dropping fast. Factories, shops, and offices lay off workers when they’re earning less. It’s like a big puzzle – each piece affects the whole picture.

International Trade Decline and Its Global Impact

Now, on the trade side of things, when countries trade less with each other, it’s another red flag. International trade is like a game of catch. If you stop throwing the ball, the game stops. Countries sell goods and services to each other, which helps their economies grow strong. A decline means countries are buying and selling less. Less trade can lead to a worldwide market contraction.

And why does trade drop? There can be many reasons. Maybe things cost more to make, or people from other countries don’t want to buy as much. Sometimes, it’s because of politics or laws that make trading hard. When trade goes down, it’s not just about ships and goods. It affects real people and their jobs too.

So, when you hear about rising unemployment or trade falling, take notice. These are big clues that a global economic slowdown could be on the way. We keep an eye on these trends to get ready and act early. By understanding these signs, we can work on making the economy strong again.

Financial Markets and Investment Moods: Analyzing Changes and Consequences

Central Bank Policies and Interest Rate Hikes

In the heart of a vibrant economy, central bank policies are key. They steer the ship. When there’s fear of inflation, central banks often hike up interest rates. This makes borrowing pricier. It’s a red flag, signaling cooler winds in the economy’s sail. The goal is to keep money’s value steady. Yet, these hikes can slow growth. They make loans for homes and cars cost more. It can slow down how much people spend and invest.

So, when you hear about rate hikes, pay attention. This is not just talk among bankers. It’s real life. It’s about whether it costs more to get a mortgage this year. It sums up to this: higher rates, pricier loans, less cash flowing. And that can lead us down a path to a global economic slowdown.

Investment Reduction and Consumer Confidence Drop

Investment mood swings matter. Just like a sunny or cloudy day can swing your mood, market moods swing investor actions. When things look grim, folks pull back on buying stocks. They might sell what they have. They’re scared they might lose money if they keep them. This is a signal loud and clear: we might be heading into rough waters.

Likewise, if people are not feeling confident, they zip up their wallets. They wait. They spend less. A drop in consumer confidence can push a powerful wave through the economy. Shops may sell less. Factories may make less. Jobs may get cut. It’s all tied together. And it all points to a possible global recession.

What you see in the news about investments and spending—it’s not just numbers. It echoes in malls and on main streets. It’s in the ‘For Sale’ sign on the neighbor’s lawn. It’s in empty seats at dinner spots.

As a savvy observer, keep an eagle eye on investment reductions and dips in consumer confidence. These are early whispers of economic downturn indicators. They often come before the storm of a worldwide market contraction hits us full force.

These shifts signal more than just a bad day. They can mark the start of long-term change in our money world. Interest rate hikes and falling investments tell us to brace ourselves. The global economy could be in for a bumpy ride. And if we catch these signs early, we can better prepare for what’s ahead.

Sectorial Signals and Practical Strategies During Economic Uncertainty

Manufacturing Sector Output vs. Service Industry Performance

Let’s talk about how things are made and serviced. When times get tough and wallets get tight, how much stuff factories make can tell us a lot. This is your manufacturing sector output. If factories slow down a lot, this can be a sign of trouble ahead. It’s like noticing less smoke from a chimney. It means there might be a fire burning out. Often, less making can signal a worldwide market contraction.

But wait, there’s more to the story. Think about all the jobs that help you without making a thing. These are part of the service industry. When people stop eating out, getting haircuts, or seeing movies as much, it’s no good for the economy. If both making and servicing slow down together, hold on tight. It could mean a global economic slowdown is on the way.

Now, how can you stay safe if all this happens? You can look at what we call recession-proof investments. These are places to put your money that don’t crash when the economy does. Some things, like basic foods, healthcare, and fixing things, always need workers. Putting money into companies that do these can be a smart move when other bets look risky.

We also use smart math, known as economic forecast models, to take a guess at what’s coming. Experts use information from the past and present to predict the future of our money world. It’s not magic, it’s just good guesses based on lots of numbers.

In tough times, making smart choices helps you and the whole economy too. Keep an eye on how busy factories are and whether people keep paying for services. Be ready to switch your money to safer spots if you need to. And don’t forget, smart people use forecasts to make better guesses about what to do next. It’s like checking the weather before a picnic. You’ll know if you need to bring an umbrella or if it’s better to just stay home.

In this post, we’ve tackled the signs of an economic downturn, looking into shrinking GDP and what it means, inflation spikes, and job trends. We’ve also seen how global trade can falter and the way financial markets react to uncertainty through interest rates and investment. Not all sectors take hits the same way—manufacturing and services differ here—and smart investment moves can help. To wrap it up, stay alert to these signs. They can guide you to make sound decisions, safeguard your finances, and weather any economic storm ahead. Keep an eye on the trends, think before you act, and don’t panic. With knowledge comes power, and with the right moves, you can come out strong.

Q&A :

What are common indicators of a global recession?

A global recession is often signaled by a widespread decline in economic activity across multiple countries. This might be observed through key indicators such as a significant drop in Gross Domestic Product (GDP), high unemployment rates, reductions in purchasing power, and a fall in international trade and investment. Additionally, declining manufacturing indices, lower consumer confidence, and a deflation in asset prices can also be indicative of a looming global downturn.

How does a global recession impact the job market?

During a global recession, the job market often feels one of the strongest impacts due to reduced business activity and a slowdown in economic growth. Companies may initiate hiring freezes, reduce work hours, or lay off employees in an attempt to cut costs. As demand for goods and services decreases, sectors such as manufacturing, retail, and hospitality can experience higher rates of job loss. Subsequently, the unemployment rate rises, creating a competitive environment for job seekers, while wage growth slows down or retracts.

What can governments do to mitigate the effects of a global recession?

To counteract the effects of a global recession, governments can embark on various fiscal and monetary policies. Fiscal instruments include increasing government spending, reducing taxes, and investing in infrastructure projects to stimulate economic growth and job creation. Monetary policy adjustments may involve lowering interest rates to encourage borrowing and spending, or implementing quantitative easing measures to increase money supply. Governments may also provide social safety nets like unemployment benefits and direct financial assistance to support individuals and enterprises.

How long do global recessions typically last?

The duration of global recessions can vary significantly, influenced by the underlying causes, the effectiveness of the response measures, and the level of international coordination in addressing the crisis. Historically, global recessions have ranged from a few quarters to several years. Recovery timelines depend on the resilience and adaptability of economies as they navigate through downturns. Coordination among countries through platforms such as the G20 can also help in synchronizing efforts to shorten recession periods.

Can a global recession affect personal investments?

Yes, personal investments can be affected by a global recession because economic downturns typically lead to a decline in stock markets and lower valuations for a broad range of assets. Investments in equities may lose value, and the risk of corporate bankruptcies can impact bonds. Furthermore, commodities like oil and precious metals may also experience price volatility. However, diversification strategies and a focus on long-term investment horizons can help individuals manage risk in their investment portfolios during recessionary times.