Investors, get ready to align your dollars with your values! The quest for the Best ESG Funds for 2024 is no longer just a trend—it’s a critical move towards a greener, more sustainable future. But with so many options blooming under the sun, how do you pick the winners? Fear not! We’re diving into the heart of sustainable investing to unearth top-notch funds that promise profits, without sidelining the planet. Whether you’re after equity muscle or the steady pulse of fixed income, I’ve got the insights to grow your portfolio’s conscience and its value. Stay tuned, let’s make your investment count—for your wallet and the world.

Unveiling the Front-Runners: Top-Rated ESG Investment Funds of 2024

ESG Equity Funds Performance

In picking top funds, we look at ESG equity funds first. These funds put money into firms with strong ESG scores. A big draw is they grow your greens while doing good.

When we think of the best ESG funds, think ones that do well and do right. They look at a company’s eco deeds and fair work ways. Solid gains here mean picking firms that care for our world and make cash.

Some funds shine bright. They pick stocks with care and show us sound returns. For 2024, we spot trends like clean tech and health firms that fly high in ESG scores. We like firms that are clear on ESG goals and hit them too.

Kids, in the future, will thank us for picks like these. We make cash, save trees, and build a world they’ll love. What a win!

ESG Fixed Income Funds Advances

Next, we look at ESG fixed income funds. These funds buy bonds from firms that are pals with the planet. They’re about steady cash flow and keeping your cash safe.

The cool part? You can lend to firms that do great stuff for the Earth. Think water clean up and sun power. Your cash helps and grows. These funds show strong growth. We expect more zip in 2024.

Firms with good bonds often have less debt mess. They plan ahead for risks, like wild weather or new green rules. Smart bond choices come from seeing who does this best.

Buying into these funds means you join a club. A club that stands for clean air, good work spots, and helps folks. Plus, the gains are sweet too!

To sum it up, investing in 2024’s top ESG funds means smart cash moves. And, you help the Earth and its people. Who says you can’t do both? Just watch, these picks could help you win in more ways than one!

A Greener Future: Green Mutual Funds and Renewable Energy Funds in 2024

Harnessing the Potential of Renewable Energy Investments

In 2024, the buzz is all about renewable energy funds. Top ESG funds are turning heads, showing us that it’s possible to make money while doing good. They support wind farms, solar panels, and more. This matters a lot if you like the planet and want to keep it safe. It’s pretty awesome to think that by investing, you’re helping the sun and wind work for all of us.

A good choice for this is looking at ESG fund ratings. These help you pick the best ones out there. Want the names of such funds? Sorry, can’t drop them here. But, ratings and rankings are simple to find with a quick web search.

Remember to check how these funds have done in the past. This can give you a hint about how they might do in the future. Consider talking to ESG-focused investment consultants too. They really know their stuff and can guide you to make smart picks.

Eco-Friendly Mutual Funds Poised for Growth

Green mutual funds are the talk of the town in 2024. They include companies that care for the Earth like it’s their own backyard. This is cool because it means your cash is avoiding the bad guys who harm our planet.

When you hear “eco-friendly investment portfolios,” think of a basket full of green goodies. Green mutual funds bring together lots of companies that are friends of the Earth. This spreads out your risk and can help you sleep better at night, knowing your green is doing good.

Socially responsible investing isn’t just a trend – it’s the future, and it’s here to stay in 2024. Funds that ace the ethical investment funds comparison are in high demand. People love that they can invest with their hearts and not just their heads.

Being climate-aware in investing is now a must-do, like tying your shoes before a run. Look at how these funds can grow your money and make a difference. This way, you can stand tall, knowing your investments are helping shape a world we’ll all want to live in.

If you’re excited about this stuff, keep an eye on the best ethical funds and grab details on the net. But here’s a hint: it’s not just about finding the fund with the highest return. It’s about matching your money with your values.

And there you have it. Renewable energy and green mutual funds are on a rocket to the stars in 2024, taking your portfolio on a ride that could make both you and the Earth a bit richer. It’s your chance to be part of a change that’s bigger than just dollars and cents. After all, investing in a healthier planet is investing in a healthier future for all of us.

