Geopolitics and Oil Price Fluctuations: it’s like a game where each move shakes the world. You need to understand this game to get why your gas prices change. Countries and big companies control oil like chess pieces. When they clash, prices jump or dive. It’s all about power—who has oil, who wants it, and who’s making the rules. We’ll dig into this complex mix, see how it affects what you pay at the pump, and uncover how today’s moves might change tomorrow’s game. Strap in, we’re navigating the global energy chessboard.

Understanding the Interplay Between International Relations and Oil Markets

Examining the Role of Global Oil Markets in International Relations

Oil is like the blood that flows through the world’s veins. It keeps things moving. When I think about global oil markets, I see them as a network. This network connects many countries. Every move in this game affects prices and people’s lives.

Let’s start with a question: Why do “international relations” matter to oil markets? They matter a lot because countries talk, trade, and sometimes fight over oil. If two countries have trouble, the oil market can shake like a leaf.

For example, if Country A doesn’t like what Country B does, it can stop buying oil from them. This can make prices jump up or crash down. It’s important to watch these moves. They can influence the whole world.

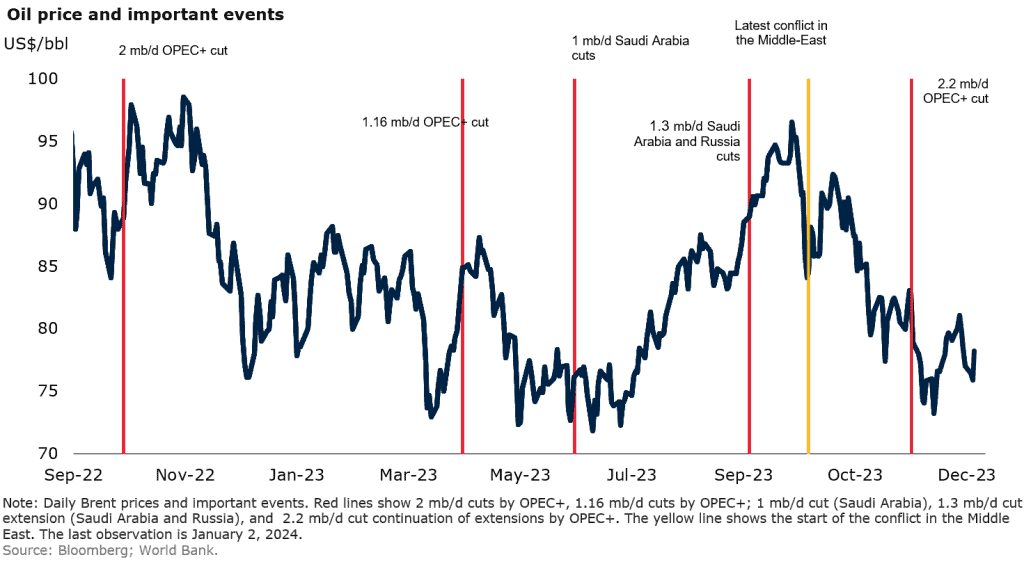

Another piece of the puzzle is “OPEC policies.” OPEC stands for a group of countries that agree on how much oil to sell. They can open the tap wide or just let it drip. Their choice can make oil rare or plenty, changing prices as they wish.

The Impact of Political Instability on Oil Prices

Now, let’s talk about how trouble in a country affects oil. When there’s fear in a place with lots of oil, buyers get worried. They aren’t sure if they will get the oil they need. So prices can shoot up fast.

“Political instability” means when a government isn’t strong or safe. Picture this: If a country is erupting with protests or battles, it’s hard to get oil out. Workers can’t get to the oil fields. Pipes and roads may be broken or dangerous. Oil can’t flow if it’s not safe.

Conflicts in places like the Middle East can cause big troubles for oil markets. Why? Because these areas are full of oil. If fighting starts there, the world pays attention. The supply of oil might shrink. This makes countries worry about their energy needs.

Trade deals play a part too. Countries make agreements on who can buy oil and for how much. If these deals change, it’s a big deal for oil prices.

In summary, oil prices dance to the music of world events. A tip for you: Keep an eye on the news. You’ll spot the rhythm behind the rise and fall of oil prices. It’s a dance where the steps are made by deals, peace, and the chase for power.

