Impact of digital economic platforms: the phrase alone might make your eyes glaze over. But stick with me. These platforms are flipping the world of work and business on its head. Think about how often you use apps to buy stuff, or find a ride, or even land a job. We’re living the revolution, folks—business isn’t just “business as usual” anymore. I’ve seen it first-hand, and I’m here to break it down for you. From the rise of gig work to the e-commerce boom, it’s all changing fast. And with this shift comes new rules. How will companies keep up? Can jobs keep growing? And let’s not forget the nitty-gritty of staying safe and playing fair in this digital sandbox. Ready to dive in? Let’s dig into the nitty-gritty of this modern shift.

The Rise of Online Marketplaces and the Gig Economy

Transforming the Landscape of Job Creation

Have you noticed more people finding work online? It’s a big trend now. Online marketplaces are places on the internet where folks can sell or buy services and goods. They’re changing how people find jobs and make money. The gig economy helps too, letting people work as freelancers or take short-term jobs.

Here’s a cool fact: these marketplaces create lots of jobs. From designers to drivers, people now have new ways to earn. So, if you have a skill, you can sell it online to anyone anywhere! This wasn’t common 20 years ago, but now it’s a growing part of our working world.

I’ve seen firsthand how folks use their phones to find gigs. It’s smart because you can work when you want. This creates jobs that fit around your life, not the other way around. Imagine choosing your hours instead of a boss doing it for you.

But this new way of working isn’t just about freedom. It’s about tapping into a global market. Let’s say you make cool t-shirts. You can sell them to anyone in the world with the internet. This wasn’t easy before online marketplaces.

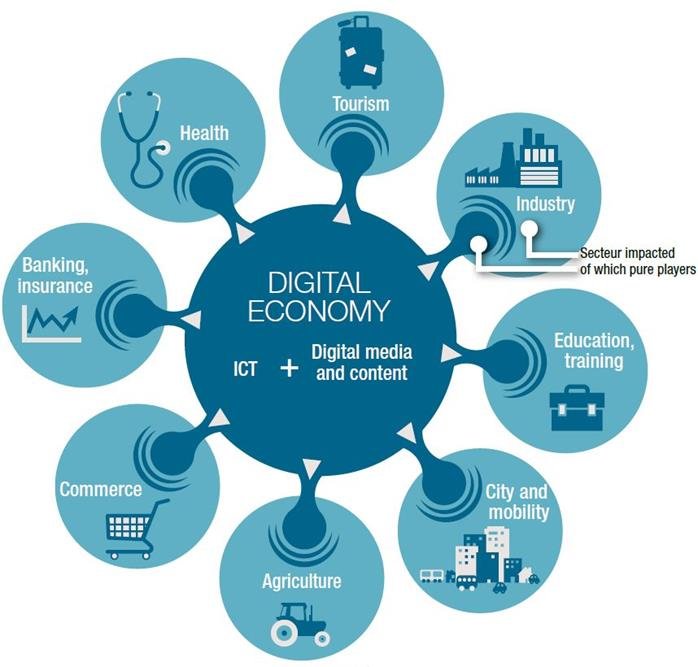

Fostering Economic Growth Through Technology

Now, let’s talk about growing money, the economy kind. When we use technology, like apps for jobs, it helps our whole economy grow. More online sales mean more money moving around. And when money moves, businesses can grow and hire more people.

Tech is super important too. It gives us digital payment systems. These let us pay with a click instead of cash. So buying stuff, even from far away, gets a lot easier. It’s a big deal for folks who sell things. They can now get customers from around the world, not just from their town.

Here’s another cool thing about tech: it lets us share what we own. Like cars or homes. Platforms like Airbnb let you rent out your place. That’s the sharing economy. You get extra cash, and guests get a homey place to stay.

The gig economy benefits from tech too. Apps connect workers with jobs fast. Got a car? Drive for Uber. Got a knack for writing? Find a freelance gig online. These are jobs that didn’t exist in the old days. They’re new, and they’re growing fast.

Just think, with all this tech, someone in a small town can sell to someone in a big city halfway around the world. They use their phone to do business, to grow, and to bring in money. From this, we see more jobs and a stronger global economy. Technology isn’t just changing jobs; it’s making our world richer, one gig at a time.

Navigating the Shift to Remote Work and Digital Employment

Leveraging Remote Work Trends for Business Continuity

Around us, remote work shapes how businesses stay afloat. It’s the new norm. Companies now use tech to link teams across the globe. This trend keeps business going even when offices close down. Work from home setups, online tools, and digital platforms make this possible. Firms stay productive. They serve customers without missing a beat. This way, they also tap into a wider pool of talent.

