Combining technical and fundamental analysis isn’t just a strategy; it’s a trader’s superpower. Imagine unlocking the hidden stories behind stock moves. You don’t have to pick sides anymore. With the essentials of market analysis in your toolkit, you’ll understand why stocks tick the way they do.

My journey has shown that blending chart patterns with company earnings is not just smart; it’s essential for crafting robust trading strategies that stand the test of time. Dive in with me, and let’s demystify the art of merging these powerful tools for making informed trading decisions and forging a path to long-term market success. Your portfolio will thank you!

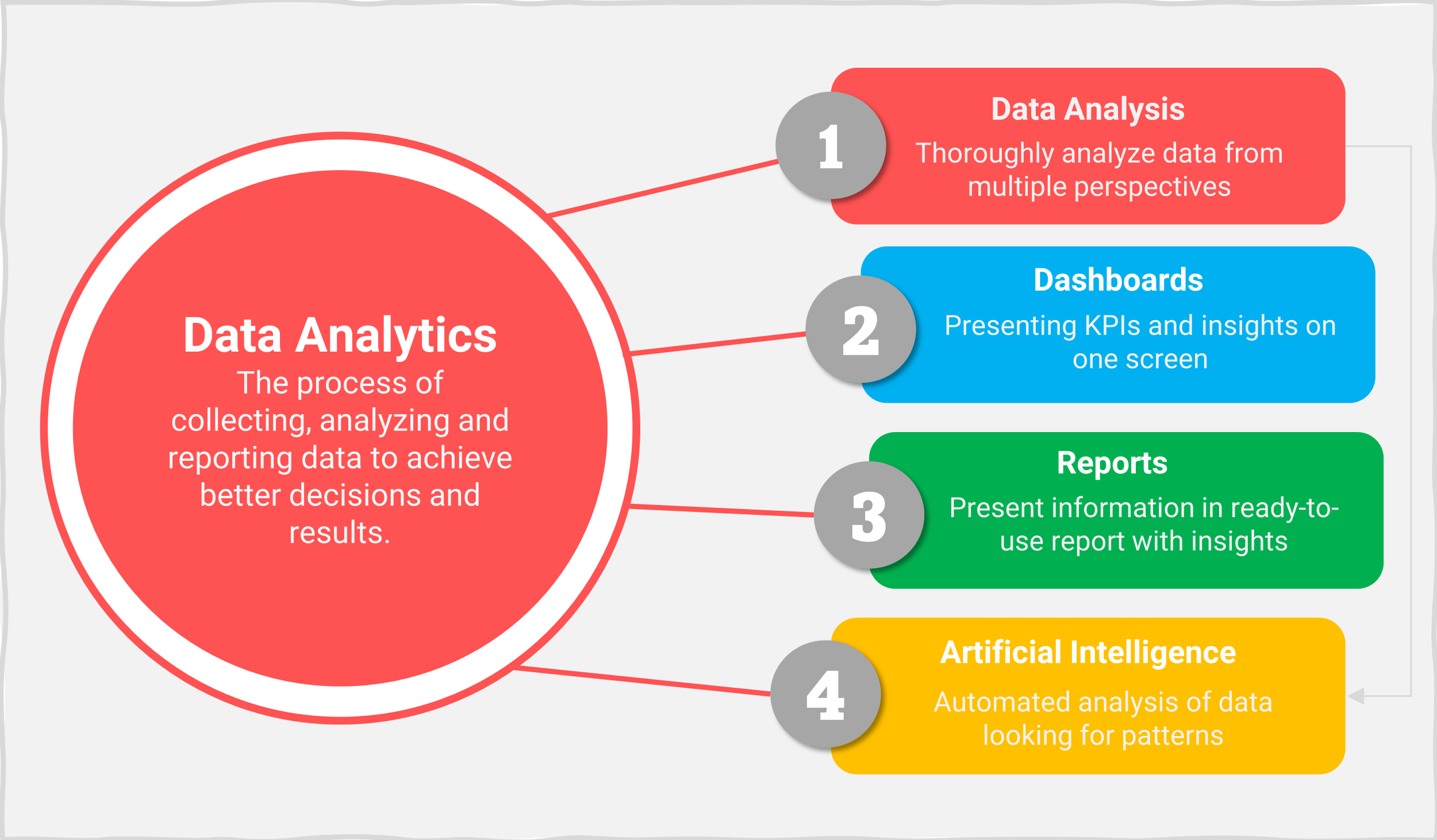

The Essentials of Market Analysis

Understanding the Pillars of Technical Analysis

When we talk about trading, technical analysis is like a toolbox. It’s full of different tools that help us see patterns in stock prices. Think of charts with lines moving up and down. Those lines can tell us where prices might go next. We use tools like price action, moving averages, and price volume analysis. We look at past price moves to guess where they might go. It’s like using clues to solve a mystery. But technical analysis isn’t just about lines and charts. It’s about understanding how other traders think and act.

So, what about combining technical analysis with fundamental analysis? When we mix these, we get a complete picture. Just like you need both eyes to see clearly, we need both types of analysis. With technical analysis, we watch prices and patterns. But that’s not enough to make good choices. We need to know if a company is strong inside. That’s where fundamental analysis comes in.

The Role of Fundamental Analysis in Stock Valuation

Fundamental analysis is like getting to know someone. Just like you can’t know a person by their looks alone, you can’t know a company by its stock price alone. To really understand, we dig deep. We look at things like how much money the company makes and how much debt they have. This tells us if the company’s healthy, like checking if a person eats right and exercises.

With fundamental analysis, we ask questions like:

How’s the company doing?

Is it making money?

Can it pay its bills?

These questions help us see if the stock price is fair.

So, why blend the two – technical and fundamental analysis? When we combine them, we’re like detectives with more clues. We have a better chance of figuring out the mystery. We see not just how the stock is moving, but also why. And that helps us make smarter trades – ones that could make money.

By mixing chart patterns with things like earnings reports, we can spot a stock that’s about to do well. Or we can avoid one that might drop. We use these insights to decide when to buy or sell. We get the best of both worlds – the quick signs from price charts and the real story from the company’s numbers.

