Securing Your Cyber Wallet: Why Data Security is Vital for Digital Payments

In a world where a swipe or a click moves money, the importance of data security for digital payments matters more than you think. Every digital transaction you make is a treasure trove for thieves if left unprotected. From the card you swipe at the store to the payment app on your phone, each deserves ironclad security to guard your hard-earned money. My goal is to guide you through the maze of risks and defenses, helping you secure what’s yours. Imagine leaving your wallet open in a crowd. That’s digital payments without proper security. Let’s lock it up tight.

The Foundation of Digital Payment Security: Understanding Key Concepts

Recognizing the Landscape of Cyber Threats in Electronic Payments

Keeping your cash safe was simpler in the old days. When we moved to cards, we had PINs. Now, online cash needs tough security. Imagine your phone as a wallet. Just like you wouldn’t leave your wallet out for thieves, you can’t let hackers near your phone cash.

Cyber thieves want your digital dollars. They use sneaky tricks to steal from you online. We’re fighting back, though! We make super-safe paths for your money to move. These paths are called secure payment gateways. They are like armored trucks for your cash on the internet.

Without good safety steps, your money could vanish. That’s why we build walls of codes around your cash. Think of it as a secret language that hides your money info. This secret code is called encryption. Encryption jumbles up your payment data so only the right person can read it.

How else can we guard our cash online? We double-check who’s asking. In real life, you show your ID. Online, we use something called two-factor authentication. This means we make sure it’s you in two ways, like asking for a password and then sending a code to your phone.

The risk of data leaks is like leaving your wallet on a park bench. So, we’re always watching, always updating our protection. Digital payment security doesn’t take breaks.

The Role and Importance of PCI DSS Compliance in Financial Transactions

Did you know there are special rules for how we keep card info safe? This is called PCI DSS compliance. It’s a big deal and all big shops follow it. Think of it as a promise to guard your card like a knight.

Why is this so important? Well, imagine if no one watched how your card info was kept! That’s asking for trouble. That’s why these payment card industry rules are so strict. They make sure everyone’s playing it safe with your card details.

Staying in line with PCI DSS means shops and banks take specific steps to keep your money data secure. They check their safety measures often to make sure they’re working right. They also need to stop threats to your card. It’s all part of keeping your cyber wallet safe.

In short, PCI DSS makes sure there are guards at the gate of your digital fortress, keeping your card details safe. This is just the start. To keep ahead of the bad guys, we need strong cybersecurity strategies. Then you can click, buy, and relax, knowing your digital dollars are well-protected.

Fortifying Digital Wallets: Advanced Secure Payment Mechanisms

Deploying Two-Factor Authentication to Combat Fraud

Scared of someone stealing from your online wallet? You’re right to worry. Thieves love easy money. They’re always finding new ways to snatch your cash online. This is where two-factor authentication (2FA) enters the scene.

What’s 2FA, you ask? It’s like a double door to keep your money safe. First, you enter your password. Then, you prove it’s really you by using something else – like your phone. Just know this: it stops a lot of theft cold. Each time you check in, 2FA asks for that second proof. No second key, no entry. Simple, right?

With 2FA, even if someone cracks your password, they can’t get to your digital dough without that second step. And that step is your secret weapon. Banks, shops, and payment apps all use it. They know it’s a strong block against online robbers.

The smartest thing? Use 2FA every chance you get. Whether it’s face ID, fingerprint, or a code sent to your mobile – just turn it on. It’s not hard, and it makes a big difference. This keeps your money where it belongs – with you.

The Significance of Encryption and Tokenization for Transaction Safety

Next up: keeping your card safe online. This matters a lot. When you buy stuff on the web, your card details fly through cyberspace. You want those details locked up tight. Enter encryption. It’s like turning your card number into a secret code. Only the right computer can crack it and complete your buy. If bad guys grab this code, they get gibberish.

But wait, there’s more. Heard of tokenization? Imagine swapping your card number for a decoy every time you buy. That’s tokenizing. The decoy number is called a token. It’s good for just one buy. So, toss it to the thieves, and they can’t use it again. Your real card number stays hidden, and safe.