With more folks working from afar, the gig economy blooms. Here, people can pick short-term jobs or projects worldwide. It’s no shock that remote work and the gig-economy are tight-knit. Together, they are shifting the work scene. They bring fresh chances for earning and growth.

The Implications of a Distributed Workforce on Global Productivity

Imagine a world where work knows no borders. Well, it’s here. Businesses hire the best talent from anywhere. This widens their reach and boosts results. So, what does this mean on a bigger scale?

For one, it pumps up global productivity. People work in zones across different times. They can pass tasks like a baton in a relay race. This cuts down idle time. And that’s not all. It opens doors to jobs in places that once lacked them.

So, we see a global economy taking shape—one that’s alive round the clock. It’s a change we can’t ignore. It affects everything from local shops to global trade.

This shift is not without challenges, though. For instance, how do we keep data safe when it travels all over the place? And what about making sure everyone plays fair in this vast digital workplace? We’ve got to figure these things out as we go.

There’s a lot going on in this digital leap. Businesses morph, new jobs pop up, and the economy gets a jolt of energy. Let’s keep our eyes on how we grow smarter, more secure, and fair for everyone in this global digital workspace. It’s an exciting time, and we’re all a part of it, together.

E-Commerce and Digital Payment Systems: The Backbone of Modern Trade

Analyzing Consumer Behavior and E-Commerce Growth

Today’s shoppers love to click and buy. E-commerce websites let us shop 24/7. We buy all sorts from clothes to food, all online. It’s handy and fast. This shift has changed how shops work and how they reach us. Tech helps them learn what we like. This makes us find and buy things faster. It also helps shops sell more.

Digital payment systems make shopping online easy. We use cards, phones, or apps to pay with a quick tap. This boosts sales for stores because it’s so simple. It’s not just about ease, though. Folks now feel safer paying online rather than with cash.

Many shops are now online-only. They save money by not having a store. This means we often get better prices. But with so much online shopping, stores must work hard to stand out. They make websites fun and fill them with deals to keep us coming back. Shops have to ship goods fast to keep us happy. Faster shipping keeps us clicking that ‘buy’ button.

The Integration of Blockchain and Fintech in Digital Transactions

Money talk can be tricky, but let’s try to keep it simple. Fintech means using tech to handle our cash, like mobile banking. Now there’s blockchain too. It’s like a safe, trackable ledger that’s all over the web. It helps keep our money safe when we send or get it across the world.

Fintech firms make paying for things super easy. They let us send money without stress. Some fintech apps even round up our spare change from purchases. This money can go into savings or investments. Fintech can also check many bank accounts at once. This helps keep our money in order.

Blockchain can be hard to wrap your head around. But it’s a big deal for safe trades. It’s done without the need for banks or big fees. It’s like passing a note that everyone can see, but no one can tear up or change. This is great for folks and companies trading across borders. It means trust, no matter if you’re near or far.

Together, blockchain and fintech are changing the game. They make buying and sending cash quick, cheap, and safe. This helps small businesses grow and reach more people. It also lets startups join in on trade with less fuss. This is all good news for our wallets and the globe’s economy.

This tech change has been a win-win. People find shopping easier, and businesses can sell more. With all these new ways to buy and sell, our world feels smaller, and our choices feel bigger. And with a good plan, both our data and our dollars stay safe. We must make sure that everyone can play a part in this new economy. The web is big enough for all our shops, ideas, and dreams.

Regulatory Challenges and Evolution in the Digital Economy

Addressing Data Privacy and Cybersecurity in an Interconnected World

We live in a world more connected than ever before. Our personal info is online, and businesses hold lots of it. This raises major concerns about data privacy. How safe is our info? The answer is tricky. We depend on cybersecurity to keep our info secure. But as the internet grows, so do the risks. Hackers get smarter, and data breaches happen more often. That’s why we need strong cyber security measures, now more than ever.

Data privacy isn’t only about keeping info safe from hackers. It’s about how businesses use your info. Ever wonder why the ads you see online seem to read your mind? That’s because companies track what you like and buy. They use this to show you things they think you’ll want. But this can feel creepy and like an invasion of privacy. So, how can we enjoy the perks of the online world without feeling watched all the time?

This is where smart laws come in. Governments around the world are working hard to create rules that both protect our privacy and let businesses grow. Europe made a big step with its GDPR law. GDPR makes sure people know what info companies have on them and how it’s used.