As traders, knowing both methods matters. We can’t just focus on one and ignore the other. We need to understand the market from all sides. And that’s what I do as a Chief Market Strategist. I look at all the pieces. Then, I put them together to get a full picture. And when we have that, we’re ready to make trades that make sense. This way, we can be more confident in our choices and have a better shot at winning in the stock market.

Crafting a Mixed Analysis Approach

Technical Indicators and Economic Data Synergy

I start by looking at the charts. Technical indicators tell me where a stock might go. For example, moving averages smooth out price data. They show clear trends over time. When I see these lines crossing, they warn me of potential price moves.

But charts are just one piece. I pair them with economic data too. Reports on jobs, sales, and growth give me a bigger picture. It’s like getting a sneak peek at what may move the market.

I ask, “How do interest rates affect stocks?” Interest rates can push stocks up or down. If rates rise, borrowing costs more. Companies may slow down spending. This can drop stock prices. But, if rates fall, it can be the opposite. Stocks may rise with cheaper borrowing.

By combining these, I make smarter trades. I look for where both technicals and economics agree. It gives me more confidence in my decision. It’s like having two friends agree on where to eat.

Merging Chart Patterns with Earnings Insights

Next, I dive into company earnings. Earnings show if a company is making money or not. They can drive stock prices sharply. Strong earnings often lift stocks, while weak ones can sink them. By reading these reports, I know a company’s health.

I ask, “Why do earnings matter?” Earnings are a company’s report card. They tell you if it’s profitable. Good earnings mean the company does well, often pulling the stock up. On the other hand, bad earnings can warn of trouble. They may push the stock down.

Chart patterns help too. They can flag upcoming moves. Patterns like ‘head and shoulders’ or ‘double bottoms’ are clues. They suggest if a stock may rise or fall. It’s like knowing the end of a story before it happens.

Now, I match chart patterns with what the earnings tell me. If patterns and earnings line up, that’s powerful. It’s two separate methods saying the same thing. It’s a green light for me to act.

Remember, no one tool is perfect. But by combining them, I chase better results. It’s like using a map and asking for directions. You’re more sure to reach your destination. Combining market analysis strategies isn’t easy. But it can pay off big for those who learn to do it right.

