Financial Disintermediation Unveiled: Are Banks Facing a New Era of Threat?

Imagine your go-to bank slowly fades from the picture. This isn’t science fiction, folks, it’s the buzzword shaking the foundations of finance: financial disintermediation. Is financial disintermediation a threat to banks? Absolutely. Think about it – no more middlemen, just straight dealings between investors and borrowers. This isn’t just changing the game; it’s flipping the entire board.

The question is, how are banks bracing for the shockwaves spreading from peer-to-peer lending and bold fintech innovators? And that’s what I’m here to unravel. Who’s gaining ground and who’s bracing for impact? Stick with me, and I’ll walk you through this unfolding drama, where technology dances cheek-to-cheek with dollars and cents.

Understanding the Mechanics of Financial Disintermediation

The Rise of Peer-to-Peer Lending and Its Impact on Traditional Banks

Peer-to-peer lending lets people borrow and lend money without a bank. It’s like friends lending each other cash, but online and with strangers. This system is now a big player in the money game. These platforms connect folks who need money with those who have it to lend. It’s fast, often cheaper, and doesn’t need a physical bank.

This shift has made waves. Banks, which used to be the go-to for loans, are seeing customers drift away. With these platforms, borrowers often get lower rates, and investors can earn more. It’s clear why people like this new way.

But it’s not all roses. Risks include the chance of not getting paid back. Still, more and more folks are picking P2P over banks.

Decoding the Role of Fintech in Banking Disintermediation

Fintech, or financial technology, is changing the money game. It brings us stuff like digital wallets, making cash and cards seem old school. Banks used to control everything money-related. Now, tech companies are stepping in.

These fintech firms offer cool tools that banks don’t. Think of sending money to a friend with just a tap on your phone. Who needs a bank when you have that? It’s easy to see how fintech is giving traditional banks a tough time.

Technology is cutting out the middleman – the banks. Because of this, banks need to find new ways to stay in the game. They have to tackle competition not just from each other but from these tech wizards too.

So, banks face a real challenge. It’s a race to stay relevant in our digital world. The game is changing, and banks must change with it. They need to keep up or risk being left behind.

How Emerging Technologies Are Reshaping the Banking Industry

Blockchain and Cryptocurrency: A New Competitive Landscape for Banks

Banks used to be the only game in town for money matters. Now, things have changed. Blockchain is shaking things up, and it’s not just talk. This tech makes it so you can move cash and keep track of it without banks. That’s a big deal!

Cryptocurrency, that’s digital money like Bitcoin, could change banks forever. People and businesses can use this instead of regular dollars or euros. No need for banks to step in. Folks can even get loans or pay someone across the world quick and easy. Just think, no more waiting for bank approval!

Now, do cryptocurrencies threaten banks? Yes, they do. Banks make money by being the middleman, and crypto cuts them out. But it’s not all doom and gloom for banks. They’re smart. They know they must adapt or get left behind. They’re starting to use blockchain to speed up their own services. Pretty smart, right?

The Growth of Digital Wallets and Mobile Banking: Convenience Over Tradition

Check your pocket. Chances are you have a smartphone. It’s not just for chats and pictures. Now, our phones are banks. This is huge because it’s so darn convenient. Want to send some cash to a friend? Just tap your phone. Easy.

This mobile banking is growing fast. Why? Well, everyone loves things easy and fast. You’ve got apps for saving, investing, and even getting loans. Parents use them to teach kids about money. And savings? They sometimes offer better rates than walk-in banks.

So, are digital wallets and mobile apps a threat to regular banks? You bet. People don’t always want to go to a bank and stand in line. They would rather tap a few times on their screen. Banks have to figure this out. They need cooler apps and better online services. They’ve got to keep up with what folks want.

Banks are still important, though. We trust them with our cash. They’re part of our communities. But they’re getting a major nudge. Technology is like a wake-up call. It tells banks to up their game. To stay part of our lives, banks have to be as handy as our favorite phone apps.