Businesses must be careful with how they collect and store our data or face big fines. Rules like these aim to give people more control over their personal info. This changes how companies work and impacts the global economy. Rules are tough to make, though. They must be strict enough to protect us but not so tough that innovation suffers. It’s a fine line to walk.

Balancing Innovation with Regulation: Platform Economy and Antitrust Issues

In this new digital age, platforms like Amazon and Uber have changed how we shop and get around. Let’s call it the platform economy. These platforms offer cool services but they also grow super fast and can crowd out smaller players. That’s why antitrust issues pop up. “Antitrust” means making sure businesses play fair and no single one can control the whole market.

Some folks worry these big platforms might be too powerful. They can set their own rules, which may hurt competition and choice for us. If there are fewer companies to pick from, we might end up paying more for less.

How do we fix this? Again, it’s about finding balance. Regulators study digital platform regulation to keep markets fair. They want to make sure new companies have a chance to thrive, too.

Remember, big platforms can be good for efficiency and can help the economy. They connect buyers and sellers from all over the world, making trade easier. But we don’t want them to get so big that no one else can compete.

It’s not an easy problem to solve. Regulators need to be as creative as the companies they’re checking on. The goal is to keep the market open for innovation while making sure it stays fair and competitive. Everyone should get to play the game—not just the ones who own the ball.

Staying ahead in business today means more than just having a great product. It means playing by the rules in a digital world that’s always changing. That’s how we can make sure the digital economy stays healthy and fair for everyone.

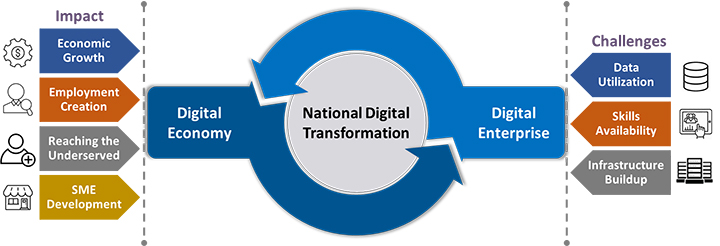

We’ve seen how online marketplaces and the gig economy are revamping how we work. These platforms are making jobs for tons of people and giving a big boost to our economy, thanks to tech. Remote work is now a huge thing too, and it’s changing how businesses keep going, even when times get tough. It’s also shaking up work around the globe.

On top of that, we can’t talk shop without e-commerce and digital cash – they’re key to trade today. We watched how folks shop change and how super smart tech like blockchain is mixing into how we pay for stuff online.

But hey, with all this cool tech, we’ve got to stay sharp with rules and keeping our online world safe. That means getting a handle on keeping our private stuff private and making sure new ideas don’t get squashed by old rules.

All in all, the digital economy is like a game changer. It’s got its ups and downs, sure, but it’s here to make a splash and I think we’re just getting started. Here’s to finding our way in this bold, new world of clicks, swipes, and digital handshakes!

Q&A :

What are digital economic platforms and how do they work?

Digital economic platforms, often known as online marketplaces, connect buyers and sellers through a digital interface, facilitating transactions of goods, services, or information. These platforms use sophisticated algorithms and data analytics to match supply with demand, streamline transactions, and optimize the user experience.

How do digital economic platforms affect the traditional economy?

Digital economic platforms disrupt traditional markets by offering more efficient, scalable, and often less costly alternatives. They often reduce barriers to entry for small businesses and individual entrepreneurs, while also impacting employment and business models in sectors like retail, transportation, and accommodation.

What are the benefits of digital economic platforms for consumers and businesses?

For consumers, digital economic platforms provide greater convenience, expanded choice, and often better prices. Businesses can benefit from wider market access, reduced overhead costs, and data-driven insights into customer preferences, which can lead to more tailored offerings and innovations in service delivery.

How have digital economic platforms changed employment patterns?

Digital economic platforms have given rise to the ‘gig economy,’ characterized by flexible, freelance or short-term contracts. While this offers workers flexibility and the opportunity for entrepreneurship, it also raises concerns about job security and benefits traditionally associated with permanent employment.

What regulatory challenges do digital economic platforms pose for governments?

Governments face challenges in regulating digital economic platforms to ensure fair competition, protect consumer rights, secure tax revenues, and prevent abuse such as monopolistic practices. Additionally, there is the challenge of safeguarding workers’ rights in a landscape where traditional labor laws may not easily apply.