If you’re itching to know How is the stock market performing this week?, you’ve hit the jackpot. Dive in as we unpack this week’s wild swings and trends. We’ll cut through the noise to bring you the no-nonsense scoop on market dynamics, index performances, and trader sentiment. Whether you’re tracking the giants like Dow Jones and S&P 500 or zoning in on NASDAQ and sector shifts, we’ve got the insights to keep you one step ahead. So if you’re ready to decode the market’s moves and plan your next trade, let’s jump right in and grab the bull by the horns.

Analyzing This Week’s Market Dynamics

Dissecting Current Stock Market Trends

Let’s dive into the current stock market storms. Ups and downs rule the game. All eyes landed on a wild mix of highs and lows. Big companies and small players alike felt the wave.

We saw tech stocks slip then soar. Retail investors cheered some wins. But some pros frowned, seeing their picks trip. It’s a mixed bag of tricks this week.

Wall Street’s mood swings are clear. One day, gains paint our screens green. Next, red takes over as losses loom. It’s a rollercoaster ride, no doubt.

Evaluating Weekly Financial Market Analysis

Looking at the numbers, things get real. The Dow Jones dipped, then danced back up. S&P 500’s path? Much the same. NASDAQ? It zigged and zagged.

Stock market trends this week proved shifty. Each day brought new tales of turns. Financial experts pored over charts. They sought clues in the market’s heartbeat.

Market volatility analysis? It’s a must. Choppy waters need keen eyes. This task shows us who’s up, who’s down. And why.

Sector analysis spilled the beans. Some corners of the market beamed. Others? They took a breather. Or a snooze.

Let’s talk about market sentiment. It’s what folks feel about the market. This week? It’s all over the map. Joy, worry, surprise — we saw it all.

Traders kept busy. They watched screens like hawks. Buy, sell, hold? Tough calls, all week long.

Our week’s wrap? Whirls and twirls aplenty. Let’s bank those insights for next time. Because in stocks, each week’s a fresh game.

Drill-Down on Key Indices Performance

Dow Jones and S&P 500: A Weekly Synopsis

Let’s jump right into the heart of Wall Street and see how the big players are doing this week. Weighing in first is the Dow Jones, known for its mighty blue-chip stocks. It’s been like a seesaw lately, shifting up and down day by day. Some days, investors seem to cheer, while on others, they’re biting their nails! The Dow’s dance shows how companies make and lose money, affecting our wallets too.

Now, let’s peer over at the S&P 500. This index is like a snapshot of the market. It includes 500 of the largest companies in the U.S. It’s had a wild week too. Think of it like a team of runners – when most sprint ahead, the index scores big. But when many stumble, it takes a tumble. The S&P 500’s weekly run tells us if the market’s heating up or cooling down.

NASDAQ and Sector Performance: Weekly Highlights

Swinging over to tech and trade, we have the NASDAQ. The NASDAQ is the go-to place to see how tech giants and up-and-comers are faring. This week, it’s been as bouncy as the latest app or gadget hype. These ups and downs in tech can nudge the whole market. They show whether folks are betting big on the future or playing it safe.

We also look under the hood at different parts of the market – these are sectors. Maybe health care’s soaring or energy’s slumping. Seeing which sectors shine or dim lets us spot trends. It’s like knowing which way the wind’s blowing so we can sail smoothly or brace for a storm. This week, some sectors surprised us, while others just followed the flow.

In the market’s ebb and flow, we’ve spotted everything from tiny ripples to huge waves. As a stock market analyst, I latch onto these trends. I see what’s soaring or sinking each week. Keeping a keen eye on these shifts, I help folks like you ride out the highs and lows. Remember, the market’s always on the move, and staying informed is your power play.

Understanding Market Sentiment and Movement

Decoding Market Volatility and Investor Confidence

This week, the stock market has been on a wild ride. If you’re like me, each market swing has you on the edge of your seat. Let’s dive into the nitty-gritty. First up, market mood swings – that’s investor confidence for you. How do folks feel about their stocks? Are they upbeat or down in the dumps? This week, we’ve seen that smile turn upside down and back again.

We gauge this mood by looking at big market moves. Quick shifts mean investors are a bit shaky. And this week, let me tell you, it’s been shake-city. Shares jump up and down as news hits the streets. Good news sparks a buying spree; bad news has them hitting the sell button – fast!

Spotlight on Market Leaders and Laggards This Week

Now, who’s winning and who’s falling behind? Market leaders are those stocks powering ahead. They’re like your friends who always finish first in a race. Market laggards? They’re trying to catch up but can’t quite make the cut.