Practical Application in Trading Decisions

Balancing Trading Signals with Business Metrics

When we blend technical and fundamental analysis, we walk a tightrope. On one side, there’s the rhythm of price movements and trading volume. On the other, we find the heartbeat of a company – its financial health.

Technical indicators light the path. They show where a stock might head in the short run. Think of it like weather forecasting – we get a sense of whether we need an umbrella today. Yet, this is just half the view.

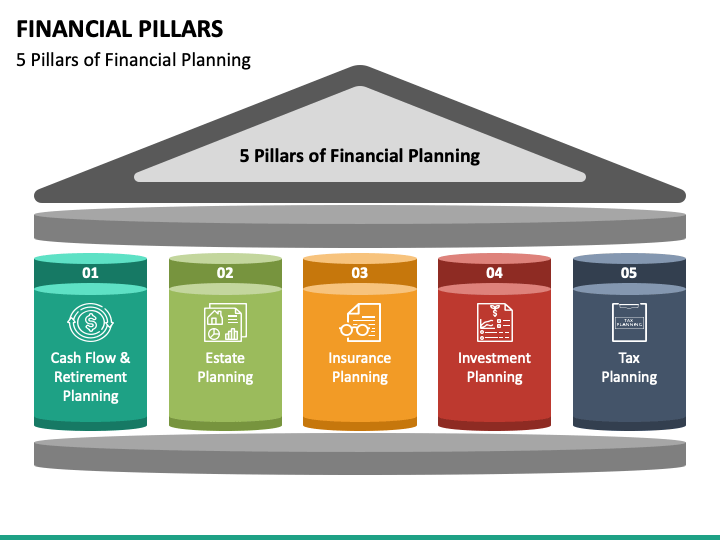

Fundamentals are our bedrock. They involve earnings, the company’s debt, and more. They answer bigger questions. “Is this firm solid?” “Will it grow over years, not just days?”

We need both to make smart trades. Think of it as using both a map and a compass when hiking. One shows where you are; the other, where you’re going.

Price Volume Analysis Versus Financial Health

Now let’s talk price volume analysis. It’s how many shares change hands each day. It’s a sign of life in a stock. More trades can mean a tip-off. Maybe good news is coming, or maybe it’s not so rosy.

Financial health is deeper. It’s like getting a check-up at the doctor’s. We look at all things money — from profits to debts. It tells us if a company is fit, ready to grow, and stay strong in hard times.

Here’s how they meet. While price volume can give us a quick signal, the financials back it up or warn us to stay away. When both point the same way, it’s a green light. If they clash, caution is king.

By combining market trends with a firm’s financial health, we create a powerful toolkit. It makes sure we’re not just chasing the latest hot tip but investing in real value. It’s where street smarts meet book smarts.

We’re after synergy in our trading strategies. This means letting technical analysis shine when markets are fast and wild. But when the dust settles, fundamentals help us see clear for the distance.

Investment analysis integration is key here. We’re not jumping from one tool to another. Instead, we’re crafting a unified approach to market analysis. It’s the bridge between the quick wins and the lasting gains.

In the end, it all comes down to balance. Spotting a fast-moving trade is a thrill. Yet, we know it’s the solid, well-researched investments that build wealth. It’s like a diet — we can enjoy some junk food, but we need our veggies to stay healthy in the long run.

As we explore market technicals and fundamentals side by side, we see the full picture. It’s more than charts or spreadsheets. It’s about understanding a living, breathing market where every beat matters.

Remember, the goal isn’t just to play the game. It’s to play it well, with eyes wide open. We’re combining chart studies with balance sheets, short-term thrills with long-term plans. We’re on a quest for a comprehensive stock evaluation.

In the world of investing, knowledge is power, and a mixed analysis approach is our sword and shield. With these in hand, we can navigate the market’s twists and turns — ready for whatever comes.

Strategy Development for Long-term Success

Applying Different Time Frames to Market Analysis

When we trade, we must look at time. Short and long times tell us different things. Stocks move fast or slow, and we watch this to choose when to buy or sell. Looking at hours or days is for quick moves. We check months or years to plan for the long haul. Both ways guide us to make smart trades.

In short-time markets, we see quick ups and downs. Charts show us patterns. These patterns hint at what comes next. For long times, we dig into a company’s health. We look at their money and plans. This tells us if they can do well in the future.

