Latest security threats to digital payments are like quicksand; the more we use digital cash, the deeper the danger gets. They evolve as fast as our apps update. You might think your money is safe, tucked away in your e-wallet or coursing through the net during a purchase. It’s not. Every click could be a trap. Sophisticated scams lurk behind emails. Malware waits to snatch your cash during transactions. Even that extra security step might have a hidden flaw. Money matters, so let’s get ahead of those threats. Read on and learn to keep your digital dollars secure.

Understanding the Evolution of Digital Payment Risks

The Rise of Sophisticated Phishing Scams

We’re seeing more smart tricks to steal your money online. These tricks often start with fake messages. They look like they’re from your bank but aren’t. These messages trick you into giving away personal info. Here’s the catch: the phisher uses this info to grab your cash. To stay safe, check if links seem funky. A real bank never asks for your password by email.

Phishing has grown more in the last few years. It’s a clear danger to all who shop or bank online. These scams trick millions each year. They send fake bank messages to your email or phone. When you click the link, it looks like your bank’s website. But it’s not. If you enter your login details here, scammers get them. And just like that, they can take your money. Always double-check links and never share private info unless you’re sure it’s safe.

Malware and Ransomware: Targeting Financial Transactions

Next, let’s talk about software made to harm: malware. These include ransomware attacks, a big threat to your cash. They lock your files and demand money to unlock them. Often, they strike through links or downloads that seem okay but aren’t. Let’s be real. No one wants to find their bank accounts locked. Or to pay a fortune to get their files back.

Data shows ransomware hit around 200,000 businesses last year. It’s a major problem when bad folks lock up your info and want money to free it. They might sneak in when you download something. Or when you click a link that plants this bad software on your device. Once inside, they lock your files or control your computer. Then they ask for cash to give you control back. Remember, don’t click unknown links, and back up your stuff. Keeping your computer clean of this bad stuff is key. Use software that watches for malware and stop it from ever getting a foothold.

In a nutshell, the digital payment world has new threats we all need to know about. Phishing now has more polish, tricking even careful folks. Malware, including ransomware, is a sneaky problem that can cost businesses big time. Keeping your eyes peeled for misguided links and making sure your computer’s defenses are up to the task can save you a world of hurt. Stay informed, stay skeptical, and stay safe.

Navigating New Frontiers in Fintech Cybersecurity

Addressing Emerging Online Transaction Threats

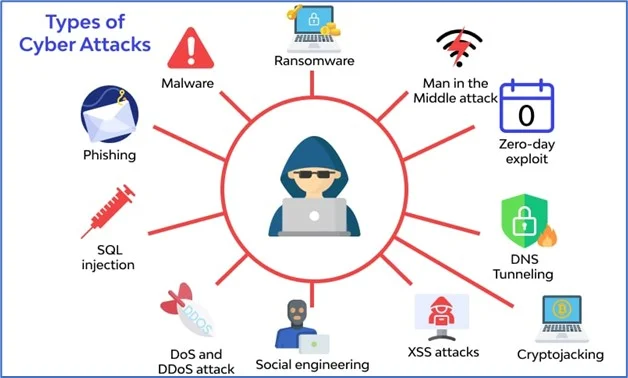

Cyber crooks are always hunting for ways to swipe your cash online. They’re getting smarter and their tricks, sneakier. Watch out for the latest threats like scammers pretending to be legit companies. They’ll try anything to get your card details or trick you into sending them money. These bad guys also use viruses to get into your phone or computer and spy on your payments. So, be sharp and double-check everything.

Let’s get real about fighting these cyber sharks. The trick is to stay one step ahead. Make sure you’ve got strong passwords and change them often. Don’t trust every email or text you get. If it smells fishy, it probably is. And hey, keep an eye on your transaction alerts. If anything looks off, call your bank right away.

