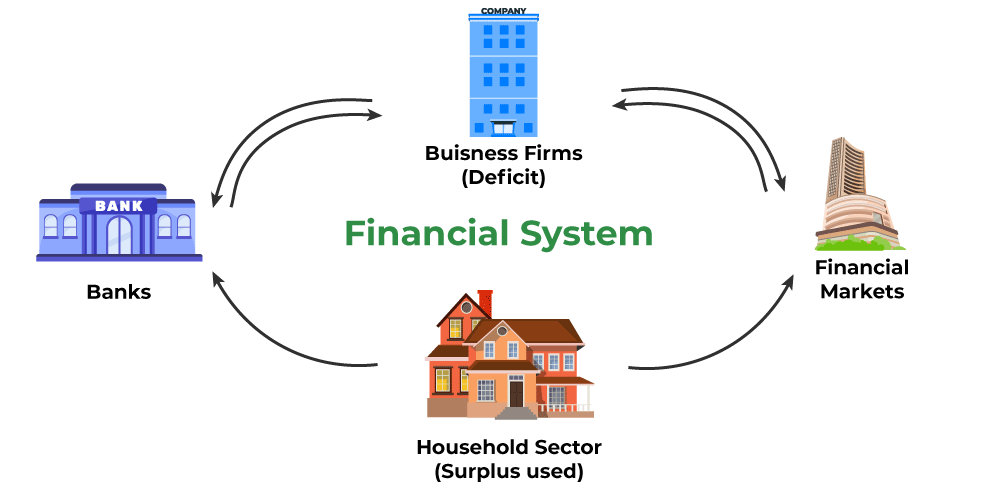

Choosing the right financial market analysis tools can be a game-changer in decoding the markets. But, with a sea of options out there, how do you pick the winner? I’ve sifted through the top picks to bring you a definitive Financial market analysis tools comparison. Whether you’re a seasoned trader or green around the gills, grasp the pros and cons of each heavyweight in the ring.

From stock and equity insights to the sharpest charting aids, let’s break down their muscle and finesse. Dive in as we explore cutting-edge data tools that deliver the lowdown before the bell rings and powerful backtesting that could be your crystal ball. Then, strap in for the risk management tactics and strategic planners that promise to armor-plate your portfolio. Get ready to learn which tool will earn its place as your trusty sidekick in the financial arena’s daily tussle.

Evaluating the Heavyweights: Stock and Equity Analysis

Navigating Through Top Stock Analysis Software

Which stock analysis software tops the charts? That’s the big question. The best stock analysis software needs to hit the mark on several things: ease of use, features, and bang for your buck. Let’s break it down.

Ease of use is key. You want software that makes sense the moment you pop it open. If it’s a bear to learn, it’s no good. Charting features? We need a lot, and we need them to be top-notch. Tools for drawing, indicators, and analysis should be at your fingertips. Price matters too. You want to know, does the cost match what you get?

Now, I’ve poked around with heaps of these tools. Believe me, they are not all created equal. Take stock screener effectiveness. Some give you the world, and some leave you asking, “Where’s the meat?” The best ones let you slice and dice stock info with razor precision. They have filters for days, from basic price data to complex algorithmic screens. It’s like having a crystal ball for stocks.

Finding this perfect mix can be like chasing a unicorn. But unicorns do exist. I’ve seen tools that let you dip your toes or dive deep in the data sea. They give rookies and pros alike the power to make smart, snappy decisions.

Equity Research Platforms: A Deep Dive into Features and Usability

Now, let’s talk equity research platforms. These are the big guns, my friends. If you’re serious about shaking hands with success, you can’t skip on these.

Top equity research platforms go beyond just stock prices. They spoon-feed you juicy stuff like financial statements, analyst forecasts, and more. A sharp platform has it all on a silver platter: real-time data, historical stats, and the ability to compare companies until you’re blue in the face.

They are like your personal Wall Street analyst. They break down hard market info into bites you can chew and swallow. User-friendly? That’s the name of the game. You should be able to tour through their features with a few clicks. It’s about getting the low-down on a stock without getting locked in a data dungeon.

And if you’re on the hunt for a platform, don’t just settle. Test drive a few. See which one doesn’t just talk a good game but plays it. You’re after clear, helpful data that lights up a path to wise investment choices.

In the end, the champ among stock analysis software and equity research platforms is the one that serves you best. It fits like a glove, feels right, and helps you hit your targets square. Remember, it’s not about the flashiest toy. It’s about the one that gets the job done and makes you feel like the heavyweight champ you are.

The Technical Edge: Charting and Trading Tools Explored

Customization and Precision in Market Charting Software

The right market charting software is like a super tool. It turns data into clear pictures. These pictures show us where the money might be hiding. To pick a winner, compare different programs. Can they bend to your will? Yes, good software must.

The key is how easy you can set it up for your needs. Can you switch colors, lines, or details? Can you save your perfect setup? Good software lets you do this fast. Names and bells and whistles don’t matter. It’s all about what you can change to fit your eye.

