Monetary Policy Mastery: Fueling Unstoppable Economic Growth

Ever wonder how money moves make or break an economy? I dive deep to decode how monetary policy and economic growth intertwine. It’s more than just bankers in a room deciding your credit card rate. It’s about the tough calls that impact jobs, your savings, and whether your favorite shop stays open. I’ll break it down: from how central banks steer the ship with interest rates, to the delicate dance of controlling inflation without tipping us into a slowdown. Get ready to see the wizardry behind those economic headlines and grasp how the gears of monetary policy empower a nation’s growth. Buckle up; we’re about to take a ride through the financial mechanisms that fuel our daily lives.

Understanding Central Bank Operations and Their Economic Impacts

The Mechanisms of Interest Rate Decisions

Central banks hold the keys to the economy’s heart. Their big move? Changing interest rates. When they change rates, they decide how much it costs to borrow money. This can make people spend more or save more. What happens when rates go down? Folks find it cheaper to get loans. They buy more houses and cars. Businesses borrow more, too. They start new projects and hire more people. This helps the economy grow. But if money is too easy to borrow, prices can go up too fast. That’s called inflation, and it can be a problem.

When central banks see prices climbing too quick, they push rates up. This makes borrowing cost more. Now, spending slows. It’s like taking a little air out of a balloon that’s too full. It helps keep the economy from getting into trouble with too much inflation.

Now, it’s not just about moving rates up or down. It’s about timing and being smart. Central banks look at all sorts of things. They look at how fast prices are rising, if people have jobs, and overall, if the economy is strong. They use all this info to decide on interest rates.

Examining the Effects of Quantitative Easing Measures

Sometimes, cutting interest rates to nearly zero isn’t enough to boost the economy. When times are really tough, central banks use a special tool named quantitative easing, or QE for short. Here’s how it works. The central bank makes more money, then buys stuff like government bonds. This pumps money into banks and financial markets. Why is this good? It makes it easier for banks to lend money to people and businesses.

QE is like a big, juicy burger for the economy when it’s super hungry. It gives a big energy boost. But just like too many burgers can be bad for your health, too much QE can cause trouble, too. If there’s too much money in the economy, prices can start to soar. Then we’re back to dealing with too much inflation.

Central banks need to do a balancing act. They need to make sure there’s enough money flowing when times are bad. But they also need to pull back when the economy starts to heat up. By doing so, they keep the economy growing steady, without going too fast or too slow.

So, what have we learned? Interest rates and QE are tools central banks use to guide the economy. They need to be super careful with these tools to keep the economy on a smooth ride. A big part of their job is to keep a sharp eye on everything that’s happening. By doing this right, they help all of us. They help businesses grow, people find jobs, and make sure we have a strong, healthy economy.

Inflation Targeting and Fiscal Policy: The Balancing Act

Strategies for Effective Inflation Control Mechanisms

Central banks hold a big job: they keep prices stable. They want to stop inflation from getting too high. When prices rise too much, your money buys less. That’s bad news for families buying food or things they need. Central banks set a goal for inflation. This goal is like a speed limit for price rises. How do they do it? They change interest rates.

When a bank raises interest rates, it costs more to borrow money. People and businesses then spend less. This slows inflation down. Okay, but what if the bank cuts rates? It gets cheaper to borrow money. This can spur spending and fuel the economy.

A tool central banks use is called open market operations. In simple terms, it’s buying or selling government securities. This affects how much money is out there. More money chasing the same amount of goods can push prices up, right? So, the central bank uses this tool to keep money in balance.

We also have something called reserve requirements. Banks must keep a part of deposits safe and not lend it out. When this requirement is high, there’s less money to lend. When it’s low, more money can flow into the economy. It’s a careful dance to keep it all in check.

Analyzing Fiscal Policy Interaction with Monetary Tools

Now let’s talk about fiscal policy. The government controls this. It’s about taxes and spending. It’s another way to affect the economy. When a government spends more, this can grow the economy. It’s like adding fuel to a fire. But if it raises taxes, the fire gets smaller. There’s less money for people to spend.

How do central bank actions and government policies work together? Well, they should dance in step. If the central bank works to cool down the economy, the government shouldn’t heat it up too much with big spending. They have to agree on the tempo to keep the economy humming along just right.

But wait, there’s a twist. When a government spends a lot more than it earns, that’s a fiscal deficit. Too much of this, and the country could have a big debt problem. If the debt keeps growing, people might start to worry about getting paid back. It could scare investors away. That’s where central bank independence is key. It should make decisions without any political pressure to keep the economy sound.

