Money has evolved over time, from bartering to banknotes to digital transactions. But what’s the next big leap? Central bank digital currency (CBDC) might just be it. This isn’t just another form of digital payment; it’s a game-changer. With a CBDC, you hold money that’s as direct as cash and as handy as an app. Imagine a world where your cash is as smart as your phone. This isn’t sci-fi; it’s the future knocking at our doors. Let’s dive deep into why CBDC could lead us into a new monetary era, making transactions faster, smarter, and more inclusive than ever. Buckle up and get ready to explore how a CBDC might just redefine your wallet and the world’s economy.

Understanding the Landscape of CBDCs and Their Potential Benefits

Exploring the Advantages of CBDC over Traditional Money

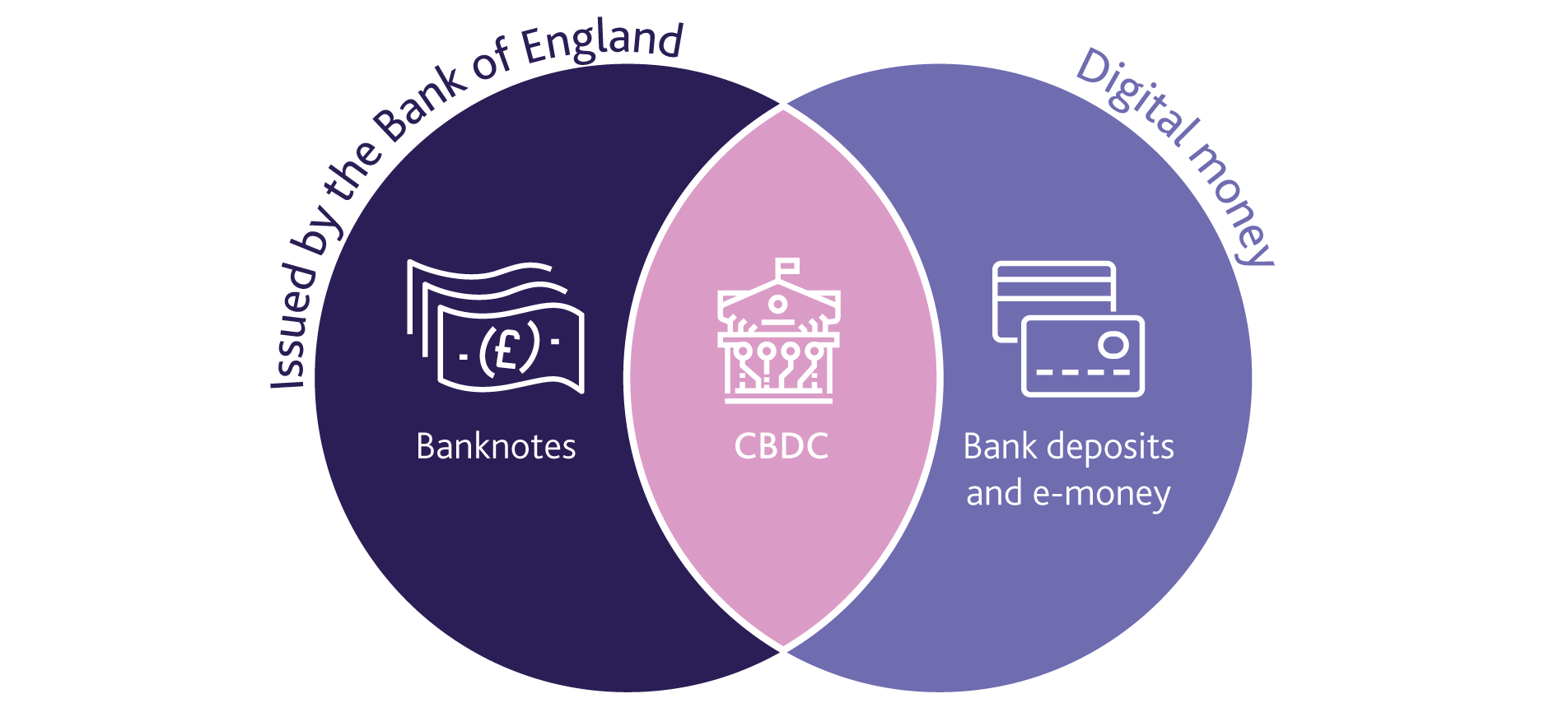

CBDC, or central bank digital currency, is like money but digital. It is like having your cash online, but safer. You don’t worry about losing your wallet. CBDCs are the next step in how we use money. They’re made by a country’s central bank, making them very reliable. The digital currency systems used by CBDCs allow for fast and easy payments. This means buying things could become quicker than before. People can also get money from others without trouble.

Now, you might ask, “How is CBDC different from the money in my bank account?” CBDC is not the same as the money you use through credit cards or online banking. It’s a new type of money created and backed by a central bank. It’s like having cash but in digital form. You can use it just like normal money, but it’s just for online use. It is a mix of the best parts of cash and digital payments.

You may hear “blockchain” when talking about digital things. Blockchain is a tech that can make CBDC very safe. No one can change the transactions. CBDC privacy is a big deal too. Your info is secret, so no one can see what you buy unless they need to.