Let’s talk precision. The best charting tool must show tiny price moves. It should zoom in without a blur. Sharp charts let traders see changes swift and clear. This helps to catch the best buy or sell spots.

Now, you also want speed. Slow charts are bad news. As a trader, you have to stay ahead. Top-notch programs update with each tick of the clock. This means you see new prices as fast as they come.

To sum it up, great software gives you control. It makes info easy to see. And it does this all super fast.

Technical Analysis Tools Versus Quantitative Trading Software

Alright, moving on. Let’s put technical tools and quant software head to head. First, what’s the deal with technical tools? They are like treasure maps. You use history to spot patterns that hint at future moves. It’s about trend lines, shapes, and where prices might go next.

These tools are a trader’s best pal. They help you get a feel for the market’s mood. They light up signals like “buy now” or “sell soon”. But remember, tools rely on past patterns. They don’t promise what comes next.

On the other side, there’s the quant stuff. Quantitative trading software is like having a math genius buddy. It crunches numbers, stats, and complex math to make trades. It doesn’t guess or feel. It just looks at hard data.

Now, here’s the face-off part. With technical tools, you need to watch and think. It’s hands-on. For quants, the buzzword is automate. Set your rules, and off it goes. It trades without you needing to click.

Which reigns supreme? Well, that’s like asking about the best ice cream flavor. Some traders love to dig in with technical tools. Others let quant software do the brain work. What’s cool is you get to choose. Or mix them up! Use the precision of technical analysis and the power of quant data.

This choice is big. It shapes how you trade, win, and sometimes lose. But fear not, the perfect mix is out there. And it’s more about your style than the tool’s flair.

Both charting and trading tools pack a punch. They work hard to guide you in the money maze. The best traders harness both to get ahead. So, dive deep, test lots, and find your perfect match.

Real-Time Insights: Data Tools and Algorithmic Prowess

Leveraging Real-Time Market Data for Informed Trades

Let’s cut straight to the chase. Investing is about making smart choices, fast. To do that, you need real-time market data tools. Imagine you’re a chef. Fresh ingredients are the secret to a great dish. Similarly, fresh market data helps you cook up winning trades. It’s all about speed and accuracy. When you have the latest stock info, you spot opportunities before they slip away.

What grabs your attention? Quick updates on stock prices, for sure. News feeds that shoot to your screen faster than a cheetah runs. This is where the best real-time data tools shine. They’re your eyes on the market, keeping you informed so you can act in a heartbeat.

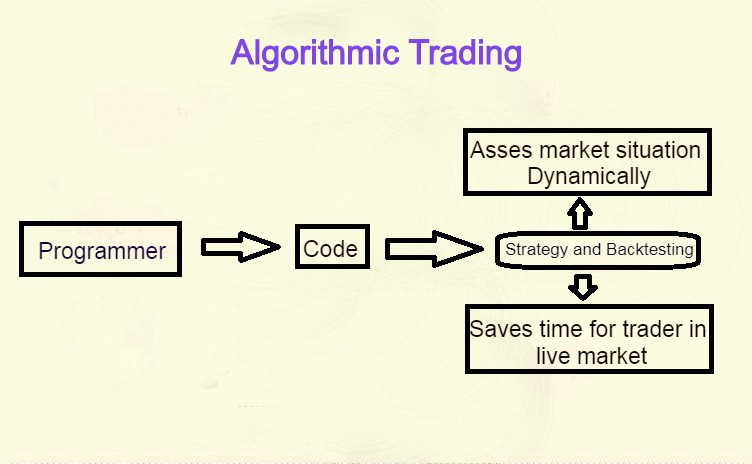

The Role of Trading Algorithms and Backtesting in Strategy Development

Now, let’s talk about the brainy side of trading: algorithms. Trading algorithms are like well-trained pets doing chores for you. They follow rules to buy and sell stocks without you lifting a finger. Sounds cool, right? But this isn’t a set-it-and-forget-it game. You need to train these pets, so to speak.

Backtesting is where you play pretend. It’s like time travel for your trading strategy. You go back in time and test your moves with past data. Did they work? Great! If not, you tweak and try again. No money lost, just lessons learned. Backtesting saves you from real-time tumbles and stumbles.

But let’s back up. What’s the role of trading algorithms? They carry out your trade plan with laser-like focus. No emotions. No cold feet. Just pure execution. The right software finds these smart algorithms and lets you backtest too. It’s all about planning and perfecting before you dive into the deep end of the trading pool.

Finding the right set of tools is like hunting for treasure. You look at heaps of options: stock screener effectiveness, best technical analysis tools, you name it. Comparing trading tools is tough work, but boy, is it worth it! You get a kit that fits your style and goals.

And there’s more than just stocks to think about. Forex traders? You need tight forex trading tools comparison charts. Options traders? Options strategy simulators are your new best friend.

Bottom line: trading’s a zero-sum game. You win; someone else loses. Real-time data gets you ahead. Algorithms keep you on track. Backtesting makes sure your plan is tight. And me? I’m here to guide you, sharing my chest of tools and tricks. It’s a jungle out there, but with the right gear, you’re the king of the trade.

