Banks once stood unchallenged, the go-to for all things money. Now, the ground shifts beneath them as the Impact of financial disintermediation on banks reshapes the finance landscape. As an expert wading through this change, I’ve seen firsthand how banks are racing to adapt. With new tech players entering the fray and customers opting for digital-first services, a question hangs in the air: Are banks losing their foothold? This transformation affects everything from where we save our cash to how banks make their money. Dive in as I lay out what’s driving this financial shake-up and what it means for the future of banks.

Understanding the Drivers Behind Financial Disintermediation

The Emergence of FinTech as a Competitive Force

You may wonder, “What’s shaking up our banking world?” It’s FinTech – a blend of finance and technology. FinTechs include any business using software to give financial services. The buzz is all about them!

These tech stars, like peer-to-peer lending sites and digital wallets, are changing how we think of money. They connect people who need cash with those who have it, without a bank in the middle. Folks who want to invest or save find online platforms handy. And when they use these, traditional banks see less action.

FinTechs not only offer new ways to do things. They often do it cheaper and faster than banks. And people love that! They can get loans, invest money, or send cash with just a few taps on their phones. Who wouldn’t like that ease?

Also, think about cryptocurrencies, like Bitcoin. They’re a new spin on cash. This tech lets people buy things or send money without banks. For banks, that means less control over money moving around. And when banks lose that, they find it tougher to make money.

Consumer Shift Toward Digital-First Banking Solutions

Now let’s switch gears and chat about you and me, the regular folks. These days, many prefer banking that’s quick and easy – right from our phones or laptops. Why go to a branch when you can do everything online?

People want their banking swift, smooth, and smart. This means they’re flocking to personal finance apps and mobile payment services. These apps show us our spending, savings, and offer tips. And for payments? Zap! Money’s sent in a heartbeat. This tech-led path means fewer folks visit bank branches or use traditional methods.

This shift isn’t just about cool tech. It’s about our habits and what we expect. We want our banks to know us well. And we want services made just for us, not one-size-fits-all.

Banks have a big task ahead. They need to catch up and get on the digital train, or they’ll watch their customers walk away. Keeping up isn’t simple; it’s a mix of new tech, changing rules, and staying safe.

So, as banks face these tech tides and changing tastes, they’re rethinking their game. It’s innovate or get left behind. The goal? To stay needed and loved in a world where a bank isn’t just a building on the street corner but an app on your phone.

Banks today are busy figuring out how to stay important in this digital dash. They’re cooking up fresh ideas to keep you happy and your money safe. Sure, it’s a big shift, but banks know they have to stay agile in this fast-changing money world. And for us, the customers? This could mean banking that gets even better and more tuned into what we need.

The Changing Landscape of Banking Revenue and Profitability

Impact on Traditional Revenue Streams for Banks

Banks used to be the go-to for all our money needs. We’d go there to save our money, get loans, and invest. Now, things are different. FinTech companies and online platforms are everywhere, and they’re changing how we use our money. This means banks are seeing less action. Less people are walking through their doors to get loans or set up savings accounts because they can do it all online.

One main way banks make money is from the interest they charge for loans. But peer-to-peer lending sites let people borrow money straight from others. No banks needed. This cuts banks out of the deal. Online investment platforms are another issue for banks. People can invest money without needing a bank to help them do it. They’re quick, they’re easy, and that hurts bank’s profits.

Cryptocurrencies are also messing with how banks do business. They let people do business without touching regular money that banks control. Again, banks don’t get to be part of the action. All these changes and new ways to do old things mean banks have to fight harder to make money.

How Reduced Margins Are Affecting Bank Profitability

So, because banks aren’t the only money game in town anymore, they’re not making as much from fees and interest. This is tough for banks because these fees were a big part of what kept them going. Think of it like this: If a baker sold fewer cakes because there were lots of other cake shops around, they’d make less money right? It’s like that for banks now. Banks are feeling the pressure and seeing their profits dip.

Interest rates are always changing, and that used to help banks. They could make more money when rates went up. But now, with so many options out there for us to manage our money, banks can’t rely on this as much. Online banking, apps, and tech firms coming into the financial world means banks must find new ways to make money. They need to adapt or get left behind.

