Security of fintech payment platforms has your head spinning? You’re not alone. We swipe, click, and tap to pay without a second thought. But is your money safe? Here’s the deal: As fintech weaves into our daily transactions, the stakes skyrocket. With giants and startups alike promising the moon, we’re left wondering about the safety net beneath our digits. Today, I’ll cut through the jargon, decipher the tech, and show you the backbone of these platforms’ defenses. From gateway fortresses to data shields balancing tight access with your privacy, the truth is in the trenches. Let’s explore what’s really standing between your cash and the cyber abyss.

Understanding the Security Landscape in Fintech Payment Platforms

The Crucial Role of Payment Gateway Security

Picture the lock on your front door. Now, imagine that door leads to a vault full of money. That’s like the security for payment gateways in the fintech world. These gateways act as the middleman when you buy something online. They make sure your money reaches the right place. It’s a must for them to be super safe to keep bad guys out. When they work right, they check the money’s coming from a real place and going to a real place. And just like a strong lock, good gateway security helps stop theft.

Payment gateway security does a lot of heavy lifting. They have rules to follow so your money’s safe. Say you go to buy shoes online. The second you hit ‘pay’, the gateway makes sure your bank’s aware and agrees to send the money. Then, it tells the shoe shop to send you your shoes. All the while, it keeps your bank details hidden so no one can sneak a peek.

User Data Protection: Balancing Accessibility with Safety

It’s like a superhero’s mask. It protects their real identity while they’re out saving the city. In fintech, we use tools that protect your info. These superhero-like tools keep bad folks from seeing your details. But, we know you still need to use your money when you want to. So, we work hard to make sure stuff like paying bills on your phone is both easy and safe.

User data protection keeps your secrets safe. When you use an app to pay for a coffee or check your bank online, lots of steps keep your info safe. Your name, card number, even your coffee order stay between you and your bank. All this talk about security might make it sound hard to get to your own money. But really, it’s not. It’s just that we put up lots of tiny roadblocks. This way, only you, the person who should see and use your money, can get to it.

We want to make sure no one else gets their hands on your cash or info. We use things like secret codes, thumbprints, and even face scans to make sure it’s really you. Plus, with rules like PCI DSS, which are sort of like the laws of fintech, we make sure every business that deals with card info plays it safe. This means they need to guard this info, just like a goalie guards a soccer goal. Every swipe, tap, or click you make should go through these checkpoints, like a car through toll booths, making sure everything’s A-OK.

Keeping you safe is our top job. We check and recheck every process to make sure no cracks show up where bad stuff could sneak in. Our teams look out for any weak spots like a hawk. If something’s looking fishy, we’re on it. And with every new piece of tech, we’re asking, “Can this make things even safer?” We’re all about finding cooler, smarter ways to guard your money.

And that’s the scoop on how fintech keeps your money protected. It might seem complex, but it’s all to make sure your hard-earned cash stays just that—yours.

Implementing Advanced Security Measures in Fintech Transactions

The Integration of Biometric Authentication and Multi-Factor Authentication

When you pay online, your money’s safety is key. Here’s the deal: bad guys are smart, but we’re one step ahead with new tech like biometric checks. This means using your fingerprint or face to prove it’s really you trying to get into your account. This is biometric authentication. It’s like having a super secret handshake that only your body knows.

Multi-factor authentication, or MFA, adds more layers. Think of it like a treasure map. You need one piece to start, like your password. But you also need another clue, like a special code your phone gets. Mixing these methods makes it super tough for hackers to get in.

Encryption Methods and End-to-End Encryptions in E-Payments

Let’s talk about secret codes. The secret codes I mean keep your card info safe when you buy something online. This secret code is called encryption. It scrambles your card details into a puzzle that only the right person can solve. Even if someone bad gets this puzzle, they can’t do anything with it. It’s that safe.

End-to-end encryption is like passing a note that only you and your best friend can read. No one else can peek, not even the person giving you the note. For payments, it means from the time you pay, to when the store gets it, your info is super secret. It stays safe the whole time, all the way.