Assessing the Impact of CBDC on Financial Inclusion and Economic Growth

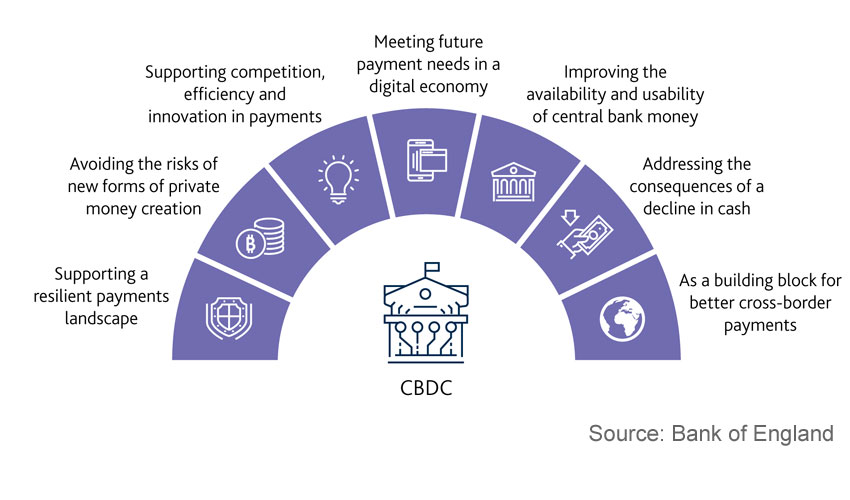

CBDC can help people who don’t use banks. It can make it easier for them to join the economy. This is what we call “financial inclusion.” CBDCs can reach everyone, even in far or poor places. People there can now do things like save money safely or buy things from far away.

CBDCs can also make countries’ economies stronger. They can make trading faster and lower costs. Imagine sending money to another country with no wait or big fees. This can help businesses grow and make more jobs. It’s exciting to imagine a world where everyone finds it easy to access and use money.

Kids, think of CBDC as special money for the internet that is very safe and helps people use money easier. It is made by important groups in your country to make sure it is good to use. It helps people who are not close to a bank and can make doing business better. CBDC is like your piggy bank but for the digital world. It could change how we all use money very soon!

Navigating the Technological Blueprint of CBDCs

The Role of Blockchain and Distributed Ledger Technology in CBDCs

Money is changing fast. Central Bank Digital Currencies, or CBDCs, are a new form of money. Think of them like the dollars or euros you use now, but in digital form. They are made by central banks, so they’re safe. Now, let’s dive into how they work.

CBDCs use special tech to keep your money safe and to move it quickly. This tech is called blockchain and distributed ledger technology (DLT). A blockchain is like a chain of digital blocks. Each block holds a list of transactions. Once a block is full, it gets locked and linked to the next one. This makes a strong chain that’s hard to break or change.

DLT is like a big notebook that many people hold. Everyone has the same notes, so if someone tries to cheat, the others will see it. Since many people check the notebook, it’s trustworthy. DLT can help CBDCs move fast and safe across the world.

DLTs can make money smarter too. This means CBDCs can do things automatic, like paying your bills when they are due without you doing anything.

CBDCs and the Progression Towards Programmable Money

CBDCs are not just digital cash. They can be programmed. This is a huge step for money. Programmable money means we can set rules for how it’s used. For example, imagine you get money that only buys food, nothing else. This can help make sure people spend money the right way.

CBDCs can change a lot about how we use money. They can make sure people who need help get it fast and use it right. They can also make sure businesses follow the rules.

But there’s much to think about. We have to make sure these new CBDCs are fair and keep your info private. We must build them right, so they work with other money systems and are easy for you to use.

As we use less cash, CBDCs could be the future of money. They are not just new, they are smart and safe. They can make life better for all of us. But we’re just starting and must learn as we go. How we build and use these new CBDCs will shape our future. It’s like we are all on a big ship, heading into new waters. The journey might be rough, but there are many new things to find. With CBDCs, we have a chance to make money better for everyone. Let’s make sure we do it right!

Addressing the Challenges and Risks in CBDC Implementation

Tackling Privacy Concerns and Regulatory Compliance in CBDCs

We all want our money safe and our info private, right? But as we move our dollars to digital, we run into new problems. ‘How do I keep my money info safe?’ and ‘What rules do we follow?’ are big questions with CBDCs. Banks need to balance keeping our money info out of wrong hands while sticking to the law. Tough job, but doable.

Take privacy. It’s a hot button issue. When we spend CBDC, we don’t want others snooping. A digital wallet can help here. This wallet needs to be tight. Like a safe that only you have the key for. And yes, tech experts are on it. They’re testing ways to keep our CBDC spends hidden yet legit.

Rules matter, too. Countries all over have different rules. We need rules that work for everyone. CBDC rules should stop bad acts like money laundering. We also want them easy to use across borders. Because, let’s be honest, we want to buy stuff from everywhere.

Analyzing the Global Landscape of CBDC Adoption and Pilot Programs

Now, looking at the world, countries are at different spots with CBDC. Some are just starting, while others are already testing. It’s like a race, but with a twist. No one really wants to be first until it’s all clear. That’s why pilots matter.

