The stock market feels like a roller coaster lately, doesn’t it? Retirement planning in the current stock market climate demands we stay sharp and informed. We can’t predict every twist and turn, but with the right moves, your golden years can still be bright. I’ve been where you are, staring down the path to retirement, worried about my nest egg in these choppy markets. Let’s tackle this head-on. Today, I’m spilling my best advice on staying on course to a secure retirement, despite market madness. Ready to navigate through this financial fog? Let’s dive in.

Understanding Market Volatility and Retirement Planning

The Impact of Stock Market Trends on Retirement Savings

Have you seen how stock prices bounce around? That’s called market volatility. It shows up a lot in news and can make our retiree hearts skip a beat. So, how do stock market trends affect your nest egg as you near or enter those golden years? Retirement savings are often tied to how well stocks do. When stocks go up, your savings smile. But when they fall, it’s frown time.

Think of your retirement savings plan like a ship in the ocean. When waters are calm, your ship sails smooth. But when a storm hits, things can get rocky. That’s what market swings can do to your savings. Now, imagine that you’re pulling money out of your retirement account when the market dips. It’s like having a hole in your boat when you need it the most.

A big dip in the stock market can hurt if it happens right when you retire. Why? Because you’re pulling money out and can’t put it back in. So, your ship could sink faster than you planned.

Strategies for Navigating Volatile Markets

As you plan to sail into retirement, you’ve got to ride the waves of a choppy market. A top move is to change where you put your money. This is called adjusting asset allocation. You don’t want all your eggs in one basket. Having a mix of stocks, bonds, and cash can help smooth out the ride.

Remember the ship? Well, think of more baskets as more lifeboats. It’s wise to spread your money across different types of investments. This is called diversification. It helps because not all investment types fall at the same time. Think about it. When one part of your savings takes a hit, the other parts can help keep you afloat.

But there’s more you can do to steer through stormy markets. Think about risks in your portfolio. As retirement nears, you may want to tilt towards safer harbors, like bonds or fixed income choices. These are less likely to shake up when the stock waters get rough.

Retirees can also get creative with where they pull money from. This might be the time to look at that stable pension fund or the dependable income from Social Security. This can help you leave your other investments alone to grow.

And don’t forget, you can always ask for a little help from a financial advisor for retirees. They know the seas well and can help you chart the best course for your long-term retirement goals.

So, when the stock water gets wild, hold steady. With smart planning and a little know-how, you can navigate those waves and keep your retirement ship on course. Just start with the right mix of investments and keep an eye on the weather. With a solid plan, you’ll be ready, come rain or shine.

Optimizing Investment Vehicles for Retirement

Maximizing Your 401(k) and IRA Investments Amidst Uncertainty

Making the most of your 401(k) and IRA is key today. With markets up and down, you can’t just sit and hope for the best. You’ve got to be smart with where you put your money. A solid 401(k) strategy in this bear market can secure your future.

Why is this? Because your 401(k) and IRA are powerful tools. They can help you save a lot of money for later. A big chunk of the cash you sock away grows without you paying taxes on it right away. Not bad, right? It works like magic over time. The trick is to keep investing, even when the stock market dips. When prices are low, your money buys more. It pays to stay steady and not bail when things look rough.

A big question I get all the time is, “How much should I save each month?” Well, max out your 401(k) if you can. That’s $20,500 per year, or more if you’re 50 or older. IRAs are cool too. In them, you can save up to $6,000 a year, and a bit more when you hit 50. The sooner you start, the bigger your retirement pot will be. That’s because of compound interest – it’s like a snowball rolling down a hill, growing bigger as it goes.

Also, check out if your boss will match your 401(k). That’s free money! You put in cash, your company adds more. Not all firms do it, but if yours does, grab that chance. Say your company can match up to 5% of your pay. If you toss 5% into your 401(k), your company’s 5% can make it 10%. Nice, right?

Diversification and Asset Allocation Adjustments for Retirees

As you near retiring, how you spread your money matters a lot. This is your asset allocation. And change is good as you get on in years. Diversification is your pal. It means not having all your eggs in one basket. Mix it up with stocks, bonds, and maybe some other types. This helps you weather market storms better.