Impactful Choices: Spotlight on Socially Responsible Investing and ESG ETFs

Assessing the Impact of Socially Conscious Fund Picks

How do we know if our investments truly make a difference? We look at the impact. Socially conscious fund picks mean choosing investments that do good for the world and also aim for strong returns. By picking these funds, we can help shape a better future. We call this socially responsible investing.

In 2024, top-rated ESG investment funds make this easier. They let you invest in companies that care about the environment, treat people well, and are run in fair and honest ways. Such companies work on clean energy, help communities, and much more. When we choose these funds, our money supports the good they do.

The performance of these funds can be just as strong as regular ones. Sometimes, they may even do better. It’s because these ESG funds often invest in companies that plan for the long term. They make smart choices to avoid risks related to climate change and social issues.

Leading ESG ETFs Set to Make Waves

Have you heard about ESG ETFs? They are funds that track indexes of companies chosen for their environmental, social, and governance quality. Top ESG ETFs in 2024 will be making big waves. That means they’re set to grow and offer good returns. These funds are easy to trade like stocks, and they help spread your investments across many areas.

Many of these ETFs focus on companies that use less energy or make renewable energy. This is part of green mutual funds. They also invest in tech that cuts waste or helps nature. With ESG index funds to watch, we can find ones that match our values and investment goals.

When we choose ESG funds, we’re not just thinking about money. We’re also thinking about the world we live in and building a future we can all enjoy. ESG investing trends are changing the way we think about money and values.

By putting our money into top ESG ETFs, green mutual funds, and other eco-friendly investment portfolios, we become part of a bigger move for change. It’s a power we all hold. And in 2024, it’s clearer than ever how much good our investments can do.

Kids, communities, and the whole planet can benefit when we invest in ESG funds. So let’s make our next investment one that helps build a future we all want to see. Responsible, happy, and healthy. Here’s to making big waves with our money in 2024 and beyond!

Strategic Climate-Aware Investing: Integrating ESG in Portfolio Management

ESG Fund Performance Metrics and Their Role in Investment Strategies

Let’s talk shop about ESG funds. You know, the funds that care about the planet, people, and how companies run. So, why should we even bother with ESG fund performance metrics? It’s like a health check for your investments. You get to see if your money’s doing good while doing well.

First up, we look at returns. Makes sense, right? We want our eco investments to make money. But we also peek at how they do ESG-wise. It’s not all about cash. It’s about our future, too. We dig into the nitty-gritty, comparing funds to see which do best. Think of it as a race where both speed and driving clean matter.

Next, we match our cash with our values. ESG stands for environmental, social, and governance. It guides us to put money in places that care for these things. These metrics tell us who’s really walking the talk. A high score here means more than just good vibes; it tells us a fund is serious about making a difference.

And guess what? These metrics can actually lead to more money in our pockets. Weird but true! Funds that score high on ESG tend to avoid big mess-ups. They’re more about long-term wins than quick cash. They keep an eye out so their companies don’t harm the planet or get bad press. That means less drama and more stable gains. Who doesn’t like that?

Now, when I whisper to you the magic words – “top-rated ESG investment funds 2024” – I’m sharing gold. This isn’t hype; it’s the lowdown on who’s boss in the ESG world this year. Want funds that soar while keeping it clean? This list is where it’s at.

What you need to remember is that ESG fund managers are the captains of this ship. They steer it right. And fund ratings are like a GPS, guiding you to the best picks. You’re the boss, though. Your choices, your future, your green.