The Weak Links in Multi-Factor Authentication

Think of your online cash as a treasure chest. Now, to keep it safe, you’ve got this cool lock called multi-factor authentication (MFA). Sounds tough, right? But guess what? Even this has weak spots. Some bad guys can trick your phone into giving them your security code. Some can even steal your fingerprints to break into your accounts.

To keep these pirates at bay, get choosy with your MFA. Use your face or thumbprint if you can. But keep those devices locked tight. Be wary of texts or calls that ask for your codes. Real banks won’t ask for these over the phone. Remember, having MFA is good, but you need to make sure it’s as strong as can be. Stay sharp and keep that treasure safe!

Protecting Your E-Wallet: Best Practices for Consumers and Enterprises

Encryption Best Practices to Fortify E-payment Security

Let’s talk money – but keep it safe, okay? In our pockets, we carry our banks, our cards, our shopping. It’s all there, in our phones, our e-wallets. Yep, you guessed it – I’m talking about those apps that let you pay for anything with a tap or a click.

But here’s the thing, these handy tools, they can attract some real sneaky folks. I’m talking about cyber crooks. They try to crack into our digital money pots – and we’ve got to stay a step ahead of them.

So, how do we do that? Encryption is our guard dog. It’s like a secret code that scrambles our details. Only the right person can unscramble it, so our money stays tight in our virtual wallets.

Here’s the deal – always use strong passwords. Mix them letters, numbers, and symbols. And that public Wi-Fi at the coffee shop? Don’t use it for bank stuff. It’s like an open door for thieves.

Businesses, listen up! You must keep your customer’s info like it’s your treasure. Update your safe walls – I mean your software – and use the best locks – those are your encryption methods.

Keep those guard dogs – encryption – always fit and strong.

Counteracting Mobile Payment Security Concerns

Okay, hands up if you love buying stuff with your phone. I sure do. But, do you ever wonder if it’s really safe? Mobile payment security concerns, they’re on the rise, just like mobile shopping.

Bad news, folks – the sneaky guys, they love phones too. They use tricks like fake apps and dodgy messages to try and get your cash.

Here’s how you stay safe: First, only get apps from stores you trust, like the real App Store or Google Play. And those updates that keep popping up? Hit ‘update’ now. It’s not just nagging; those are new shields for your money.

Watch out for messages or calls that smell fishy. If they want your details or say you won something, it might be a trick. It’s easy – if in doubt, just shout… or, well, hang up or don’t reply.

For the money handlers out there, businesses and banks – you’ve got homework too. Test your apps, all the time, for leaks. Teach your folks about the phony stuff and get them ready to spot it.

So, before you tap to buy that hot new game or the shoes you’ve been eyeing, think – is everything locked up tight? Are you giving the cyber crooks a fight?

Remember, e-wallets are cool, but keeping money safe is way cooler. Stay sharp, stay safe, and let’s beat those cyber baddies together!

Enhancing Security for the Contactless Era

Biometric Verification and Advanced Authentication Techniques

We live in a time where a tap can pay for coffee. But, this ease can bring real risks. To stay safe, we need solid security measures. Top of the list? Biometric checks. These use unique traits like fingerprints to confirm who you are. It’s tough for thieves to copy these personal bits.

So, what’s the scoop on biometric security for digital payments? In a nutshell: it uses your body’s info to guard your money. Let’s dive deeper. With biometrics, smartphones and payment devices get smarter. They require your physical touch – a fingerprint, an eye scan, or even your face – to okay a buy. These methods are super personal. This makes it hard for someone else to fake and spend your cash.

This isn’t all dreamland stuff. Sure, new tech has hiccups. Some worry about their prints being stolen or gadgets messing up. Not to fret, though. The tech world is buzzing, finding ways to fix these speed bumps.

Preventing Card-Not-Present (CNP) Fraud in Digital Transactions

Ever shopped online and paid without showing your card? That’s a CNP deal. Handy, yes. Safe? Not always. Thieves love this kind of shopping because it’s easier to do sneaky stuff.