Pilots are like test runs. Countries try CBDCs in real life but on a small scale. They want to see what works and what doesn’t. China’s ahead here. They’ve got a system up and running in some cities. Others are watching and learning.

But why do we care? Simple. CBDCs can make money moves fast and cheap. They can cut out middlemen that slow things down. Plus, they can help those who don’t have a bank. About 1.7 billion adults are bankless. CBDC can change that.

We’re also watching what happens when countries get CBDCs right. Will we see a cashless society? Maybe. Will it shake up the old ways banks work? It could. But these are big ‘could be’ ideas. We’re still figuring out the road map.

There’s a lot to think about: how we keep info safe, stick to laws, and what we learn from each other. CBDCs can bring big perks, but we have to do it right. If we nail it, then we might just see the future of money. And that’s a future worth getting right.

CBDCs and the Future of the Monetary Ecosystem

The Potential Influence of CBDCs on Central Bank Policy and Retail Banking

Have you heard about CBDCs? They’re like digital cash from a country’s central bank. Imagine sending money as easy as a text message. Central banks control them, so they’re safe. Banks and apps will need to keep up with this new tech.

Central banks set money rules. With CBDCs, they can change rules quick to help the economy. It’s like having a magic wand for money policies! This digital cash can also fight crime. It makes sure money goes where it should.

Retail banks must adapt or fall behind. CBDCs mean you can bank straight with the central bank. But don’t worry! Regular banks will still offer loans and services that a CBDC can’t.

Exploring the Cross-border Implications and International Cooperation for CBDCs

Sending money to another country can be slow and costly. CBDCs can change that. They can move cash fast across borders. It’s like sending an email instead of mailing a letter.

Countries working together can make CBDCs even better. If they agree on rules, paying someone far away gets easier. It can also mean you get more for your money when you travel or buy things from other countries.

But this teamwork is tricky. Nations must trust each other and agree on how to run these digital currencies. They need to protect against cyber attacks and keep your money safe.

CBDCs have a big part in our money’s future. They make things quick and simple. Plus, they help banks and countries work together in new ways. It’s an exciting time for all of us who spend, save, or send money!

We’ve walked through the world of CBDCs, from benefits to tech to risks. These digital coins could change money as we know it, making it faster and more inclusive. We’ve seen how they rely on new tech like blockchain and could lead to money that can do more, like ‘programmable money.’ But it’s not all smooth sailing. We must keep privacy safe and follow rules. We’ve looked at who’s jumping in and testing these waters.

Looking ahead, CBDCs may shake up how central banks and retail banks work. They could make it easier to use money across borders too. But we’ll need countries to work together. As we watch CBDCs grow, remember the journey is just as key as the destination. Let’s keep our eyes open for what comes next in this exciting shift.

Q&A :

What is a central bank digital currency (CBDC)?

A central bank digital currency (CBDC) is a type of digital currency that is issued and regulated by a country’s central bank. Unlike cryptocurrencies, which are decentralized and operate on a blockchain, CBDCs are centralized and have the backing of the government, which aims to provide a secure and efficient digital payment system. CBDCs can improve financial inclusion and streamline payment processes, making transactions faster and potentially more stable than traditional banking systems.

How does a central bank digital currency differ from cryptocurrencies like Bitcoin?

Central bank digital currencies are fundamentally different from cryptocurrencies like Bitcoin in several ways. The most significant difference is that a CBDC is issued and backed by a state’s central bank, which gives it legal tender status and a high level of security and stability. In contrast, cryptocurrencies such as Bitcoin are decentralized and not backed by any government or central authority. Additionally, the value of a CBDC is typically stable and tied to the country’s fiat currency, while cryptocurrencies can be highly volatile.

What are the potential benefits of using a central bank digital currency?

The adoption of a central bank digital currency can offer numerous benefits. These include increasing the efficiency of payment systems, reducing transaction costs, and enhancing the speed of cross-border transactions. CBDCs can also improve financial inclusion by providing access to financial services to individuals who may lack traditional banking resources. Moreover, with advanced tracking and monitoring capabilities, CBDCs can help combat financial crimes such as money laundering and fraud.

Can a central bank digital currency impact monetary policy?

Yes, a central bank digital currency has the potential to significantly impact monetary policy. By implementing a CBDC, a central bank can gain greater control over the money supply and more directly implement monetary policy measures. The ease of distributing money could enhance the effectiveness of fiscal policies, such as direct payments to citizens. Additionally, through the use of programmable features, central banks could enforce specific monetary rules, like negative interest rates, more efficiently using a CBDC.

Are there any privacy concerns associated with central bank digital currencies?

Privacy concerns are one of the major considerations in the design and implementation of central bank digital currencies. While CBDCs have the ability to improve security and reduce illicit activities through better traceability of transactions, they also raise concerns about the level of financial surveillance by the government. The challenge lies in striking a balance between protecting user privacy and complying with regulatory requirements intended to prevent financial crimes. The exact nature of privacy implications will depend on the design choices made by the central bank issuing the CBDC.