Staying safe while paying online is like being a superhero for your money. And the best part is, you don’t have to be a tech whiz to keep it safe. Just knowing these things helps a lot. We’re always working on making it even safer for you. So, next time you click ‘buy’, remember, there’s a lot of cool tech working to protect your cash!

Regulatory and Compliance Measures for Enhanced Fintech Security

Navigating PCI DSS Compliance and Other Regulatory Requirements

Keeping money safe is key in fintech. We must follow certain rules, called regulatory compliance, to do this. The most well-known of these is PCI DSS compliance. What is PCI DSS compliance? It’s a set of rules that all companies must follow if they handle card payments. These rules make sure that payment data is safe.

Companies must do many things to meet these rules. They must build and keep a secure network. They must protect cardholder data. They must have a plan to handle security issues. Most of all, they must test their systems often. They must be sure that they are keeping card data safe.

Why do companies need to follow these rules? It’s simple: to keep our money safe. If they don’t, card data could be stolen. This would be bad for everyone. It would hurt customers and businesses alike. So, companies work hard to follow these rules well.

But PCI DSS is not the only rule out there. There are many others. For example, in Europe, there’s one called PSD2. It deals with making payments safe and open. All these rules change often. So, companies must always be ready to update their security to keep up.

Anti-Money Laundering and Fraud Prevention Techniques

Fraud prevention is also huge in fintech. Money laundering means hiding where money came from, often because it was made in a bad way. Companies use special techniques to stop this. They look at how and where money moves. If something seems off, they check it more closely.

What are some methods companies use to stop fraud? They use risk assessment. This means they think about what could go wrong. They make plans based on what they find. They also use smart tech like artificial intelligence. It learns patterns and flags strange behavior.

When a company finds fraud, they act fast. They stop the bad transaction. They use what they learn to make their systems better. This way, they stop more bad things from happening in the future. They teach their staff to spot fraud. Everyone is a part of stopping money laundering.

So, yes, fintech works hard to keep our money safe. They must follow many rules. They use smart tech to spot and stop fraud. It’s not easy. But it’s very important. It helps us feel good about using fintech services. We can trust that our money is safe.

Emerging Technologies and Their Impact on Payment Security

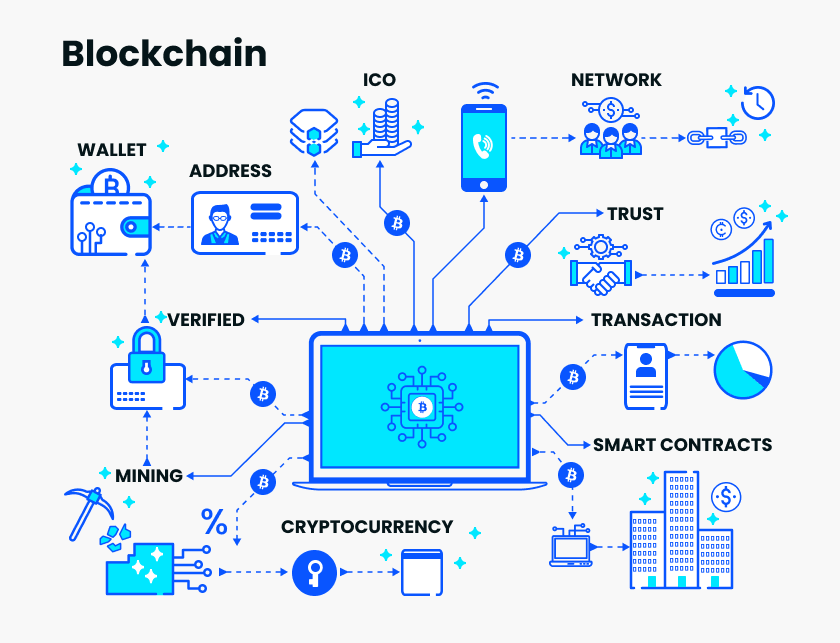

Blockchain Technology: A New Paradigm for Payment Security

Say hello to blockchain, the tech changing how we keep money safe. You might ask, “What is blockchain in payment security?” It’s a system that shares and checks info across many places at once. This means it’s super hard for bad folks to mess with your money.

