Mastering fundamental analysis strategies for long-term investing is not just smart; it’s essential for your wealth growth. You must dig deep into financial statements and understand company value. I’ll show you how to break down balance sheets and cash flow. You’ll know what numbers matter and tell if a company stands on solid ground. Ever looked at valuation and felt lost?

I’ll make it simple. Learn to use financial models, and see why ratios like P/E are crucial. And market trends? You’ll catch those, too. Knowing the right moves can mean the difference between an investment that soars and one that sinks. Stick with me, and let’s chart a course for your long-term investing triumph.

Understanding Financial Statements for Long-Term Investment Success

Dissecting Balance Sheets and Income Statements

When we invest, we put trust in a company’s future. We look at its story told by numbers. These reports are its tell-all: the balance sheet and the income statement. The balance sheet shows a company’s assets and debts. It answers, “What does the company own and owe?” It lists what the company owns, what it owes, and what is left over for you, the investor.

On the flip side, the income statement tells us if a company can make money. It’s like a report card that shows if the company passed or failed at making profit. This is where you find out how much money came in from selling goods or services and how much went out for costs.

The Importance of Cash Flow Analysis in Assessing Earnings Quality

Cash is king, as they say. So, cash flow analysis is like checking the royal treasury. It looks at how cash comes in and goes out from actual business activities. It shows if a company is really making money, not just on paper but in the real world. Cash flow tells us whether earnings are high quality or if they’re just good on paper.

Cash can come from selling things, but also from loans or investors. If a company makes cash mainly from selling its stuff, that’s a good sign. That means it has strong earnings quality. But if it depends on loans or selling stock, that’s not as strong.

By understanding these numbers, we shape a clear picture of how strong and stable a company really is. Learning from financial statements is a solid step in making wise long-term investment choices.

Company Valuation Techniques and Their Impact on Investment Decisions

Exploring Discounted Cash Flow Models and P/E Ratios

Let me walk you through how to figure out what a company’s really worth. Imagine you could see into the future of a business’s cash pile – how much money it will pull in or dish out. That’s cash flow. Now, kind of like putting a price tag on that future cash, we’ve got something called the discounted cash flow model. Here, we guess those future cash moves, then we make them seem smaller – or ‘discount’ them – so they match today’s dollars. It helps because money today is worth more than the same amount in the future, thanks to things like inflation.

To get it right, we need to guess how much cash the company will get, and for how long. A big job, for sure, but super important. By doing this, we learn what it’s smart to pay for a piece of the company, like its stock. It prevents us from paying too much.

Another awesome tool is the price-to-earnings ratio, or P/E for short. It’s like asking, “How much will I pay for each dollar the company earns?” Take the stock price and divide it by earnings per share. A low P/E might mean a bargain, or it could hint at trouble ahead. We’ve got to look hard to know for sure.

Now, both ways help us make smart choices with our cash. And making wise picks is big for long-term wins in investing. It leads us to companies priced right for their risk and possible rewards. Remember, it’s not just about finding the cheapest stock – it’s about paying a good price for something valuable in the long run.

The Relevance of ROE and ROA in Long-Term Investing

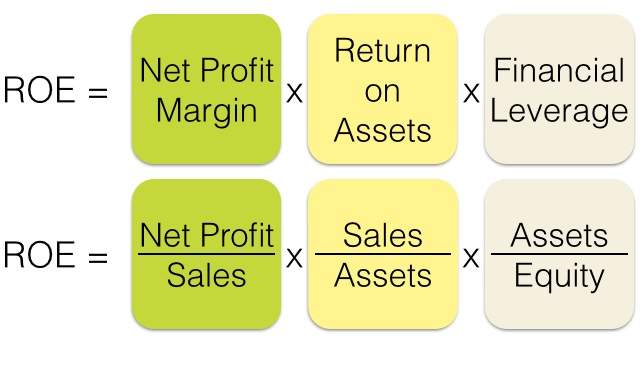

Moving on to the mighty duo: Return on equity (ROE) and Return on assets (ROA). These guys tell us how good a company is at making cash from what it owns or from the money shareholders put in. We want high numbers here, showing us that the company uses what it has really well to make profit.

Think of ROE as a grade for the boss on how well they use your investment to earn money. A strong ROE suggests smart moves from the people in charge. It hints that they’re using your dollars wisely to grow the business.

