Navigating the sea of e-commerce can be daunting, especially when it comes to how to choose an e-commerce payment platform. With customers’ checkout experiences hinging on your choice, this decision is no small feat. You want a system that not only offers diverse payment methods but also aligns with your budget without skimping on security. And let’s not forget the importance of a seamless user experience to keep those conversion rates high. Ready to tick all those boxes? Keep reading for your ultimate checklist to select the perfect e-commerce payment platform that scales with your ambition.

Understanding E-commerce Payment Platforms

Evaluating Payment Methods for Online Retail

When picking an e-commerce payment platform, first look at payment methods. Ask, “What do my customers like to use?” Most folks shop online using credit cards, PayPal, or even mobile wallets. Your store must offer these popular choices. If you don’t, customers might leave. Imagine losing a sale just because you don’t take a Visa! It sounds crazy, but it happens. That’s why it’s key to know the e-commerce payment methods and pick ones that fit your customer’s wallets.

Now, not all shoppers are the same. Some love Apple Pay, some dig Google Pay, and others keep it old school with cards. Mix it up and offer a variety. You might think digital wallets aren’t big yet, but they’re catching on fast, so stay ahead. By offering mobile payment options for e-commerce, like these digital wallet choices, you’re opening doors for more sales.

Don’t forget, if you sell across borders, you must have cross-border payment processing to tackle currency hiccups. If you’ve got a shopper from Canada but you only take US dollars, that’s a problem. Currency support in payment platforms helps dodge these issues.

Transaction Fees and Cost Considerations

Now, let’s talk cash, but not the fun kind. I mean fees. Understanding payment gateway charges is a must. Each swipe, dip, or tap costs you a bit. Find gateways with low fees to keep more money in your pocket. It’s like picking a car based on gas mileage. Better mileage, or, in this case, lower transaction fees for payment gateways, means less money spent.

Every sale includes a cut for the payment gateway or processor. It’s their piece of the pie. So, grasp the difference between a payment processor vs payment gateway. The processor moves the money; the gateway’s like a doorkeeper that makes sure the transaction is legit. You might see shared roles or separate entities. Know who you’re dealing with and what you’re paying for.

Some platforms offer quick settlement. That means you get your money faster. For small businesses, cash flow is king. So, choosing a scalable payment solution that grows and gets you paid quick can be a game-changer. You don’t want your cash stuck in limbo, right?

Also, tech matters. Go for API-driven payment platforms to keep things smooth. API-driven means the system will blend into your store like it belongs there. No clunky checkout that feels like you’ve left your own website. That’s choosing tech-friendly payment systems at its best.

Wrapping it up, quality payment platform customer service is a lifeline for any issue. Great service can turn panic into peace when snags happen.

By weighing these factors – payment options, fees, tech, and service – you’ll set your online store up for success. Remember, your choice impacts the lifeblood of your business: sales. So take the time, do your homework, and choose wisely. Your future you will thank you.

Ensuring Security and Compliance

Secure Payment System Features for Merchants

When choosing a payment platform for your online store, think safety first. Always check for secure payment systems. A strong system protects you and your customers. Look for features like encryption and tokenization. Encryption scrambles data so hackers can’t read it. Tokenization replaces sensitive info with a unique code. Both stop thieves from stealing card details.

Next, consider fraud prevention tools. These analyze every transaction. They look for warning signs of fraud. If they see something odd, they stop it before it harms you or your customers. Do your online payment solutions comparison with a keen eye for these defense mechanisms.

Also, be sure mobile payment options go well with security. People these days shop using phones a lot. So, mobile payments need to be as safe as desktop ones. Check if your platform supports digital wallet payments. They are popular and should be secure on your site.

To wrap it up, think of your business needs. How you set things up can affect security. For example, a payment processor deals with the payment itself. A payment gateway is like a door that the payment goes through to reach the processor. Both must be tight like a vault!

Importance of PCI Compliance

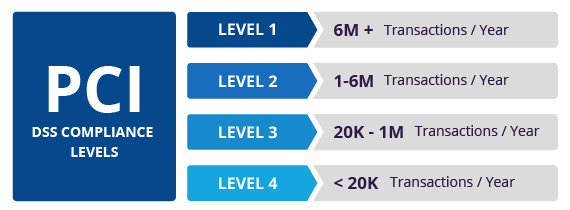

PCI compliance is next on our checklist. It’s a set of rules meant to make sure all companies that handle card data keep it safe. If you hear about PCI, think “Protection for Card Information” to remember it’s about safety.