Banks are starting to do a few things to keep up. They’re coming up with new tech, like apps for banking on your phone. They’re opening up what’s called “open banking” that lets different financial services work together. And some banks even get into the online lending game themselves. They’re also teaming up with FinTech companies instead of just fighting against them.

Just like in a game where the rules change, banks have to learn the new rules or they’ll lose. This is how banks are trying to stay in the game. It’s a big change for them, but it’s exciting for us because it means we get more choices on how to handle our money. Banks won’t ever go away completely, but they sure do have to work harder to stay important.

Adapting to a New Era: How Banks Are Responding

Strategies for Banks to Counteract Disintermediation

Banks see their world changing. FinTech companies are on the rise. They offer loans, savings, and more. They cut out the middleman. This means banks must change or lose out.

Banks now fight to keep up. They create online tools and apps. This helps them stay in the game. They work with tech firms, not against them. They aim to give what customers want.

Banks also look to protect what they have. They boost interest rates to keep savers. They lower loan rates to fight peer-to-peer lending. They add new products like smart budgeting tools. They make banking easy from home or on the go.

They even partner with FinTech companies. This has two big perks. It gives customers cool new services. It helps banks learn from tech gurus.

Banks remember their roots too. They stick to good customer service. They make sure people trust them. Trust is key in banking. Folks need to feel safe with their money.

What about rules? Banks must follow strict ones. They use this to show they are safe and sound. Tech firms are not as tightly watched. This could mean banks have a chance.

The Role of Regulatory Frameworks in Shaping Bank Strategies

Rules are big in banking. They shape how banks keep money safe. They guide how banks lend money. Rules change, and banks must change too.

One big rule change is about open banking. This lets apps and websites get into your bank data. It helps you see your info in one place. It also lets you shop around for better deals.

Banks use this new rule to their edge. They make deals with other firms. This means they offer more than just bank stuff. They might help you find a better power deal or phone plan.

Rules also protect customers. They make sure banks tell the truth. They check banks have enough money to stay strong. This makes people trust banks more, not less.

Rules can also help banks with new tech like blockchain. They can use it to cut costs and pass the savings on. It can make sending money cheaper and faster.

Banks now think ahead. They know tech will only grow. They keep an eye on what’s new. They get ready to change fast when they need to.

Always, banks look to keep trust. They show they are safe. They help customers. This is their big fight against FinTech firms. The world of money may change, but trust will stay the same.

The Future of Financial Services: Innovation and Customer Preferences

Rise of Automated and Algorithm-Based Advisory Services

Kids these days won’t know a world without smart helpers, even for money advice! You see, smart robots, we call them robo-advisors, are changing the game. They give you money advice, and it’s not like the old days at all. Imagine a robot that can tell you where to put your bucks to grow your candy stash. It’s here now, and folks dig it because it’s easy, fast, and often cheaper than a human advisor.

Robots don’t need sleep or lunch breaks. They can manage lots of people’s money all at once. This means banks are feeling the pinch. They’ve always had humans giving money advice. But now, these robo-advisors pop up and people are saying, “Hey, that’s pretty cool, and my wallet likes it too!”

Shifts in Customer Behavior and Expectations in Banking

Has a friend ever sent you money on your phone just by tapping a few buttons? That’s what banking is like today. People, especially younger ones, want banking that is quick and straight from their phones. They want it all – pay bills, send money, save money, all in one app.

Banks used to be the only game in town for all this. But now, there are companies that say, “We can do this too, and make it more fun!” These companies, we call them FinTechs, are everywhere. And guess what? You don’t even need to walk into a bank anymore.

So, banks have new homework. They have to keep up with what people want, which is a tall order. It’s not just about saving and lending money now. It’s about being as quick and easy as ordering a pizza.

People also think about who they trust with their cash. They ask, “Will this bank or app be safe and fair?” Banks have built trust for years, but now, there are so many choices. And with all the news about cryptocurrencies shaking things up, people get curious. They see banks and wonder, “Are you keeping up?”

I’ll tell you, it’s a fascinating time. As an expert, I see this every day. Banks are racing to meet what people expect now and in the future. It’s a bit of a tug of war between old school ways and super cool tech.