OPEC’s Influence and the Geopolitical Dynamics of Oil Supply

OPEC Policies and Their Global Impact

Let’s talk about OPEC, the big player in the oil game. OPEC stands for a group of oil-producing countries. They work together to decide how much oil to pump out. When they pump less, prices usually go up. When they pump more, prices can go down. This group has a big say in what we all pay for gas and heating.

These countries have lots of oil, so they have power in setting prices. They meet and make decisions that affect us all. Sometimes, they cut down on oil to make prices higher. Other times they might boost production if they want prices to fall. What they decide can change what you pay to fill up your car.

Navigating the Crude Oil Supply Chain Amid Geopolitical Tensions

Now, moving oil around the world can be like a big puzzle. The crude oil supply chain is how oil gets from deep in the ground to our cars and homes. It’s a long trip. Oil travels from wells to refineries where it turns into fuel. Then it’s shipped to places where people use it.

But it’s not always simple. Sometimes, countries don’t get along, and that can shake up the oil supply. Conflicts can block oil from getting to where it needs to go. This can make prices jump because there’s less oil available. Countries that need oil might worry about their supplies.

And then there’s trade. Countries make deals about oil, like who buys it and who sells it. These deals help oil flow around the world. But if a country gets in trouble and others stop trading with it, the flow of oil can slow down. That’s what sanctions do. They can make it hard for a country to sell its oil.

Lastly, oil-producing areas can be rough places. If there’s fighting or unrest, oil production can stop. This is a real worry because we need oil to keep our world moving. Think about when a big storm hits and oil rigs have to shut down. That’s similar to what happens when there’s trouble in oil lands.

So, as we wander through this global energy chessboard, it’s clear OPEC and geopolitics really shape our world. They decide how much oil is out there and how much it costs. It affects everything from what we pay for a flight to how much a sweater costs. And as the world keeps turning, we keep watching this big, complicated game of oil and power.

The Strategic Intersection of Energy Policy and Geopolitical Maneuvering

Assessing the Strategic Importance of Oil Reserves

Oil reserves hold great power. They fuel cars, power plants, and even economies. Countries with lots of oil—like Saudi Arabia—have strong cards to play on the world stage. They can pump more oil to make money when prices are high. Or they can cut back to push prices up. This makes oil reserves a big deal in global talks and deals.

Oil is so vital that countries plan a lot around it. Take the US, once heavily reliant on oil from abroad. They worried about their national security due to this dependence. Any shift in foreign policy or conflict could block oil, causing problems at home. So, the US worked hard to pump more oil from its lands.

Having your own oil changes things. Countries fear less about others cutting off their oil supply. This means they can make foreign policy choices with a bit more freedom. It also can tip the balance of power in global politics.

Energy Independence as a Geopolitical Strategy

Seeking energy independence is smart for any country. It’s like making sure you grow your own food instead of buying it. This way, if things go south with other nations, you’re still set. For energy independence, it can soften the blow of oil price shocks. It can mean fewer worries if there’s a conflict that hits oil production in other parts of the world.

But it’s not just about avoiding bad stuff. It can also give countries more say in global affairs. With their own energy, they can be stronger in talks and offer help to friends. This can build alliances or even cool tensions.

By lowering their need for foreign oil, countries also dodge the impacts of sanctions on oil exports. Sanctions can squeeze a nation’s economy by limiting its trade. But if a country doesn’t lean on others for oil, sanctions have less bite.

Of course, these moves affect the whole oil market. If more nations go for energy independence, the oil trade shifts. OPEC, the group that sets some oil rules, watches this closely. They adjust their own pumps to keep prices where they want them.

Energy policy is a big chess game. Every country tries to guard its king—its economy. They use energy policy as part of their defense and attack. They must think ahead, be ready for others’ moves, and always look to checkmate.

Projecting the Future: Oil Price Forecasts and Emerging Geopolitical Landscapes

Analyzing Oil Price Determinants and Forecasting Future Trends

Let’s dive into the world of oil prices. Think of it as a big, complex game, where the players are countries with lots of oil, and the rules can change based on what’s happening around the world. To figure out where oil prices are headed, we look at many things. We see how much oil countries make, and how much people want to use.