If you’re PCI compliant, you show customers that their data is in good hands. You’re telling them, “We follow strict rules to keep your payment safe!” This trust is key to keeping shoppers happy and loyal. When selecting payment gateways, always check they follow PCI rules too.

There’s more about PCI than just trust. It also helps you steer clear of fines. If bad stuff happens with card data and you’re not following PCI, you can get hit with big money fines. And nobody wants that.

So, when you compare online payment solutions, look for one with PCI compliance. This shows they’ve got what it takes to protect card info all the way. And when you’re setting up your merchant account for your online business, remember PCI. Your account setup should always include it.

In summary, when integrating payment platforms with e-commerce, prioritize security. Good security means having a solid guard against hackers and fraud. Make sure payment gateways have low fees but don’t cut corners on safety. Being cheap with security can end up costing more out of your pocket.

By taking these steps, you’re doing more than just picking a payment system. You’re building a fortress around your business and customers. And in the wild world of e-commerce, a fortress is exactly what you need to keep the bad guys out and the good vibes flowing.

Optimizing the Checkout Experience

Enhancing User Experience in Payment Processing

When you pick an e-commerce payment method, think of your customer’s ease first. Long, tricky checkouts scare buyers off. Your goal should be slick, friendly pay steps. Customers should feel calm and sure when they buy from you.

Ask, does the gateway make paying simple? The answer is key. A good gateway guides buyers smoothly, from cart to confirmation. Sharp, clear instructions remove customer guesses. It should be so easy that customers can do it with their eyes closed!

Mobile payment options need special thought. More people buy using phones now. Check if the gateway fits well with mobile screens. It also has to work quick on slower mobile data. Digital wallet compatibility is a must too. It lets buyers pay without typing card info each time.

Features for High Checkout Conversion and Approval Rates

Selecting payment gateways for an online store means digging into what they offer. Look for features that push checkout numbers up. Like what, you ask? Like showing prices in the buyer’s own money. Currency support in payment platforms helps turn lookers into buyers.

Understanding payment gateway charges matters too. High fees can cut into your bottom line. Payment gateways with low fees let you offer better prices. Or you can use that saving to grow your store.

Safety is also big. Secure payment systems for merchants block crooks and keep buyers’ info safe. This trust is vital for repeat buys.

Next, tackle fraud prevention in online payments. Pick a gateway that offers strong fraud checks. It still needs to be quick – customers hate to wait. Comply with PCI standards too. It’s a set of rules that keeps payment data safe.

Look for a payment processor vs payment gateway with smooth approval. A payment platform with a high approval rate means less missed sales. Make sure they handle cards from all the main brands.

Some buyers like to pay over time. Does your gateway offer this? Subscription billing features can bring in more sales. Loyal customers might like to pay this way. It builds trust and makes them come back.

And remember, your name is your flag! Integrating payment platforms with your e-commerce should feel like one journey. Payment solutions with branding options let you shine. It’s about blending the pay step with your store vibe.

Choosing tech-friendly payment systems helps too. It’s about staying up-to-date with how tech changes our buy habits. An API-driven payment platform can link to other parts of your business. It means you can start new things without big changes to your store.

And after all that, a hiccup might still come up. Good customer service fixes issues fast. The gateway’s help team needs to be on their toes. They must know their stuff and be kind. A sudden problem with paying can turn ugly without good help.

So, keep these tips in the back of your head. Walk in your customer’s shoes when you’re choosing. Your online store’s success is tied to how well you make paying a breeze.

Integrating and Scaling Your Payment Solution

The Role of API-Driven and Tech-Friendly Systems

Choosing the right payment gateway means making sure it can change as your business does. An API-driven system is key for easy changes and updates. It lets your store connect to the payment service without trouble. This type of system is also tech-friendly, which means it plays nice with other tech bits you may use. It’s a smart move for any online store.

A good API system will let your customers pay their way. Whether that’s with credit cards, digital wallets, or mobile pay, they get choice and ease. With this, your store can offer the latest in e-commerce payment methods. It also helps with keeping your checkout smooth and quick.

APIs also back up secure payment systems for merchants. They help make sure your customer data is safe and that you meet PCI standards. Fraud prevention is another win. A tough API system can spot shady stuff before it hurts your store. It’s also on guard for keeping customer data locked tight.

