In the age of tap-and-go, protecting yourself from digital payment fraud is as vital as locking your front door. We don’t play games with our security offline, so why take chances online? I’m here to arm you with smart tactics that act like a watchdog for your wallet. From dodging sneaky scams to fortifying your financial fortress, I’ll guide you through simple yet potent strategies. Get ready to turn the tables on fraudsters and keep your digital dough safe!

Recognizing and Avoiding Digital Payment Scams

Identifying Fraudulent Payment Requests

Avoiding phishing in online payments starts with knowing what’s fake. Always question odd payment requests. If a friend or shop asks for money in a new way, pause. Call or text them another way. Confirm that the request is from them, not a scammer. Phishing can trick you into giving away your cash. Smart scammers may fake your friend’s or company’s usual email or messages. They might implore you to act fast. Take it slow instead. Real friends and legit businesses can wait.

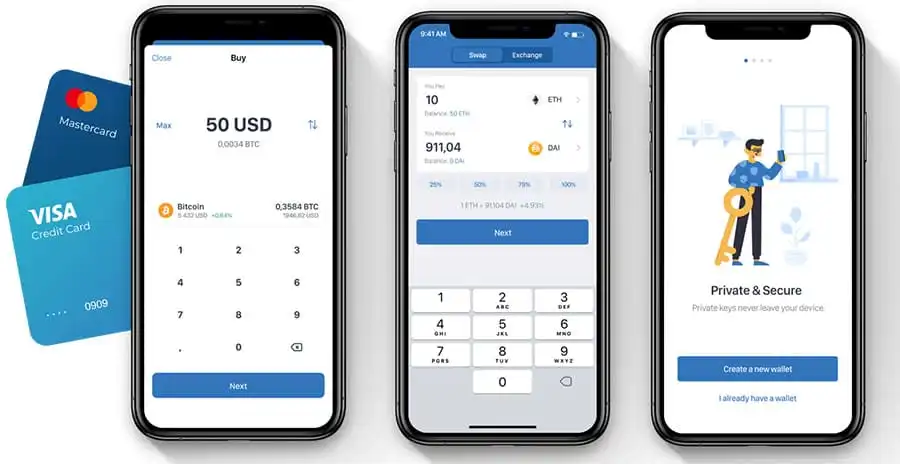

Detecting Fake Payment Apps

You need to be able to tell when a payment app is a fraud. Spotting fake apps helps prevent digital payment scams. Check the app’s reviews in the official store. Look for lots of good ones over time. A real app should have regular updates and clear, helpful support info. Scammers’ apps might lack detail or have many spelling mistakes. Also, watch out for apps that ask for too much. A payment app shouldn’t need contacts or photos access. That’s a big red flag.

Keeping your money safe online is a big job. Remember these tips for next time. Protect your cash by looking out for sketchy payment asks and fake apps. Your digital wallet will thank you.

Strengthening Your Online Transaction Defenses

Encryption for Financial Transactions

Imagine a lock that only you have the key for. That’s encryption. It turns your data into secret codes. No key, no access. It’s that simple. When you shop or bank online, look for HTTPS in the web address. That “S” means “secure.” It means the site uses encryption. Always check before you type in card numbers.

Smart tip: Use websites with HTTPS for shopping. They keep your info locked up tight.

Encryption scrambles your sensitive details. Think of your data turned into a puzzle. Hackers can’t solve this puzzle without the key. Financial sites and apps must use this to protect you. If they don’t, walk away.

Quick checks save you from big problems. Check the lock icon next to the URL. No lock, no deal. Even emails should have encryption when they ask for your info.

Two-Factor Authentication for Purchases

Two-factor authentication (2FA) is like a double door. You need two keys to get in. When you log in, you’ll use your password. That’s key one. Then, you get a text or email with a code. That’s key two.

Fact: 2FA cuts the risk of theft. It stops bad guys, even if they have your password.

Use 2FA whenever you can. It’s an extra step, but it keeps your money safe. You’ll find this option in your account settings. Turn it on. It adds seconds to logging in. It saves you from hours of stress if someone tries to get in.

Each time you buy something, 2FA asks for your permission. It’s like a guard asking “Should I let them in?” If it’s not you, you say no. Simple. It’s a powerful tool in your security belt.

Some apps can give you 2FA codes. These are even safer than texts or emails. Look for these apps and use them when you can. They’re your personal security guards.

Remember, your safety is in your hands. Small steps make a big shield. Use encryption and 2FA. They’re your friends in this digital world. Shopping safely isn’t hard. It just takes a bit of know-how and some smart habits.

In sum, online safety depends on encryption and 2FA. Check every site for HTTPS. Always use 2FA on your accounts. Stay ahead of scammers, and keep your digital world secure.

Ensuring the Security of Mobile and Contactless Payments

Safe Mobile Payments

Let’s talk about keeping your money safe. You carry your phone almost everywhere, right? But did you know that it can also be your wallet? Mobile payments are a snap – tap and pay. Yet, we must be careful. We don’t want our hard-earned cash stolen by some sneaky scammer.

How do we stop these bad guys? First, we’ve got to use secure digital wallet apps. Always download payment apps from trusted sources. This helps us dodge those sly, fake apps out to get us. Scammers trick you with fake apps that look real. Always check the app’s name and creator before you download.

Next up: passwords. A strong lock keeps a door closed, and a strong password keeps your mobile wallet safe. Combine letters, numbers, and symbols to create a tough password. Think of a password like a secret handshake only you know.

Now, some apps offer to save your card info. Handy, but risky. If your phone gets lost, someone can take a shopping trip on your dime. So, only save details if you have a passcode or fingerprint lock on your phone. Also, set up your phone to lock quickly when you’re not using it.