Here’s the deal with CNP fraud: it happens when someone buys stuff online using info they shouldn’t have. They don’t need the physical card, just the numbers. But we can fight back.

How? Think of layers. Each layer is a step to stop bad guys. One layer is using a secret code you get by text when you buy. Another is looking closely at odd buying habits. Stores might flag if you buy ten TVs when you’ve never bought one before.

Sure, it’s a game of cat and mouse. We plug one hole, they dig another. But we’re onto them. It’s about being wise. Check your buys often. Use those secret codes. Be alert. These moves help keep your hard-earned cash safe.

Cyber crooks don’t sit still. And neither do we. As they dream up new schemes, we build stronger walls. It’s a fight we can win with smarts and the right tools.

Each tap, each swipe means trust. Trust in a world unseen, where your money flies through the air. As experts, our mission is to ensure that when you tap to pay, security is there, standing guard, unseen but ever-vigilant. And together, with steps like biometric checks and layers of defense, we make this contactless era not just convenient, but safe.

Money matters. So does safety. That’s why we put our best into keeping both secure. Let’s keep tapping, but tap smart. With biometrics and secure shopping steps, we’ve got this.

We’ve dug deep into digital payment risks and how to stay safe. From phishing tricks to malware, your money faces real threats. But there’s hope. With smart moves, you can outsmart the bad guys. Remember, the key is to keep learning, use tough encryption, and don’t cut corners on security steps. Always double-check everything. Even with fancier tech like biometrics, risks lurk. So, stay sharp, update your defense game, and watch your cash stay safe in this wild world of e-payments. Stay safe out there!

Q&A :

What are the current top threats to digital payment security?

With the rapid advancement of technology and increasing reliance on digital payments, the security threats have evolved. Some of the top threats currently include phishing scams, where attackers use fraudulent messages to trick victims into providing sensitive information. Advanced malware and ransomware can also infiltrate systems to steal credentials, encrypt files, and disrupt payment operations. Additionally, identity theft and fraudulent transactions, where attackers use stolen data to make unauthorized payments, are on the rise.

How can consumers protect themselves from digital payment threats?

Consumers can enhance their protection by adopting several best practices. Using strong, unique passwords for different accounts and enabling two-factor authentication wherever available can vastly improve security. Regularly monitoring bank and payment accounts for unauthorized transactions is also crucial. Consumers should be wary of phishing attempts by verifying the authenticity of messages they receive and should never click on suspicious links or attachments. Keeping software and applications updated is also important to patch any security vulnerabilities.

What are the latest trends in security measures for digital payments?

The latest trends in enhancing digital payment security encompass a variety of technologies and methods. Biometric authentication, using fingerprints or facial recognition, is becoming more common for verifying transactions. Tokenization, which replaces sensitive payment data with a unique code, adds an extra layer of security. Artificial intelligence and machine learning are also being used to detect and prevent fraudulent activities in real-time. Moreover, the adoption of blockchain technology provides a decentralized and secure ledger for transactions, reducing the potential for tampering and fraud.

How do digital payment platforms detect and prevent fraudulent activities?

Digital payment platforms employ a suite of technologies and protocols to detect and prevent fraudulent activities. They often use advanced algorithms and machine learning to analyze transaction patterns and flag anomalies that could indicate fraud. Additionally, they utilize encryption to secure data in transit and at rest, as well as adhere to strict authentication methods for users. They also have teams dedicated to monitoring for suspicious activities and responding to security incidents to protect consumers’ financial data.

Is it safe to use digital payments for large transactions?

Using digital payments for large transactions can be safe, but it requires due diligence and the use of security features offered by payment platforms. Users should ensure they are using a trusted and secure platform with robust security measures in place, such as end-to-end encryption, fraud detection systems, and compliance with security standards like PCI DSS. It is also advisable to use secure networks when making transactions and to verify the legitimacy of the recipient. While there is always an inherent risk in any financial transaction, following security protocols can greatly minimize the chances of fraudulent activities.