Stocks are great for growth over time but can be jumpy. Bonds are steadier, but when interest rates go up, their value can go down. Having some of each can keep things more level. A retired pal of mine has a saying, “It’s not about timing the market, it’s about time in the market.” Smart guy!

Now, being more careful doesn’t mean being too scared. Some retirees go all in on super safe stuff. But with folks living longer, you might need some growth to keep up. Even if you’re already in your golden years, you could be looking at 20-30 years ahead. A financial advisor can help strike that balance. They can help you work out just what mix is best for you, based on your age, health, and dreams for retirement.

In the end, your aim should be clear – a nest egg that’s there for you, through thick and thin. Keep learning, keep tweaking, and keep your eyes on the prize — your dream retirement.

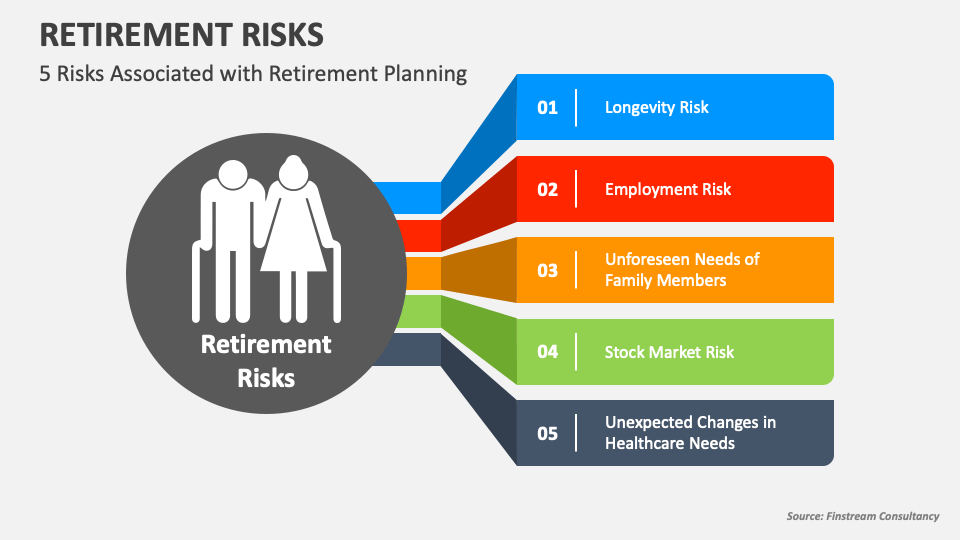

Managing Retirement Risks: Inflation, Recession, and Healthcare

Shielding Your Retirement Funds from Economic Downturns and Inflation

Let’s talk about your nest egg. That’s your retirement savings. Inflation can eat it up. Think of it like a sneaky bug, nibbling away at your money’s worth. You want to armor up against this. Start by looking at your retirement savings plan. Check if it’s strong enough to fight off these bugs.

Now, when the market gets wild, that’s a bear. You must learn to dance with this bear. How? Change where you put your money. That’s called adjusting your asset allocation. Aim for a mix that can grow but won’t crash when the market goes down. This blend helps you. It can keep your money safer when things get rough.

Investing in stuff that keeps up with rising costs can help. Like certain funds that fight inflation. They go up when costs do. This can help your money last longer. Social Security can also be a shield. But don’t bank on it alone. Having other income sources is smart. A financial advisor can show you ways to make the most of what you have.

Planning for Healthcare Costs and Ensuring Pension Fund Stability

Healthcare costs — big worry, right? They can be costly when you retire. Plan for them early. You don’t want to be caught off guard. Look for insurance options. Ones that cover more for less cash. Having an emergency fund just for health can be a big relief too.

Pension funds are like a promise. They say you’ll get money later for work you did before. But sometimes, markets tumble and so do pensions. Yikes! To avoid trouble, know how your pension is doing. Check if it’s stable. And have a backup. Maybe save a little more. Or, think about working a bit longer.

These steps can help you sleep better. They give you more control over your money. And that’s a good feeling. Remember, it’s your future. Planning now means you can enjoy it later.

So, let’s talk cash for your golden years. Keep a close eye on stock market trends. This will help you adjust your plans as needed. Diversify – that’s a big word for spreading out your investments. It can protect you from crashes. Received wisdom says: Don’t put all your eggs in one basket.