Get it? Central banks and governments need to work together, like a team. They aim to grow the economy, keep prices in check, and make sure there’s enough work for everyone. It’s a tough balancing act, but when done right, it keeps the economy moving forward without tripping over inflation or stalling out.

Banking Stability and the Path to Economic Growth

Reserve Requirements and Their Role in Financial Liquidity

Banks play a key part in our economy. They help people save and borrow money. Central bank operations make sure banks are safe. They decide rules called reserve requirements. Think of it like this: Banks must keep a part of the money they get. Not too small, not too big. Just right to stay safe and lend to others.

What happens when banks keep more money? They can handle more surprises. But, they can’t lend as much. When they keep less money, they lend more. But if too many people want their money back at once, the bank could be in trouble. It’s a tricky balance. Reserve requirements need to be just right to keep money flowing and banks running smooth.

Assessing Open Market Operations and Currency Stability

Now, let’s talk about open market operations. This is a tool central banks use a lot. They buy or sell stuff, like government bonds, to control the money out there. When they buy, they push money into the economy, helping it grow. When they sell, they take money out. This slows things down. These moves affect interest rate decisions too.

Why do we care about this? Well, stable prices mean a stable life for all of us. When prices jump up and down, things can get tough. Buying a car or house? Tough. Saving for the future? Tough. That’s where inflation targeting strategy comes in. Central banks aim for prices to go up just a little each year. This way, folks can plan and feel sure about tomorrow.

And then we have the big one: currency stability. Think of it like a game of catch. If the ball – our money – is easy to toss and catch, people are happy to play. But if it bounces all crazy, no one wants to play. Money is like that. If it keeps its value, people trust it more. They’ll spend and invest. That’s what we want for a healthy economy.

In all, central banks use these tools to steer us to calm waters. They watch over our money, plan for growth, and keep jobs coming. It’s a huge job. But done right, it means good times for most folks. It’s tough, sure. But every piece matters: reserve requirements, open market operations, watching prices. It’s like a big puzzle. And when the pieces fit, we all win.

Steering Economic Growth: Monetary Policy at the Helm

Recession Prevention and Stimulus Strategies

Central banks have big jobs. They keep the economy stable. They act like our economy’s pilots, steering us through stormy skies. Let’s unpack how they prevent recessions and boost growth. It’s about dodging economic dips and fueling the money flow.

Interest rate decisions are the central banks’ main tool. A cut in rates can spark spending and growth. It makes loans cheaper. People and businesses borrow more. They buy things and hire folks. This action heats up the economy.

Next, think about the discount rate. That’s what banks pay to borrow money from our central bank. A lower discount rate can pump more cash into banks. Then banks can lend more to all of us. More money moving means more growth.

Open market operations are another trick. Central banks buy or sell government bonds. This adjusts how much money is in the system. Buying bonds pours cash into the market. This can urge investors and businesses to spend rather than save.

Sometimes, though, things are tough. In a big scare, like a global crisis, normal tricks might not work. That’s where quantitative easing steps in. It’s like a money flood. The central bank buys lots of bonds. It creates new cash to pay for these. This extra cash lowers interest rates. It makes borrowing super cheap. This helps the economy bounce back.

Growth Forecasting and the Interrelationship with Employment Levels

Growth forecasting isn’t guessing. It’s science. Economists watch lots of things like jobs, prices, and spending. These tell us how fast our economy could grow. It’s all about planning. Knowing what might come helps the central bank steer the economy.

Jobs are key to growth. More jobs usually mean a stronger economy. When folks have work, they have money. They spend, and this helps businesses grow. When businesses grow, they can hire even more people. It’s a cycle that keeps our economy fit.

We also keep an eye on GDP growth and the consumer price index. GDP growth shows if our economy is getting bigger or shrinking. The consumer price index tracks how much stuff costs. Central banks aim to keep prices just right. If prices climb too fast, your money buys less. That’s not good. But if prices don’t go up at all, folks might wait to spend. This can slow down growth too.

So, central banks use all these tools like a pro. They aim to keep growth steady and jobs plentiful. That way, we can all plan for a sunny economic future, not worry about the storm clouds. This strategy keeps us moving forward, slowly but surely. And that’s how we steer towards unstoppable economic growth.

We’ve looked at how central banks work and how their choices touch our economy. They change interest rates and use tools like quantitative easing to guide us. These moves can pump or calm the economy. We’ve also seen the tricky job of fighting inflation without hurting growth. Fiscal policies must team up with monetary ones for this balance.

Stable banks mean a stable economy. With smart rules, banks keep enough cash on hand and governments buy or sell assets to keep our money worth the same.