It makes you think, with all these smart apps and online money tricks, what will banks do next? I’m keeping my eyes peeled. Because the one thing that’s sure, change doesn’t stop, and neither does our need to understand it.

We’ve explored how FinTech is changing banking. Banks are losing some of their usual ways to earn because people want digital services more. Under this pressure, banks now earn less money.

This means banks need new plans. They’re becoming creative and looking at rules to find ways to stay strong. With tech giving advice and customers wanting new things, banks have to keep up with the times.

In the end, banks that listen to what people want and use new ideas will do well. Those that don’t may get left behind. It’s a time of big shifts in the money world, and we’re all watching to see what happens next.

Q&A :

What is financial disintermediation and how does it affect banks?

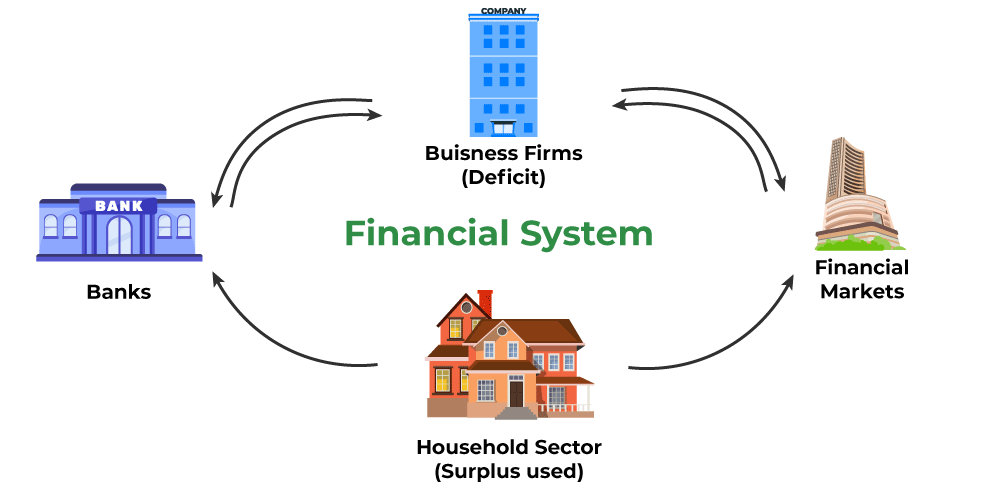

Financial disintermediation refers to the process where borrowers bypass traditional banks and financial institutions to secure funds from alternative sources, such as peer-to-peer lending, crowdfunding, or bond markets. This shift can significantly impact banks by reducing their role as intermediaries in the financial market, leading to a potential decrease in their revenue streams, profit margins, and influence over the financial sector.

How has the rise of technology-driven platforms contributed to financial disintermediation?

The advent of technology-driven platforms like online lenders, fintech companies, and investment apps has greatly contributed to financial disintermediation. These platforms offer more direct access to capital and financial services, often with lower fees and more convenience than traditional banks. This has made it easier for consumers and businesses to explore alternate funding sources, thus eroding the market share of conventional banks.

Can banks respond to the challenges of financial disintermediation?

Yes, banks can respond to the challenges posed by financial disintermediation by adapting their business models and embracing technology. Banks may invest in digital innovation, form partnerships with fintech companies, or develop their own alternative lending platforms. By doing so, they can offer more competitive services and retain their customer base. Moreover, banks can leverage their expertise in risk management and regulatory compliance to their advantage.

What long-term effects could financial disintermediation have on the banking industry?

Over the long term, financial disintermediation could lead to a fundamental restructuring of the banking industry. Banks may be compelled to focus more on fee-based services, advisory roles, and value-added services to compensate for the loss of traditional lending income. Additionally, the industry might witness further consolidation as smaller banks struggle to compete, while larger banks with robust digital strategies may continue to thrive.

Does financial disintermediation pose a risk to the overall financial system?

Financial disintermediation does pose certain risks to the overall financial system, including increased market volatility and a potential reduction in the effectiveness of monetary policy. Since alternative lending sources may not be as strictly regulated as traditional banks, there’s a potential for higher systemic risk if these sectors face financial distress. Moreover, banks play a crucial role in financial stability, and their weakened influence could affect economic stability during financial crises.