For banks, it’s time to adapt. The world’s moving fast, and so should they. Embrace tech, or become a memory. That’s the message fintech and these new services are sending. Banks have the chance to join in and make banking better for everyone. Let’s see what they do next.

The Competitive Squeeze: Neobanks and Non-banking Financial Intermediaries

From Financial Marketplaces to Neobanks: How New Players Are Capturing Market Share

Imagine walking into a bank. The lines, the wait, the paperwork. Now, think of snapping a pic of a check on your phone. Money goes straight to your account. That’s fintech magic for you. We’re in a fresh game now. Online spots to get a loan or save cash are booming. They’re called financial marketplaces and neobanks. Think eBay, but for money stuff.

Here’s the deal: Neobanks say bye to branches and hi to apps. They save on overhead and give back through better rates and low fees. Real banks feel the pinch. They must compete or risk losing out. Every dollar parked in a fintech is one less in the banks. It’s a big deal.

Now, what’s a neobank? Think of them as techy banks with no physical spots. They live online. They’re buzzing ’cause they’re easy, quick, and can be cheaper. With no branches, they’re everywhere you and your phone go. Digital wallets come in here too. Paying with your phone is the new cash.

People dig convenience. That’s why neobanks and digital wallets are scoring big. They’re part of why some now think, “Do we even need banks?” It’s serious.

Analyzing the Shift in Consumer Lending Trends and Bank Responses

What about getting a loan? Once, you’d hit up a bank. These days, peer-to-peer (P2P) lending is hot. It’s a space where folks lend to each other online. No bank in sight. Got good credit? Your rates might be better here. Traditional banks, you’ve got mail. And it’s not good.

Banks are answering back though. They know tech’s power. Apps, online services, they’re rolling them out. It’s their play to stay in the game. They’re also teaming up with fintech firms, using their tools to get cool again.

Still, the ground’s shaky. People are now banking without banks. Money’s flowing through apps, cryptocurrencies, and crowdfunding. Banks used to be the big players in town. Everyone came to them. Now, they have to fight for attention. It’s like they’re calling, “Hey, remember us?” But with so much noise, it’s tough.

This shift in lending’s got banks on their toes. They’re trying new tech, new ways to cut costs and keep clients. They still have tricks up their sleeves. Reliability, history, and knowing the money rules. It’s a question of whether they can mix the old with the new.

The game’s changing fast. New tech brings new players. Banks are more than counters and vaults now. They have to be smart, quick, and tech-savvy. If they can’t keep up, there’s a line of fintechs waiting to take their lunch. So they need to step up their game. And fast. It’s not just about being a bank. It’s about being the best spot for your cash.

Navigating the Future: Adaptation Strategies for Traditional Banks

The Vitality of Open Banking Platforms and Regulatory Adaptations

Banks today face a big shift. New tech changes how we handle money. FinTech firms, with their fresh ways, push banks to think different. To stay in the game, banks must adapt. Open banking is one big change. It lets banks and third-parties share data. With this, banks can offer better, personalized services.

Rules impact how banks and FinTech play. They need to be safe for customers and fair for all. Europe’s PSD2 is one example. It makes banks open up data. But it does more. Banks now must think how to use this chance. They can partner with FinTech to create new services. Together, they can meet what customers want.

To win, banks must think smart. They must build services that speak to a digital world. They must focus on what users need and love. This means easy use on phones and online. It means making paying friends as easy as texting. It means knowing your money’s safe, no matter where you bank from.

Security is key. Banks have trust but must keep up with safety tech. Biometrics, like finger scans, add extra safety layers. They help keep money safe in a world where more is digital.

Banks still matter a lot. We need them for big loans and to keep cash safe. But to stay important, they must change. They can no longer move slow and ignore what’s new. They must grab tech and make it work for them.