Finally, we talked about how central banks aim to keep us away from recession and push for more jobs and better living for all of us.

This stuff matters because it affects our wallets, jobs, and how our country grows. Understand it, and you get why those news headlines about central bank decisions are so key. I hope you now see the big picture of how careful planning keeps our economy moving right.

Q&A :

How does monetary policy influence economic growth?

Monetary policy plays a crucial role in affecting economic growth by controlling the supply of money and interest rates. When a country’s central bank, such as the Federal Reserve in the United States, adjusts monetary policy, it influences the amount of money circulating in the economy, which can encourage investment and spending or help reduce inflation. For example, lower interest rates can make borrowing cheaper, prompting businesses to invest in growth and consumers to spend more, while higher rates can have the opposite effect, slowing down economic activity.

What are the tools of monetary policy used to stimulate economic growth?

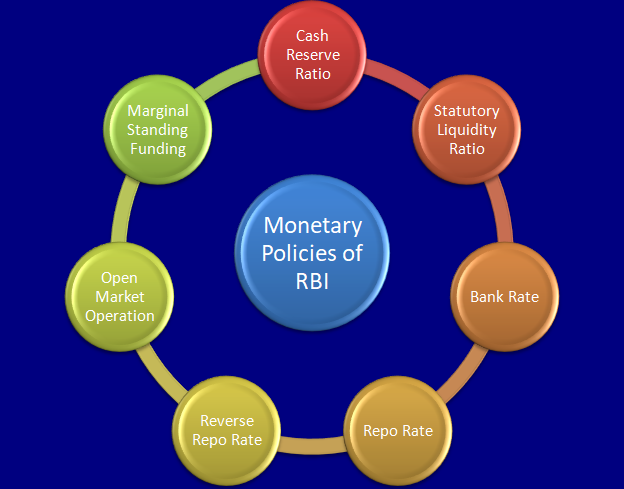

The central bank employs several tools to manage economic growth through monetary policy. These include:

- Open Market Operations (OMO): Buying and selling government securities to adjust the money supply.

- Discount Rate: Setting the interest rate at which commercial banks can borrow from the central bank.

- Reserve Requirements: Dictating the amount of funds that banks must hold in reserve rather than lend out.

These tools influence the amount of credit available in the economy and the interest rates charged on loans, which in turn affect consumption, investment, and overall economic growth.