The best traders use both short and long looks. They mix quick chart patterns with deep company checks. This blend helps them see the whole picture. By doing this, we pick the best times to trade. We can win on fast moves and also build for years ahead.

Educating Traders on the Synergies of Combined Analysis Methods

Now, let’s talk about teaching traders. Many folks only look at charts or just check company facts. Both ways can work well. But using both together works best.

I like to show traders how to mix these ways. We start with chart signs. Chart signs are quick and easy to see. Next, we match them with what we learn about a company. This means checking their money, their team, and their market place.

When we mix these, we get a strong trade plan. For example, if a chart shows a stock may go up, and the company is strong, it could be a good buy. But if the company struggles with money, even with good chart signs, we think twice.

By teaching this mixed way, traders can choose better. They learn to trust their trades. And they can tell others why they picked that trade. This trust comes from seeing both the chart and the company are pointing the same way.

Using charts and company info, we make a tool kit for winning at trades. We spot trends and check if they match with how solid the company is. Knowing both sides, traders are ready to take on the market’s ups and downs.

In short, we need to look at all parts to trade well. We use charts for quick clues and check companies for strong roots. And we teach this to traders so they can grow. With this full view, they are all set for long wins and clever trades today. This way, trading becomes both a skill and a smart path for money.

In this post, we dove deep into the world of market analysis. We started by breaking down technical analysis, showing you how stock prices can hint at future moves. Then, we tackled fundamental analysis, where business facts help work out a stock’s real worth. These are big tools for any trader’s kit.

We then mixed both methods, matching chart clues with money facts to spot winning stocks. By combining these insights, you make smarter, informed trades. It’s like having a secret code for the stock market.

Next, we talked about using these tools in real trades. We compared trade signals with company health. This helps you pick stocks that not only look good on paper but stand strong in the market.

Lastly, we covered building a strategy for year-over-year growth. We discussed analyzing markets over different times and teaching traders to merge analysis types. This way, you grow your money over time. It’s not just about quick wins; it’s about building wealth.

Keep these lessons in hand. Use them to create a robust stock strategy that lasts through ups and downs. Happy trading!

Q&A :

Can technical and fundamental analysis be used together in trading?

Yes, technical and fundamental analysis can be combined in trading to provide a more comprehensive market overview. Fundamental analysis evaluates a company’s intrinsic value through its financial statements and economic indicators, while technical analysis focuses on chart patterns and price movement. Using both methods allows traders to gain insights on both long-term value and short-term price trends.

What are the benefits of combining technical and fundamental analysis?

Combining technical and fundamental analysis offers several benefits:

- Improved Decision Making: By incorporating both analyses, traders can make more informed decisions, as they have a clearer picture of the market from different perspectives.

- Risk Management: Understand the broader economic factors along with the price trends can help traders in better risk management.

- Diverse Strategies: It allows for the development of diverse trading strategies that can adapt to various market conditions.

- Timing: While fundamental analysis may suggest what to buy or sell, technical analysis can provide insights on when to execute the trade.

How do traders integrate technical and fundamental analysis?

Traders can integrate technical and fundamental analysis by:

- Screening for Fundamentals: Initially screening stocks based on fundamental criteria such as earnings growth, debt levels, or return on equity.

- Timing with Technicals: Using technical indicators and patterns to determine the optimal entry and exit points for the stocks they’ve identified fundamentally sound.

- News and Earnings: Monitoring news releases and earnings reports and subsequently using technical analysis to gauge market sentiment and price reactions.

What are the challenges of combining technical and fundamental analysis?

Combining technical and fundamental analysis can present challenges such as:

- Information Overload: Managing and interpreting a large volume of data from both analyses can be overwhelming.

- Conflicting Signals: Sometimes, the two analyses may provide contradictory signals, leading to confusion or indecision.

- Time-Consuming: Thoroughly applying both types of analysis requires a significant time investment.

- Skillset: Traders need to be proficient in both analyses, which can require extensive education and experience.

Which should I learn first: technical or fundamental analysis?

The choice of which analysis to learn first depends on your trading style and goals. If you are interested in long-term investments and value-based trading, you might prefer starting with fundamental analysis. If your focus is on short-term trading and price action, technical analysis might be more suitable. Many traders find it beneficial to have a basic understanding of both types before specializing.