Ever lost your phone? Scary feeling, huh? Turn on the phone locator function. If your phone goes missing, you have a map to track it down. Also, you can secure your data or wipe it from afar if it falls into the wrong hands.

Lastly, always keep an eye on your bank statements. Spot something fishy? Call your bank straight away.

Best Practices for Contactless Payments

Contactless payments are like magic. Tap your card, and poof, you’ve paid. But, even magic has rules to follow to stay safe.

Encryption keeps your card info secret as it travels through the air. It’s like whispering a secret in code. Even if someone hears it, they can’t understand it. Check that the store’s payment machines use encryption for that extra safety layer.

Two-factor authentication is like a double-check. It asks for a password and then another proof that it’s really you, like a text message code. Use it whenever you can to keep your cash extra safe.

Best practices for clean and safe tap-and-go payments? Well, always check the payment machine for anything weird. Scammers can add extra bits to steal your details. When you can, use your own contactless device—like a phone or watch. This way, you keep control over where your card lives.

Been to the store or a café with your card? Later, double-check the amounts that leave your bank account. See a payment you don’t recall? Yep, you guessed it – ring up your bank, quick!

There you go. Use these tips to keep those digital dollars secure in your pocket. Remember, thieves are smart, but you’re smarter. Stay alert, double-check everything, and keep the fraudsters at bay!

Practical Tips to Keep Your Wallet Secure Online

Safeguarding Against Card Skimming Online

Card skimming is a nasty trick thieves use to steal your card details. They set up a fake website that looks real. You enter your card info thinking you’re buying something. But it’s all a setup to rob you. To fight back, always check the URL of the site you’re on. Make sure it starts with “https://” – that ‘s’ means secure. Look for a little padlock icon next to the URL, too. That’s another sign you’re on a safe site.

Don’t save your card info on sites, not even the ones you visit often. It’s easier, sure. But if hackers attack, they could grab your details. Use a payment service like PayPal or a virtual credit card instead. That way, you keep your real card info hidden.

Regular folks get fooled by these tricks. But you’re no regular folk. You know to be sharp. Keep your eyes open, and don’t let the bad guys win.

Avoiding Phishing in Online Payments

Phishing is like fishing. But instead of fish, scammers are after your money and info. They send emails or texts that look like they’re from your bank or a shop you know. They’ll say there’s a problem with your account or your order. They’re lying. They want you to click a link and give them your details.

Here’s what you do: never click those links. If you think it might be real, go to the site or app yourself. Log in like you always do. Check your account or orders there. If there’s really a problem, you’ll see it. And remember, your bank won’t ask for your password or card number over email or text. That’s a big red flag.

It takes practice to spot these scams, but once you get it, you’ll see them a mile away. Just like spotting a fish in clear water. Protect your money like it’s a treasured fish in a river full of savvy phishing scammers. Keep your hook sharp and your bait hidden.

To keep your wallet secure, pair these tips with other smart moves. Use strong, unique passwords for all your payment accounts. Fire up that firewall on your computer. Stay off public Wi-Fi when you’re buying something. And turn on two-factor authentication – it’s like a special code that only you get.

Staying safe online might seem tricky. But with these practical steps, you’re building a fortress around your wallet. You’re a smart shopper who won’t be easily fooled. Be proud of that, and keep learning. Your financial safety is worth it, and you’re up to the task.

In this post, we’ve covered how to spot and steer clear of digital payment scams. Knowing what a fake payment request looks like and calling out dodgy apps will help keep your money safe. We also walked through boosting your online safety with things like encryption and two-step verification when buying stuff.

Then, we made sure you’re up to scratch on securing your phone payments and using contact-free methods without worry. Lastly, I gave you down-to-earth advice on how to shield your card details from sneaky skimmers and dodge those tricky phishing tricks.

Always stay sharp and cautious in this digital world. Keep these tips in mind and use them to defend your hard-earned cash. Remember, taking a moment to double-check can save you from a heap of headaches later. Stay safe out there!

Q&A :

How can you safeguard your online transactions from fraud?

When engaging in digital payment transactions, it’s essential to protect your financial information. Ensure the security of your Wi-Fi connection and only use trusted payment gateways. Keep your software updated, use strong, unique passwords and enable multi-factor authentication whenever possible. Always verify the legitimacy of payment requests and review your bank statements regularly to spot any irregularities promptly.

What are the signs that you might be a victim of digital payment fraud?

Be vigilant for suspicious activity that may indicate digital payment fraud: unauthorized transactions on your account, unexplained withdrawals, or notifications for purchases you did not make. If you receive emails or messages asking for sensitive financial information, especially from unsolicited or unknown sources, it could be a phishing attempt. Any of these signs warrant immediate action to secure your accounts.

What immediate steps should you take if you suspect digital payment fraud?

If you believe you’re a victim of digital payment fraud, act without delay. Contact your bank or payment service provider to inform them of the suspicious activity and discuss next steps, which may include freezing your accounts or cards. Change your online passwords, monitor your accounts closely, and consider setting up additional security measures. It’s also wise to report the incident to relevant authorities to help prevent future fraud.

How do regular software updates protect you from digital payment fraud?

Keeping your software updated is a critical security practice. Updates often include patches for security vulnerabilities that could be exploited by fraudsters. An outdated system or application is more susceptible to hacking attempts, which could compromise your personal and financial information. Regular updates, especially for payment apps and your device’s operating system, contribute significantly to shielding your digital transactions from fraudulent attacks.

What are some best practices for creating strong passwords to protect digital payments?

To fortify your digital payment accounts against fraud, employ robust passwords—those that are long, complex, and include a mix of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information such as birthdays or common words. Implementing a password manager can help generate and store strong passwords. Additionally, never reuse passwords across different accounts to minimize the risk if one service is compromised.