ROA is like a scorecard for the company’s whole tool kit – everything it owns – and how well these things churn out dollars. It’s the company flexing its muscles, showing us it can turn desks, computers, and ideas into profits.

Both metrics – ROE and ROA – are huge in helping us decide if a company’s a champ – if it can stick around and make us money through thick and thin. We use these numbers to compare companies within the same game – or industry – to find out which one’s the star player.

So there you have it. Using these methods, we spot the golden eggs in a nest full of regular ones. We want our money to work hard, just like we do. By finding strong, profit-making companies at fair prices, we stand a great chance to win in the game of long-term investing.

Assessing Market Dynamics and Intrinsic Company Value

Interpreting Dividend Yields and Their Long-Term Benefits

Dividend yields show how much a company pays out in dividends each year relative to its stock price. They offer a clue to the company’s stability. A stable, high yield is a sign of good health and can mean steady cash for investors. But, high yields can also warn of trouble if a company’s stock price has fallen due to issues within. Therefore, looking just at dividend yield isn’t enough. You have to dig deeper into why the yield is what it is.

Think of it like a routine check-up. A high heart rate might seem bad at first glance. But if you find it’s from regular exercise, then it’s a good thing. It’s the same with dividends. High yields from strong profits are great. But high yields from a dropping stock price, not so much. In long-term investing, you want the companies that have solid earnings and pay out dividends consistently.

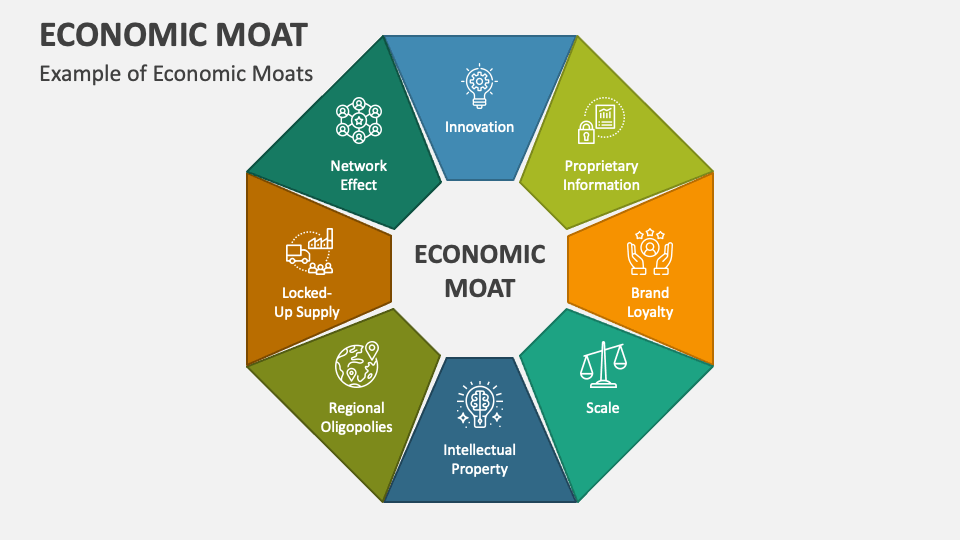

Economic Moats and Sector Performance: A Competitive Analysis

An economic moat is what keeps rivals away from a company’s profits. The wider the moat, the better the company can fend off competition and stay profitable. Companies with strong brands, patents, or high customer switching costs have wide moats. They make great picks for long-term investments because they can keep making money year after year.

Next, consider how whole sectors perform. Some sectors do well when the economy grows; others are safe picks when the economy slows down. By keeping tabs on these patterns, you can avoid rough patches in the market. For example, tech stocks might lead the charge during booms. Staples like food and utilities offer shelter during downturns.

Sector performance tells part of the story, but within each sector, the companies with wide moats do best. They stay afloat even when others struggle. Like a big ship in a storm, they can ride out the rough waves. So look for those companies when you’re after long-term wins.

In conclusion, successful long-term investing is like being a detective. You gather clues: dividend yields, economic moats, and sector trends. You don’t jump to conclusions based on one clue. You look at them all to see the big picture. This way, you make smart moves that pay off not just today, but for many tomorrows to come. Looking at dividend yields and economic moats helps you find the real champs of the stock market. By doing so, you play a winning game in the long-run investing world.