Online shops are turning to this more and more. With tokens, your shopping spree is like a series of one-off locks, very tough for thieves to break. They can’t steal what they can’t crack.

Now you’re catching on. Encryption? It scrambles your details. Tokenization? It swaps them for a one-shot number. Both serve one goal – to keep your cash and cards safe as houses. Keeping your money safe online is a big job. But with 2FA, encryption, and tokenization, you’re building a cyber fortress.

So next time you tap to buy or send cash, just think. Behind those quick clicks, there’s a ton of tough tech guarding your greenbacks. Sleep easy knowing your cyber wallet is locked up tighter than a drum.

The Digital Shield: Protecting Consumer Data and Privacy

The Implementation and Advantages of SSL Certificates and Digital Wallet Technology

Think of SSL like a superhero cape for data. It wraps it up safe when it flies across the internet. When you pay online, this cape jumps into action. The SSL makes a secret code that only you and the website know. This keeps your card number safe from bad guys.

But what is SSL actually? SSL stands for Secure Sockets Layer. It’s a way to make an internet connection safe. It makes your information private when it goes from your computer to the payment site. When you see that little padlock in your web browser, it means that SSL is working.

Why is it vital, though? Every day, many folks like you buy stuff online. If there was no SSL, hackers could easily steal your payment info. And nobody wants that to happen!

So how does it work with digital wallets? It’s like a superhero team-up! Digital wallets keep your payment info in one spot. You can use your phone to pay without showing your card. Blending this with SSL makes your payment twice as safe.

Digital wallets are cool because they’re not just about hiding your card number. They watch out for thieves by checking who’s trying to pay. They make sure it’s really you by asking for a fingerprint or a face scan.

Upholding Standards with Biometric Verification Systems and Contactless Payment Measures

Now, let’s chat about biometric systems. These use parts of your body, like your fingerprint, to check it’s you. They can even use your face or your voice! No one else has the same body parts as you, so it’s super safe.

But are biometrics really secure? Yes! It’s like having a secret handshake with your phone. Only you can unlock it because only you have your fingerprint. Even if a crook knows your password, they can’t fake your fingerprint.

Contactless payments are also part of our big security family. You have seen folks tap their card or phone on a machine to pay. That’s contactless! It’s quick and means you don’t have to touch anything. That helps stop germs and thieves.

These tap payments also have special security built right in. Every time you tap to pay, a one-of-a-kind code is made just for that purchase. It’s like your payment is wearing a disguise. Even if a hacker grabs the code, they can’t use it again!

So, when we add up SSL, digital wallets, biometrics, and contactless payments, we are like a strong team working to protect you. It’s important to use these tools to keep your money out of the wrong hands. Everyone deserves to shop and pay without worry. And that’s what we’re here for – to shield your digital payments and help you shop safely every single day.

Addressing the Hidden Threats: A Holistic Approach to Payment Security

Strategies for Effective Fraud Detection and the Role of Regulatory Compliance

When you shop or pay online, dangers lurk. Bad guys aim to steal your hard-earned cash. But fear not, digital payment security is our shield. Keeping financial info safe online is job number one. Cyber threats in electronic payments come in many forms, but we’ve got the tech to stop them dead in their tracks.

We use cool stuff like encryption for online payments to scramble your data. It’s like writing a secret code that only you and the seller can read. And guess what? There’s a set of rules called PCI DSS compliance that all online shops must follow to protect your card details.

But what about when you’re logging in to pay? We make sure you’re really you by using two-factor authentication methods. It’s like needing two keys to open a treasure chest. Now, with all of this in place, the risk of data breaches – when sneaky hackers break in and steal data – gets way lower.

To stay extra safe, we guard your info like a dragon guards treasure. Payment card industry standards are our battle plans. They tell us how to keep every payment safe. We never let our guard down. Cybersecurity strategies are always getting better, and we’re always watching out for you.