A look at the big players – the Dow Jones, S&P 500, and NASDAQ – gives us the whole picture. The Dow Jones? It’s like a steady ship, less rocky. The S&P 500 is broader, catching more market winds. NASDAQ? Tech-heavy, so it’s more up and down.

You ask, “Who stood out this week?” Blue-chip biggies mostly stayed strong. Sector-wise, tech had a rough patch, while healthcare gained muscle. This gives you a hint on where to look next.

The week has shown us highs and lows, like a roller coaster track. Keeping an eye on these trends helps us know what might come next, making us smarter traders in a zippy market.

Strategic Trading Insights and Forecasts

Equity Market Trading Volume and Strategy Approaches

Let’s look at this week’s trading volume. It tells us how busy the market was. The busier it was, the more people were trading. Sometimes more volume means prices can change fast. As traders, we like to see lots of trading. It can mean more chances to make money. But it also means we have to watch the market very close. We don’t want to miss out or lose on big moves.

To stay on top of things, we use certain strategies. Some of us buy and hold, thinking stocks will go up over time. Others try to time the market, buying low and selling high. And some trade more often, grabbing small wins that add up. No matter the plan, the goal is to make more than we lose, right?

Now, let’s move into new trends. Are tech stocks hot or not? How about health care? Watching where the money moves gives us clues. If money leaves one area, it often finds another. We call the winners ‘market leaders’ and the losers ‘laggards.’ By following the leaders, we look for chances to earn.

Market Predictions: Navigating the Week Ahead

Predicting the market is hard. If it were easy, we’d all be rich. Still, we can use facts to make smart guesses. We look at things like jobs numbers or company profits. These can make the market move up or down. We also watch stories in the news. Big events can scare or excite investors.

Next week, we’re keeping an eye on a few big reports. They might shift the market, so we need to be ready. Do we buy more? Sell what we have? Wait and see? These choices can be tricky. We try to cut the noise and focus on what really matters – the facts.

What’s our take for next week? Caution. It’s like being in unfamiliar woods. We might hear sounds or see tracks. But without knowing if it’s a deer or a bear, we move slow. Same with the market. We read the signs and watch our step.

Remember, while we gather clues and plan, always expect the unexpected. That’s how the stock market keeps us on our toes!

And as we wrap up, take this to heart: trading isn’t just about making money. It’s about making smart moves based on facts, not fear or hope. Do that, and you’re already ahead in the game. Let’s see what next week’s market has in store for us!

In this post, I’ve broken down the stock market’s beats and dives. We looked at the main trends shaping our financial scene and dug into the Dow Jones, S&P 500, and NASDAQ numbers. I shared my take on how market moods and big player moves play out each week.

I also gave you a slice of strategy, sharing insights on trading volume and some smart moves for the days to come. Keeping tabs on all these can help you play the market game better. Remember, markets move quick, and so should you. Stay sharp, stay informed, and use what you’ve learned here to make your next trade count. Here’s to making smart moves and watching them pay off. Stay tuned for more.

Q&A :

How has the stock market trended this week?

The stock market’s performance can fluctuate greatly within a week, influenced by a variety of factors such as economic data releases, corporate earnings reports, geopolitical events, and market sentiment. To get the latest trend, investors typically look at the main indices such as the S&P 500, Dow Jones Industrial Average, and NASDAQ for a snapshot of market performance. Remember, past performance does not necessarily predict future results, and it’s crucial to refer to real-time financial news and stock trackers for up-to-date information.

What factors are influencing the stock market’s performance this week?

Several factors might influence the stock market in any given week. Key among them are economic indicators like inflation rates, job reports, and retail sales. Market participants also watch for news on interest rate changes by central banks, international trade developments, political stability, and significant events in leading industries. It’s important to stay attuned to financial news to understand how these factors might be impacting the market’s movement.

How can I check real-time updates on stock market performance?

To get real-time updates on the stock market, you can use financial news websites, stock market apps, and platforms provided by financial institutions. These services often offer live data, charts, and analysis that provide insights into market trends. Popular options include Bloomberg, CNBC, MarketWatch, and dedicated broker platforms. Stocks apps also send alerts and provide tools that help you track specific indices or stocks instantly.

What are the best practices for analyzing stock market trends?