Advanced Strategies in Fundamental Analysis for Predictive Insights

Evaluating Management and Business Model Sustainability

When I dig into a company, I first look at who’s running the show. Good leadership matters. I check for bosses who’ve steered through rough seas. They should have solid records of making companies grow and earn. This shows me if they can handle what’s ahead.

Then, it’s time to poke around the business plan. Can it last? I scout for plans that can make money over time. This means they adapt well and keep customers coming back. If they can stand tall when others fall, that’s a green light for me.

Incorporating Financial Forecasts and Growth Projections into Investment Strategies

Now, let’s talk future talk. Not the wild guesses kind, but smart looks ahead. I want to see if companies are set to make more cash. To do this, I sift through past numbers and trends. This helps me guess future gains or losses.

It’s like putting together a puzzle. I match up the pieces of what they earn, spend, and owe. Often, I peep at the discounted cash flow model. It tells me what today’s earnings could be worth later. Growth should be steady, not just spikes. I eye those that grow bit by bit. It tells me they’re likely not just a flash in the pan.

Sticking to these moves has steered me right in fetching long-term wins. The trick is to dig deep and think ahead. It’s how we map our path to grow our cash, not just today but years from now.

In this post, we’ve covered how to read financial statements and why they’re key for smart investing. You learned how balance sheets and income statements reveal a company’s health. We also saw how cash flow is a big deal for figuring out real earnings.

Next, we talked about ways to tell what a company is worth. You found out how using cash flow, P/E ratios, ROE, and ROA can help you make better choices.

Then we looked at what the market is doing and found out how much a company is really worth. We saw how dividends can pay off later. We learned why some companies last longer because they’re the tough guys in their market.

Last, we dug into pro tips for using deep analysis to guess what will happen next. Smart choices depend on good leaders and strong future plans.

Always remember, knowing the numbers, understanding value, and seeing the big picture makes you a smarter investor. Keep these tools in mind, and you can make investment choices that really pay off in the long run. Let’s make those smart moves that grow your money for years to come.

Q&A :

What is fundamental analysis in long-term investing?

Fundamental analysis involves examining a company’s financial statements, management, competitive advantages, and market conditions to determine its intrinsic value. In the context of long-term investing, this method helps investors identify stocks that are undervalued by the market but have the potential for substantial growth over time. Investors look beyond short-term market trends and focus on the actual business performance and prospects.

How do you perform fundamental analysis for long-term investments?

To perform fundamental analysis, investors start by looking at the company’s financial health through its financial statements – balance sheet, income statement, and cash flow statement. Ratios like Price-to-Earnings (P/E), Price-to-Book (P/B), and Debt-to-Equity are analyzed. Investors also assess the company’s business model, competitive positioning, and assess the competence of the management team. Future growth prospects and industry health are considered to ensure the investment aligns with long-term goals.

What are the key indicators to look at in fundamental analysis for long-term investing?

When performing fundamental analysis for long-term investments, key indicators include:

- Earnings Growth: Is the company consistently increasing its earnings over time?

- Return on Equity (ROE): How effectively is the company generating profits from the shareholders’ equity?

- Debt-to-Equity Ratio: How much debt is the company using to finance its operations relative to shareholders’ equity?

- Price-to-Earnings Ratio (P/E): Does the stock price reflect the company’s earnings potential fairly?

- Dividend Yield: How much is the company paying out in dividends relative to its share price?

Can fundamental analysis help in choosing ETFs or mutual funds for long-term investing?

Yes, fundamental analysis can be applied when choosing ETFs or mutual funds for long-term investing. Investors should look at the fund’s performance history, expense ratio, portfolio turnover rate, and consistency of the fund manager. Evaluating the underlying assets in a fund’s portfolio, such as the financial health and growth prospects of the constituent companies, is also essential.

Why is understanding the economic environment important in fundamental analysis?

Understanding the economic environment is crucial as it affects every company and industry. Factors such as interest rates, inflation, unemployment rates, and economic growth can significantly impact a company’s performance. By analyzing these macroeconomic indicators, investors can better predict potential risks and opportunities for the companies they are looking to invest in for the long term.