You might have seen some online shops ask if you want to save your card for next time. That’s called tokenization of payment information. It means replacing your card details with a unique code. If hackers get this code, it’s useless to them – it’s a dud!

Remember, locking down your financial data is like putting armor around your money. And when it comes to secure payment gateways, we double-check that they’re tough enough to keep out any unwanted guests.

Safeguarding Mobile Payments and Evaluating Payment Processors’ Security Protocols

Now let’s chat about paying with your phone. Mobile payments are super handy but have to be super secure too. We keep an eye on mobile payment security concerns every day. That way, every tap or scan is a secure one.

How do we do it? We dive into payment processors’ security protocols with a fine-tooth comb. We check that they’re bulletproof. All this stuff may sound like a bunch of tech mumbo-jumbo. But trust me, it’s crucial for keeping your cyber wallet safe.

Every swipe, every tap – it’s all protected. We use the best tricks in the book to block the bad guys. From fancy biometrics that read your finger or face, to high-tech chips in your card, we use it all to keep you safe.

And we’re always one step ahead. New rules come out, like GDPR and PSD2, and they’re like new moves in our security dance. We learn them quick to make sure you’re covered.

Paying online is part of life. It should be easy and safe. That’s the job – no, the mission – of every digital payment security pro. Protecting your money, your info, your peace of mind. Every click, every payment, every time.

In this blog, we looked at keeping digital payments safe. We dug into cyber threats and why rules like PCI DSS matter. We learned that tools like two-factor authentication and tokenization are key for wallet security. We also saw how SSL certificates and biometrics protect our data. Finally, we talked about spotting fraud and choosing secure payment processors. Always pick strong security to keep your money safe. Trust is everything in digital payments, and staying ahead of threats is a must. Keep these tips in mind to secure your transactions every time.

Q&A :

Why is data security crucial for digital payments?

Data security is essential for digital payments to protect sensitive information like bank details, credit card numbers, and personal identification from unauthorized access, fraud, and theft. Ensuring strong data security builds trust between merchants and consumers, and is critical for maintaining the integrity of the digital economy.

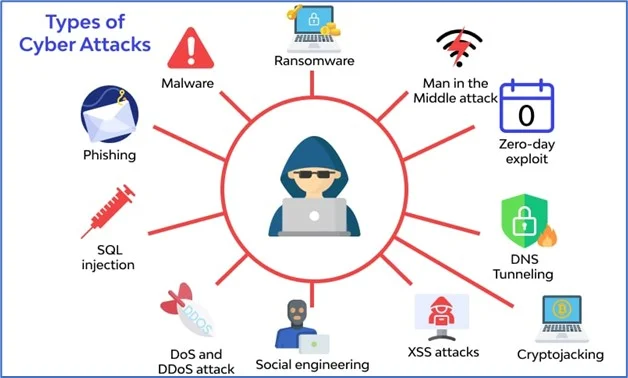

What are the common threats to data security in digital payments?

The digital payments ecosystem faces numerous threats, including hacking, phishing attacks, malware, and ransomware. Fraudsters use these methods to intercept or steal financial data during transactions. Protecting against such threats is imperative to secure digital transactions.

How can consumers ensure their data is secure when making digital payments?

Consumers can enhance their data security by using strong, unique passwords for their payment accounts, enabling two-factor authentication, and only using trusted payment apps and platforms. Regularly monitoring bank statements and being cautious of phishing attempts also contributes to securing their data.

What role do encryption technologies play in securing digital payments?

Encryption technologies play a pivotal role in securing digital payments by converting sensitive information into unreadable text during transmission over the internet. This ensures that even if data is intercepted, it remains inaccessible to unauthorized parties. Secure Socket Layer (SSL) and end-to-end encryption are common forms of encryption used in digital payments.

Can regulations and compliance standards help in ensuring data security for digital payments?

Yes, regulations and compliance standards, like PCI DSS (Payment Card Industry Data Security Standard), are designed to ensure that all entities that handle credit card information maintain a secure environment. Adhering to such standards helps in mitigating risks and enhancing the security of digital payments on a broader scale.