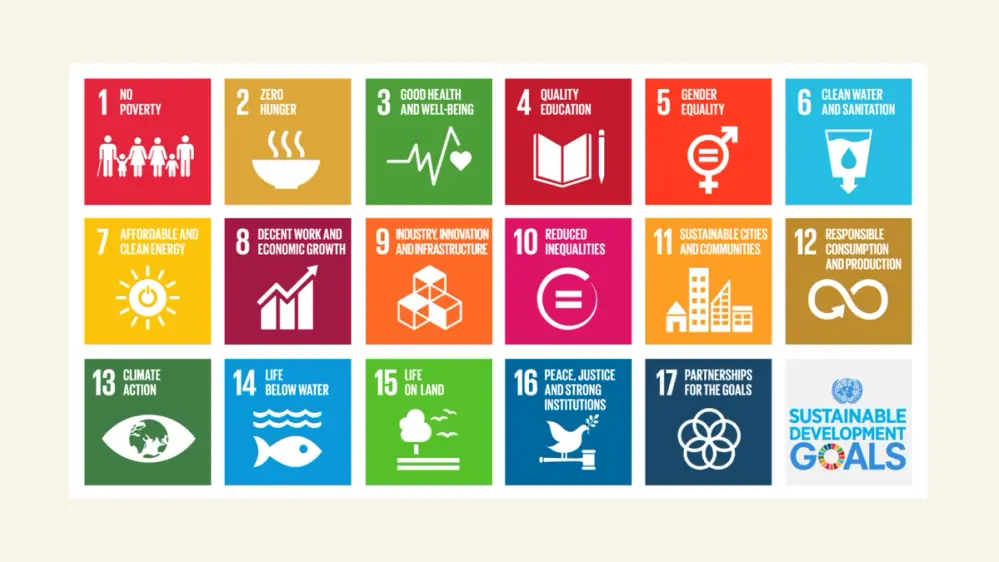

Aligning Investments with the Sustainable Development Goals

Alright, let’s chat about aligning your stash with the big goals. Yep, I’m talking about the Sustainable Development Goals or SDGs. These are huge, world-changing aims. Guess what? Your investment choices can help hit these goals. Boom!

When we pick sustainable development goal funds, we do more than make money. We change the game. We help things like health, education, and cleaner energy. Want a world without hunger or poverty? Your money can help build that.

Here’s the deal. Each fund looks at different goals. Some might focus on water, others on clean power. It’s a buffet of good choices. You pick what matters to you. Then, money goes to companies and projects fighting for that cause.

By choosing these funds, you join a team that dreams big. Together, we aim for a better world. You might think, “Can my money really make a difference?” Yes, it sure can. When you add it up, all our cash can push huge changes. That’s pretty awesome.

Remember, green mutual funds in 2024 or any year are not just a trend. They’re part of building something that lasts. They’re a promise for a greener, fairer world. Partnering your portfolio with the SDGs? That’s power. That’s investing with heart and smarts. And that’s how we win the future.

In this post, we’ve dived deep into the best ESG funds of 2024, showing how they’re changing the game. We looked at how equity and fixed income ESG funds are doing well. We saw green mutual funds and renewable energy funds are growing fast, ripe for smart investing. We then put a spotlight on socially responsible picks, noting top ESG ETFs shaking things up.

Finally, we talked strategy. We explained how to mix ESG into your investments and align them with big goals for our world. All these options are not just good for the planet; they’re smart for your wallet too. Remember, investing with an eye on ESG is more than money—it’s about our future. Choose well, and let’s build that brighter tomorrow.

Q&A :

What are the top-rated ESG funds to watch in 2024?

Investors looking to participate in sustainable and responsible investing may want to keep an eye on the performance and ratings of ESG funds. These ratings are often based on various criteria, such as environmental impact, social responsibility, and corporate governance practices.

How do you choose the best ESG fund for your portfolio in 2024?

Selecting the best ESG fund for your investment portfolio involves researching fund performance, management, fees, and alignment with your values and investment goals. It’s important to consider the fund’s approach to ESG criteria and how it integrates ESG considerations into its investment process.

What are the expected returns for top ESG funds in 2024?

While specific returns on investment cannot be guaranteed, ESG funds that skillfully manage to align strong sustainability practices with solid financial performance may offer competitive returns. Investors should review historical fund performance, although past results are not indicative of future success.

Can you invest in ESG funds through a retirement account in 2024?

Yes, many retirement accounts, including IRAs and 401(k)s, offer options to invest in ESG funds. Participants interested in incorporating sustainable investing into their retirement planning should consult with their plan’s administrator or a financial advisor to explore available ESG fund options.

How has the performance of ESG funds compared to traditional funds as of 2024?

ESG funds have been gaining popularity due to their potential to offer comparable or even superior performance to traditional funds, alongside the benefit of supporting sustainable practices. Comparing their performance requires looking at long-term trends, risk management strategies, and how they fare during different market conditions.