Beyond Analysis: Risk Management and Strategic Planning

Assessing Risk with Advanced Management Software

When we trade, we’re buddies with risk. But we also want to stay safe. That’s where risk management software shines. It’s like a seatbelt for your cash. With it, you can spot the bumpy roads in markets. It helps us know when to pump the brakes—or hit the gas—on our trades.

These smart tools look at past data to guess risks ahead. They crunch numbers and spot patterns we can’t see. But they are not all the same. Some have more bells and whistles and some are just simpler. So, finding the right one matters a lot.

With so many out there, I’ve checked out the best risk management software. I compare them head-to-head. I check how well they predict the tricky stuff. I look at the features they offer. Most of all, I see if they are easy to use. Nobody likes a headache from a messy tool.

The best ones help us stay cool when the market heats up. They ring an alarm before trouble hits. That way, we can protect our hard-earned money.

Constructing Robust Investment Strategies with Strategy Builders and Forecasting Tech

Now, let’s talk about growing that money. We need strong plans to make more cash. Here’s where investment strategy builders and forecasting tech step in. They’re the smart pals we need to plan our next big win.

Strategy builders let us play with ideas before we dive in. Like building blocks, but for cash. We get to test our plans in a safe space. It’s kind of fun, putting together strategies like a puzzle.

Forecasting tech is like a time machine. It looks into the future of markets. It’s not magic, more like a smart guess. It uses tons of data from the past to tell what might come.

But not all tools are kings and queens. Some are more like jesters. They promise a lot but can make some funky calls.

So, I dig deep into these tech wonders. I stack them up against each other. What do we want? Tools that are sharp and get it right. I find the ones that can give us an edge, a crystal ball into the market’s heart.

Putting cash in the market is like a game of chess. We need to think a few steps ahead. With these top-shelf tools, we can plan killer moves. And most importantly, we can do it with more peace of mind.

Combined, risk management software and strategy tools are super powerful. They are the heroes that can shield our cash and help it grow, big time. Always remember, smart tools for a brighter cash future. And that’s what we all want, right?

We’ve covered a lot in this post about managing stocks and equity for smart investing. First, we looked at top stock analysis software, diving into their features and usability for better investment choices. Then, we explored how charting and trading tools can sharpen your market moves, comparing what technical and quantitative software bring to the table.

We didn’t stop there – understanding data in real-time can make or break a trade. That’s why we highlighted the importance of live market data and backtesting algorithms to fine-tune your strategies. To wrap it up, we tackled risk management – the backbone of solid investing – and how strategic planning sets you up for success.

I hope you now feel more confident navigating the complex world of investment tools. With the right resources and a clear game plan, reaching your financial goals is within reach. Get out there, use these insights, and invest with knowledge on your side.

Q&A :

What are the top financial market analysis tools available today?

When it comes to financial market analysis, a variety of tools are available that cater to different aspects of market research and strategy development. Among the top tools available today are fundamental analysis software like YCharts and Stock Rover, technical analysis platforms such as TradingView and MetaStock, and quantitative analysis tools like QuantShare. The choice of tool can depend on factors such as the user’s specific analysis needs, level of expertise, and investment style.

How do popular financial market analysis tools differ from each other?

Financial market analysis tools can differ in numerous ways, including the types of data they offer (real-time vs. delayed), analysis features (charting, technical indicators, backtesting), asset coverage (stocks, forex, commodities, etc.), integration with brokerage platforms, ease of use, and price. For instance, a tool like Bloomberg Terminal may offer comprehensive data and features but at a higher cost, while others like Yahoo Finance provide free basic services suitable for casual investors.

What should I look for when comparing financial market analysis tools?

When comparing financial market analysis tools, you should consider the following aspects:

- Range and quality of data provided (e.g., historical data, real-time data)

- Depth of analysis features (e.g., technical indicators, financial modeling capabilities)

- User interface and ease of use

- Compatibility with your trading or investment workflow

- Customizability to suit your analysis style

- Pricing structure and the value you get for the investment

- User reviews and community support

Are there any free financial market analysis tools that are as effective as paid ones?

While paid financial market analysis tools often offer advanced features and more comprehensive data, there are also effective free tools available. Free tools like FinViz for quick scans and charting, or the basic version of TradingView for technical analysis, can serve many investors well. However, serious traders might find that the additional features and data of paid tools like E*TRADE’s MarketCaster or TC2000 are worth the investment. It ultimately depends on the depth of analysis required and the user’s specific needs.

How can I determine which financial market analysis tool is best for my trading style?

Determining the best financial market analysis tool for your trading style involves:

- Identifying the type of analysis you rely on most (fundamental, technical, or quantitative)

- Looking for tools that specialize in providing the data and features necessary for that analysis type

- Considering the speed and frequency of your trading – day traders need different tools than long-term investors, for instance

- Testing out tools with free trials or demo accounts to get a hands-on feel for how they fit your trading routine

- Gathering feedback from other traders with a similar style or reading online reviews to see which tools are highly regarded in the community.