Crafting Bank Survival Strategies in the Face of Venture Capital and FinTech Innovation

It’s a tough time for banks. They must deal with FinTech rivalry and money from venture capital. FinTech brings cool, easy ways to do what banks did before. Peer-to-peer lending lets people lend to each other, without a bank. Digital wallets let money fly with a tap on the phone. Blockchain makes money moving across the world quick and cheap.

Crowdfunding and online pay systems offer more ways to get and use money. Mobile banking growth shows people want to bank quick, anywhere, anytime. Crypto aims to replace banks, with claims of better, borderless money systems.

Banks need to stand out. They must find ways to give more than what’s basic. It’s about adding value now. This could be through top-notch service or new tech perks.

A big win for banks could be in personal advice and service. They can give help that tech alone can’t. As for loans and savings, banks must compete. They need fair rates and terms. They can’t let online savings accounts or P2P platforms take their space.

Change is here, with tech driving it. Banks must see it as a chance, not just a threat. By partnering with FinTech and adapting to digital demands, they can craft their own future. They can stay key players in the money game. But this means bold moves and fresh ideas. It’s time for banks to take the lead again.

In this post, we dug into how new tech and ideas change how we bank. We saw peer-to-peer lending shake up old banks and fintech change the game. Blockchain and digital wallets are making banking easy for everyone, anywhere. Neobanks and others are stepping in, making it tough for the usual banks to keep up.

We then explored how banks can fight back. Open banking and smart rules can help. Banks need to find new ways to stay in the race, with venture capital and fintech not slowing down.

To wrap up, banks face a tough road ahead but they’re not out of the game yet. They can adapt and thrive in this bold new world of finance if they play their cards right. Let’s watch how they respond. It’s an exciting time in banking, and you’re now in the know!

Q&A :

What is financial disintermediation and how does it impact banks?

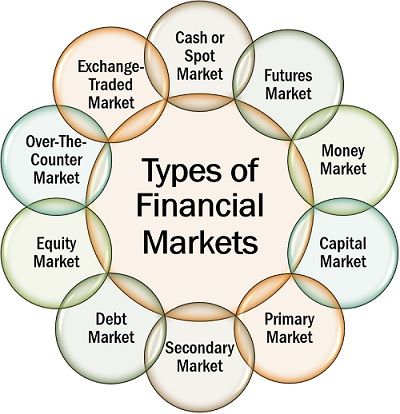

Financial disintermediation is the process where borrowers bypass traditional financial intermediaries, such as banks, to find alternative funding sources. This trend can significantly impact banks as it reduces their role in the financial system, potentially leading to a loss in market share, lower deposit levels, and reduced profitability from traditional lending activities.

Can financial disintermediation benefit consumers and businesses?

Yes, financial disintermediation can often benefit consumers and businesses by providing more direct access to financial markets, which may result in lower borrowing costs and more tailored financial products. The increased competition from non-traditional funding sources can also spur innovation among financial services.

What are the common drivers behind financial disintermediation?

The rise of technology, specifically in fintech, has been a significant driver of financial disintermediation, as it allows for efficient online platforms that connect borrowers directly with investors or alternative lenders. Other drivers include lower transaction costs outside of traditional banks, increased regulatory burdens for banks, and a growing investor appetite for debt securities.

How are banks responding to the threat of financial disintermediation?

Banks are responding to financial disintermediation by adapting their business models, investing in technology, forming partnerships with fintech companies, and embracing digital transformation to improve efficiency and customer experience. Additionally, banks are expanding their services to include non-traditional banking products to remain competitive.

What future trends might influence the extent of financial disintermediation?

Future trends that could influence financial disintermediation include advancements in blockchain and distributed ledger technology, which could further streamline direct transactions between parties. Additionally, regulatory changes, shifts in economic conditions, and evolving consumer preferences towards digital platforms may either amplify or mitigate the extent of disintermediation in the financial sector.