We want to keep costs down, too. Knowing transaction fees for payment gateways helps you save. When we talk fees, think about how much each sale will cost you. You want low fees, but not at the cost of good service. Compare online payment solutions well. It’s not just about the cheapest one.

Choosing a Payment Platform That Grows With Your Business

Now, let’s talk long-term. Your store may start small, but you’ve got big dreams! You’ll want best payment processing for small business today that can grow with you. That’s why choosing a scalable payment solution matters. It should handle more sales and go into new markets when you’re ready.

Scalability is seen in how a platform deals with cross-border payment processing. Can customers pay in their own currency? Good currency support means yes. Plus, this can up your sales, as customers like prices in their money and language.

Getting paid fast matters. Payment gateways with quick settlement mean your cash flow stays healthy. And if there’s trouble, quick help from your payment platform can save the day. Check if they’re known for solid customer service. You want a team that gets you back on track fast.

When you start, study well. Look at payment processor vs payment gateway. Ask what each does. Then think user experience in payment processing. Picture your customer’s steps to buy. You want no roadblocks or slow points here. Each click should feel easy and safe. That’s what keeps them coming back.

Your platform should also plug into your brand and style. Payment solutions with branding options let you show off your store’s unique touch. That way, every step feels like YOU.

In a nutshell, pick a system that’s easy to mix with your e-commerce setup. Look for strong service and help. And make sure it fits your future plans, ready to grow as you do. It’s about finding the fit that supports your store now – and down the road.

In this post, we’ve explored the ins and outs of e-commerce payment platforms. From picking the right payment approaches for your online store to thinking about what you’ll spend on transactions, it’s clear that the right choice matters. Keeping payments safe and meeting top security rules is a must to protect both you and your customers. Plus, making the checkout smooth and easy helps turn more visits into sales.

We also talked about tech-savvy systems that connect well with your online shop and how important it is to find a payment solution that’ll grow along with your business. In the end, the payment platform you choose plays a big part in your online store’s success. By focusing on these key areas, you can make sure your payment process is a win for everyone involved. Remember, what works great for one store may not be the best for another, so think carefully about your own needs. Here’s to smoother sales and happy shoppers!

Q&A :

What factors should I consider when selecting an e-commerce payment platform?

When choosing an e-commerce payment platform, you should consider several key factors to ensure a seamless experience for your customers and yourself. Look for transaction fees that align with your budget, and determine if the platform supports various payment methods including credit cards, digital wallets, and bank transfers. Make sure it integrates easily with your e-commerce system and provides robust security features to protect sensitive payment information. Additionally, assess the quality of customer support, the platform’s scalability, and any additional tools or services that may benefit your business.

How do security features impact the choice of an e-commerce payment platform?

The security features of an e-commerce payment platform are crucial to gain the trust of customers and protect against fraud. Verify that the platform adheres to Payment Card Industry Data Security Standard (PCI DSS) compliance and utilizes encryption for data transmission. Features such as fraud detection, SSL certificates, and tokenization can further bolster payment security. A platform that prioritizes security minimizes the risk of data breaches, which can have far-reaching consequences for both your customers and your business reputation.

Does the choice of an e-commerce payment platform affect conversion rates?

Yes, the choice of an e-commerce payment platform can have a significant impact on your conversion rates. A platform that provides a smooth and quick checkout process, with minimal steps and a user-friendly interface, can reduce cart abandonment and enhance the overall customer experience. Multiple payment options cater to different customer preferences, further aiding conversion. Speed, convenience, and trust are key elements that the right payment platform can deliver, translating to better conversion rates for your online business.

Can the integration ease of an e-commerce payment platform affect my business operations?

Absolutely, the ease of integration of an e-commerce payment platform into your existing setup can greatly affect your business operations. A platform that requires extensive customization or technical know-how can lead to longer integration times and increased costs. A payment platform that integrates effortlessly with your e-commerce website, shopping cart software, and accounting systems can help you manage transactions more efficiently and streamline your business processes.

What role does customer support play in choosing an e-commerce payment platform?

Good customer support from an e-commerce payment platform is essential for resolving any issues that may arise promptly. When evaluating platforms, consider the availability of support through various channels such as email, phone, or live chat, and the responsiveness of the customer service team. A platform with comprehensive support resources, such as a knowledge base or community forums, can empower you to troubleshoot common issues, ensuring minimal disruption to your operations and maintaining a positive customer experience.