The Organization of the Petroleum Exporting Countries, or OPEC, plays a big role. When they decide to make more or less oil, it can really shake things up. OPEC’s choices can make prices go up or down, and that affects everyone. It’s not just about how much oil there is, but how easy it is to move it around the world. Big ships take it across the sea, but if there’s trouble, like a fight between countries, it can get harder to get the oil to where it’s needed.

Money comes and goes in oil trading, just like in any market. This flow can be smooth or it can jump around, especially when there are sudden changes. And here’s a fun fact – even the weather can change oil prices! If it’s really cold, people need more oil to keep warm and the prices can go up.

We always need to keep an eye on places where there’s trouble. If a country with lots of oil has big problems, it can make it hard for them to get their oil out. That means less oil for the world, and prices can jump up.

When countries don’t get along and use sanctions, or special rules to limit trade, it can also squeeze the oil supply. Sanctions can block oil from leaving or coming into a country, and that can shake things up too.

The Role of Renewable Energy in Shaping Global Geopolitics

Now let’s chat about renewable energy and its role in all this. When we talk about renewables, we’re talking about power from the sun, wind, and other sources that won’t run out like oil might. These kinds of energy are starting to change the big game of oil. Countries who use more renewables don’t need as much oil, and that can shift the balance of power.

The world is changing, and the way we power our lives is too. As renewable energy grows, the countries that used to hold lots of power because they had oil might find things different. New players in the game, like those leading in wind or solar power, might become the new big shots.

Renewable energy is not just about keeping the lights on. It’s also about who has the upper hand in the world. Countries are now pushing for more renewable energy to make sure they can stand on their own, without relying too much on oil from somewhere else.

So, as we look forward, countries will need to think about oil, but also about how renewables can play their part. It’s like a big chess game, and we’re all waiting to see the next move.

In this post, we’ve explored how global politics and oil are tightly wound together. We saw the role oil plays in international relations and how political unrest can upset prices. We also looked at OPEC’s hand in global oil dynamics and dealt with crude supply in tough political times. Plus, we recognized the power of oil reserves and the smart move towards energy self-reliance.

To wrap up, oil will keep playing a huge part in world affairs. Prices will swing with the winds of politics. Countries will work hard for energy freedom. And clean energy might just change the whole game. Keep an eye on this space—it’s a wild, crucial world where energy meets power plays.

Q&A :

How do geopolitical events influence oil prices?

Geopolitical events can significantly impact oil prices by affecting the global balance of supply and demand. When political tensions rise in key oil-producing regions, concerns over supply disruptions can lead to an increase in oil prices. Conversely, diplomatic resolutions or stability in these regions might lower prices. Factors include regional conflicts, trade negotiations, sanctions, and changes in political regimes, which can all alter investor perceptions and thus influence the market.

What role do OPEC decisions play in oil price changes?

The Organization of the Petroleum Exporting Countries (OPEC) plays a crucial role in the global oil market because it consists of some of the world’s largest oil producers. Decisions made by OPEC regarding production levels can either tighten or increase the supply of oil in the market. Cutting production generally leads to higher oil prices, while increasing production can cause prices to fall. Market analysts closely watch OPEC meetings for policy changes that could affect global supply.

Can changes in oil prices predict future geopolitical conflicts?

While changes in oil prices might sometimes anticipate geopolitical conflicts, especially if market participants expect such events to disrupt oil supply, they are not reliable predictors of conflict. Many factors drive oil prices, and geopolitical risks are just one aspect. Hence, while there may be correlation, relying on oil price fluctuations to forecast geopolitical events would be speculative and not always accurate.

How do oil price fluctuations affect global economies?

Oil price fluctuations have a wide-reaching impact on global economies, affecting everything from the cost of transportation and production to inflation and exchange rates. Countries that are net importers of oil tend to suffer economically from high oil prices as costs for goods and services increase. Conversely, net exporters of oil can benefit from higher prices, which provide more revenue. Sudden changes in oil prices can lead to economic instability and affect financial markets.

In what ways might renewable energy impact the relationship between geopolitics and oil prices?

The rise of renewable energy sources has the potential to redefine the geopolitical landscape of energy. As countries invest in renewables like solar, wind, and biofuels, the global dependence on oil could decrease, thereby reducing the influence of oil-rich nations and their impact on global politics and oil pricing. Over time, this shift could lead to more stable energy prices and reduce the volatility associated with geopolitical conflicts in oil-producing regions.