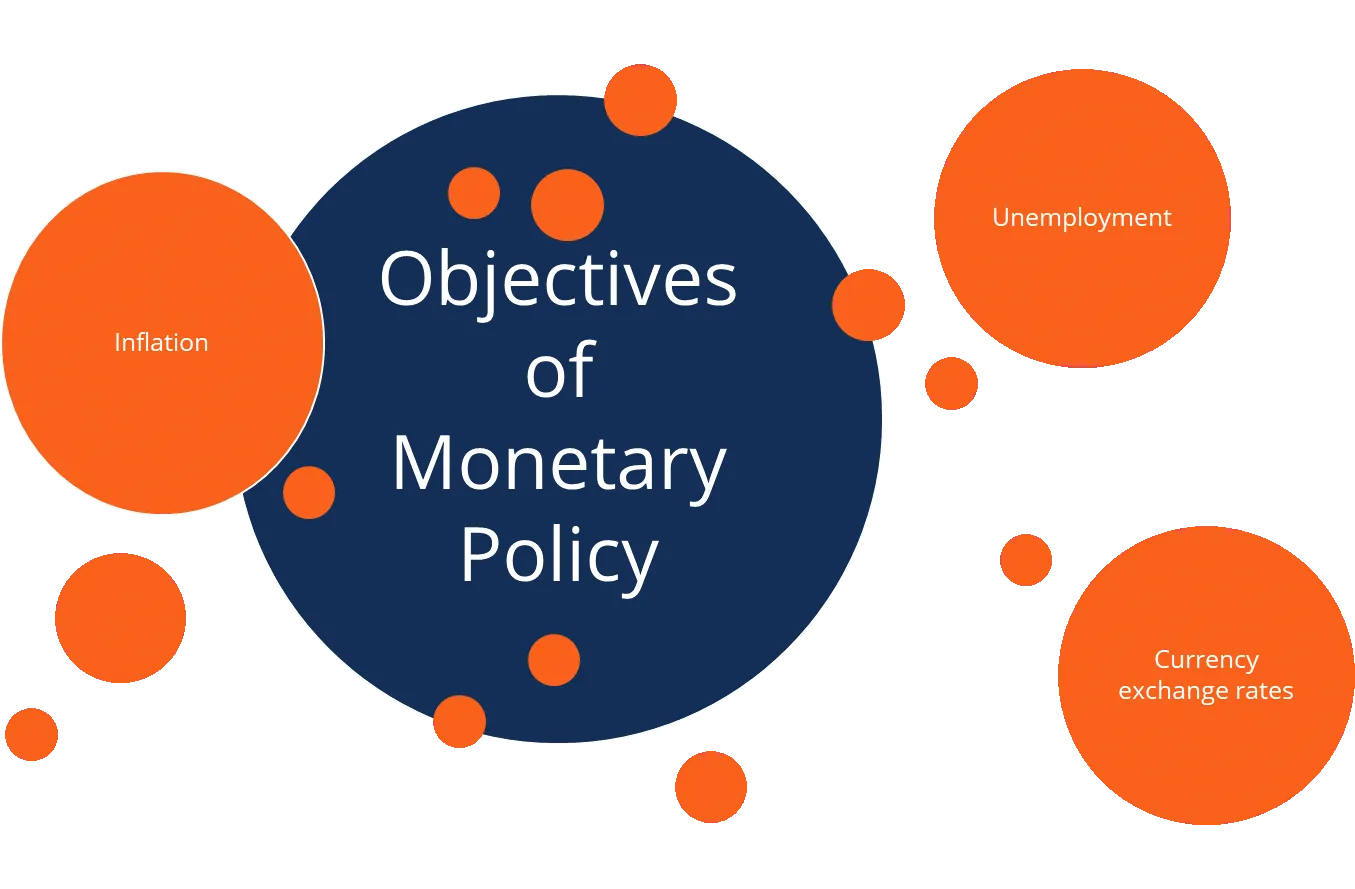

Can monetary policy target both inflation and economic growth simultaneously?

While monetary policy can be used to target both inflation and economic growth, it’s often challenging to manage these goals simultaneously because they can require opposite measures. Lowering interest rates can spur economic growth but might also lead to higher inflation. Conversely, raising rates can help control inflation but may slow down economic growth. Central banks have to strike a balance between these objectives and adjust their monetary policy based on current economic conditions and future projections.

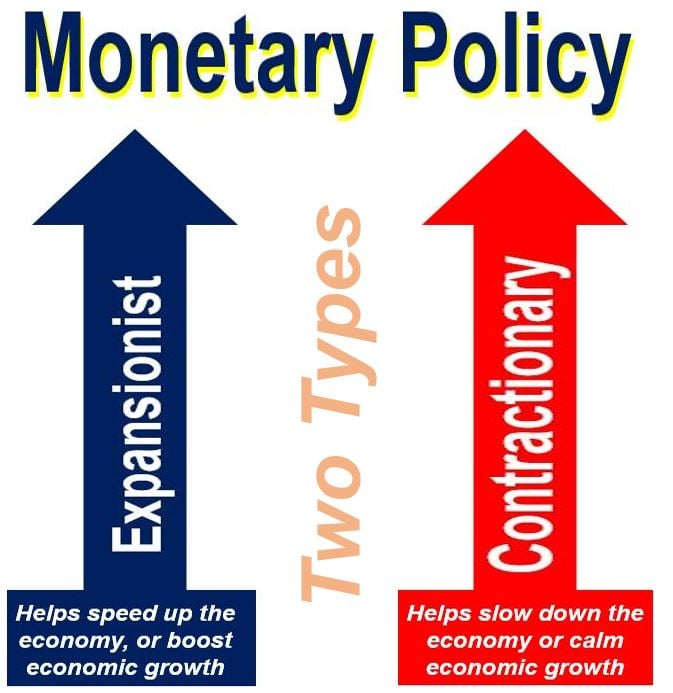

How do changes in monetary policy affect the unemployment rate?

Changes in monetary policy can impact the unemployment rate over time. Expansionary monetary policy, which involves reducing interest rates and increasing the money supply, generally aims to boost economic activity, which can lead to more job creation and a lower unemployment rate. On the other hand, contractionary monetary policy, intended to curb inflation by hiking interest rates and reducing the money supply, can dampen economic growth and potentially increase the unemployment rate if businesses reduce investments and consumers cut back on spending.

What is the impact of monetary policy on stock market performance?

Monetary policy can have a significant impact on stock market performance. When monetary policy is expansionary, with low-interest rates and increased money supply, it can create a favorable environment for stock market growth. Low borrowing costs can lead to higher corporate profits and increased investment, which often drive stock prices up. Conversely, contractionary monetary policy, which includes higher interest rates and a decreased money supply, can lead to reduced consumer spending and investment, potentially causing a slowdown in stock market growth as corporate earnings and investor sentiment may be negatively affected.