Blockchain acts like a team of guards watching over every dollar you send. All records are public, so nothing slips by unnoticed. It’s like a line of dominos; if one falls, we all see it. Now, everyone knows exactly what happens with each payment, making fraud much less likely.

Blockchain isn’t just a wall against thieves. It’s also a tool for honesty that lets you feel calm about your cash. And yes, it’s a key player in fintech transaction safety, catching more eyes in the business world each day. This safety net is always there, thanks to the blockchain’s 24/7 patrol over your transactions.

But we don’t just rely on it alone. We’ve got more tools that make sure your money stays yours.

The Future of Fintech: AI in Fraud Detection and Secure Contactless Payments

Have you heard about AI in fraud detection? Well, it’s a game-changer. AI works like a smart detective that never sleeps; it spots the bad guys trying to take what’s not theirs. Let’s say someone tries to buy something with your card. AI checks if it’s really you, looking at where you buy stuff and what you like.

It’s not just any old check-up. AI goes deep, learning about you to protect your money better. If something seems fishy, AI puts a stop to it and sends you a heads-up. This way, AI helps stop theft before it happens, keeping your fintech transactions safe from sneaky tricks.

As for tapping your card without touching anything—yes, that’s where contactless payments shine. But safe? You bet! It might seem like magic, but it’s really secure payment technology at work. These payments use tiny code changes that make every tap unique. It’s like giving each transaction its own secret handshake.

Thanks to that, even if crooks catch the code, they can’t use it again, keeping your money out of the wrong hands. Plus, contactless payments are getting even better as they team up with other safety moves, like those found in secure mobile payment apps.

To sum it up, the future posh tech—blockchain and AI—are huge deals in making sure we can use our money without worry. From everyday shopping to sending cash across the globe, it all gets a whole lot safer. Now, isn’t that a good night’s sleep worth?

[next section…]

In this post, we explored how fintech platforms keep our money safe. We looked at the tough job of payment gateway security and how they keep user info safe yet easy to reach. We dived into cool tech like biometrics and encryption that guard our transactions. We also learned about laws and rules that platforms follow to protect against bad stuff like fraud.

We saw new tech on the rise, like blockchain and AI, shaping the future of safe pay. These steps matter for everyone using fintech. They make sure our money moves without worry. As a pro in this field, I say staying ahead with top-notch security is key. We must keep our eyes open for smart ways to fight risks. Let’s embrace these changes to make sure our digital bucks stay in the right hands. Stay safe and smart with your fintech choices!

Q&A :

How secure are fintech payment platforms?

Fintech payment platforms employ robust security measures to protect user data and transactions. These often include data encryption, two-factor authentication, secure login protocols, and constant monitoring for fraudulent activity. However, like any digital service, the level of security can vary between providers, and no platform is completely immune to risks.

What are common security features in fintech platforms?

Common security features in fintech platforms typically include SSL/TLS encryption, biometric authentication, risk management algorithms, regulatory compliance checks, and secure data storage practices. Many platforms also employ machine learning to detect and prevent fraudulent transactions in real-time.

Can fintech payment platforms be hacked?

While fintech payment platforms are designed to be secure, no system is invulnerable. The increasing sophistication of cyber attacks means that there is always a risk of hacking. However, fintech companies invest significantly in cybersecurity to minimize this risk and protect their customers’ financial data.

What should I do if I suspect a breach in a fintech payment platform?

If you suspect a breach in a fintech payment platform, it is crucial to act swiftly. Contact the payment platform’s customer support immediately, monitor your accounts for unauthorized transactions, change your passwords, and take advantage of any offered fraud protection services. Additionally, report the incident to your financial institution and consider initiating a fraud alert with credit bureaus.

How do fintech platforms ensure compliance with financial regulations?

Fintech platforms ensure compliance with financial regulations by integrating comprehensive compliance programs into their operations. They keep up-to-date with changing regulations, employ compliance officers, conduct regular audits and assessments, and implement KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols to ensure all transactions are legitimate and secure.