When analyzing stock market trends, investors should look at both technical analysis and fundamental analysis. Technical analysis involves studying charts and patterns to forecast future movements, while fundamental analysis involves evaluating a company’s financial health and the economic environment. Diversifying your sources of information, examining historical trends, and considering the broader economic context are also wise strategies. Always approach your analysis with a clear investment goal and risk tolerance in mind.

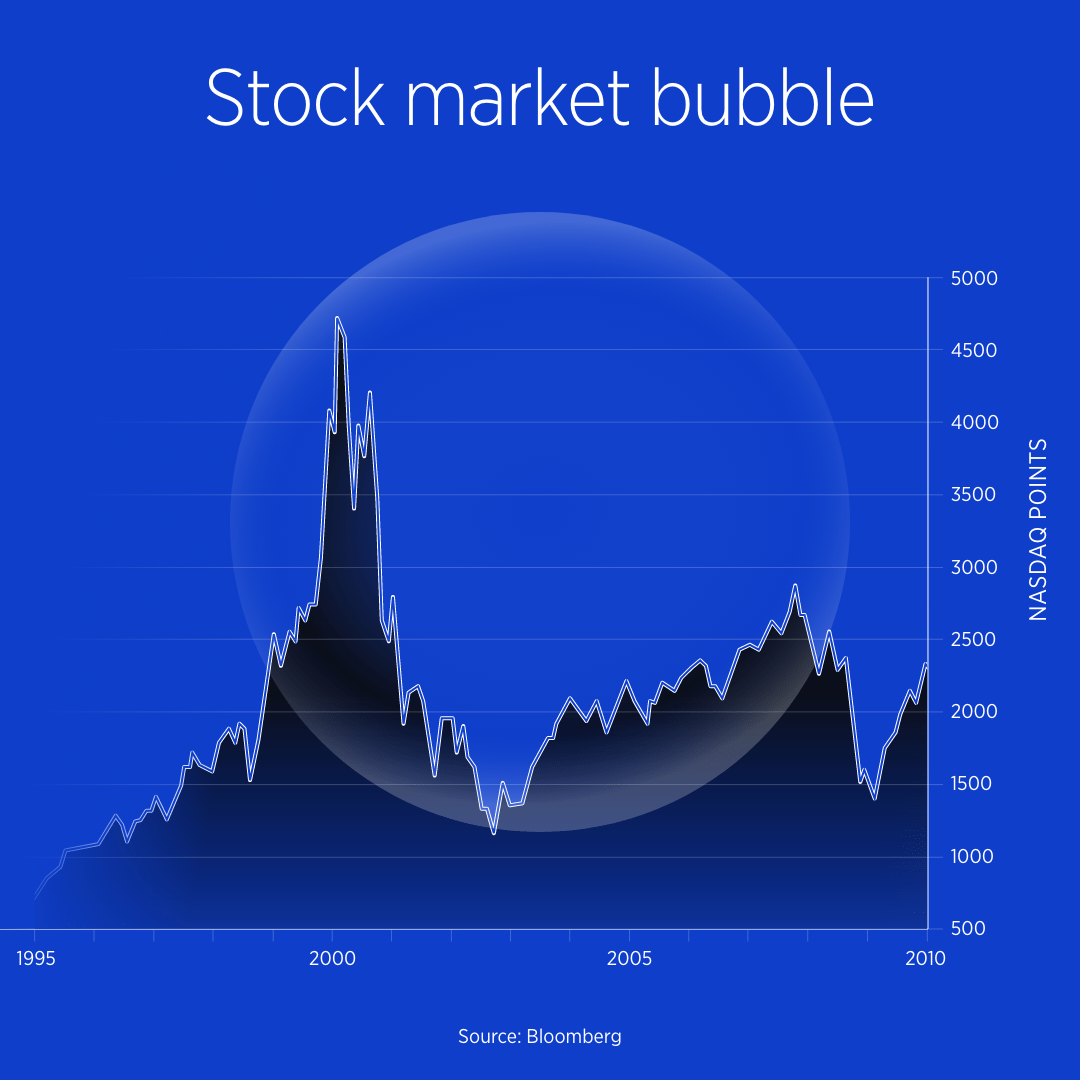

Can historical stock market data predict this week’s performance?

Historical stock market data is valuable for identifying patterns and trends, but it’s not a foolproof method for predicting short-term market movements such as weekly performance. The stock market is subject to sudden changes due to unforeseen news and events. While historical data can provide context and a framework for understanding potential outcomes, it is only one piece of the puzzle. Investors should use historical data alongside other analysis methods and stay up to date with current events to make more informed decisions.