Risk management is not just for daredevils. It’s for smart retirees like you. It means not risking more than you can afford to lose. When you’re close to retirement, or already there, be careful. You don’t have time to make up for big losses. Use strategies that stand strong during recessions. Think bonds and steady stocks. Or look at new options with a financial pro.

Make your golden years shine. You’ve earned it. Stay informed, make wise choices, and get expert help when you need it. With these tips, those retirement dreams? They can come true, even when the market throws a fit.

Crafting a Sustainable Retirement Income Strategy

Balancing Social Security Optimization and Withdrawal Rates

When it’s time to retire, creating steady cash flow is key. A big piece is Social Security. Figuring out the best time to start taking it needs thought. Taking it early, at 62, means smaller checks. Waiting until 70 means more money each month. For many, it’s smart to delay, if they can afford it.

But there’s a balance. Withdrawing from your savings too fast can hurt. Experts often point to the “4% rule.” This rule says in your first year of retirement, take out 4% of your nest egg. Adjust that number each following year for inflation. This strategy helps your money last. It’s not foolproof though. Markets shift, and so should your plans. Talk to a financial advisor to customize your approach to fit your unique needs.

Incorporating Tax Efficiency and Estate Planning into Your Retirement

Taxes don’t stop when you retire. In fact, planning for them is super important. Working out which accounts to draw from first can save on taxes. Usually, you take from taxable accounts before tax-deferred ones. But each retiree’s situation can change the order.

Now, let’s touch on estate planning. It’s not just for the wealthy. It’s making sure what you have goes where you want after you’re gone. Make a will, set up trusts, and choose your power of attorney. Do this, and you’re shaping a legacy that reflects your wishes.

A tax-smart withdrawal plan and a solid estate strategy mean a future you can trust. Don’t go it alone. A skilled advisor can guide you through laws and endless paperwork. Remember, planning now means peace of mind later.

We just explored how to manage your money for when work is done. From the ups and downs of the market, to choosing the best savings plan, we covered it all. You learned about riding out those wild market swings and making your 401(k) and IRA work hard. We talked about keeping your cash safe when times get tough, like during inflation or a recession. And let’s not forget planning for those doctor visits that pop up more as we age.

Picking where and when to put your money is big stuff. We went through making sure you have enough by mixing up your investments and changing them as you need. You also got tips on how to make every penny count after you stop working, including not giving too much to taxes and making plans for what you leave behind.

Remember, handling retirement cash is like steering a boat in open water—stay sharp and adjust the sails as the wind changes. Play it smart with these tips and sail into your golden years with ease and peace of mind. With the right moves, you can enjoy the ride and the destination.

Q&A :

How does the current stock market climate affect retirement planning?

The current stock market climate can significantly impact retirement planning as it influences the growth rate of investments and the risk level of different asset classes. Fluctuations in the market might require individuals to adjust their investment strategies to ensure that their retirement goals can be met without taking on excessive risk.

What investment strategies should be considered for retirement planning in today’s stock market?

When navigating retirement planning in today’s volatile stock market, it is essential to consider a diversified investment portfolio, rebalancing strategies, and perhaps a more conservative asset allocation as one gets closer to retirement. Working with a financial advisor to tailor strategies to the individual’s risk tolerance and retirement timeline is also advisable.

How can I protect my retirement savings from market downturns?

To safeguard retirement savings from market downturns, consider incorporating bonds, treasury securities, and other lower-risk investments into your portfolio. It’s also beneficial to establish an emergency fund, continue contributing to your retirement savings consistently, and avoid making impulsive decisions based on short-term market movements.

What are the best ways to stay informed about stock market changes for retirement planning?

Staying informed about stock market changes involves regularly reviewing financial news, subscribing to market analysis newsletters, using apps and tools for tracking investments, and potentially working with a financial professional. Staying educated and updated on market trends can help retirees and those nearing retirement make better-informed decisions.

Is now a good time to start planning for retirement given the current stock market conditions?

Yes, it is always a good time to start planning for retirement, regardless of current stock market conditions. The key is to create a personalized and flexible financial plan that can withstand market volatility and to start saving as early as possible to take advantage of compound interest and long-term market growth.