Gone are the days when big banks ruled it all. The benefits of financial disintermediation for consumers are reshaping the way we think about our money. Imagine keeping more cash in your pocket and calling the shots with your investments. It’s not a dream—it’s the real deal. You’re about to dive into a world where increased savings and direct investing put you in the driver’s seat. Let’s explore how cutting out the middleman can beef up your bank account and boost your control over your financial future. Trust me, you’ll want to hear this. Buckle up, because we’re about to get real about money.

Exploring the Rise of Financial Disintermediation

Understanding Financial Disintermediation Explained

Financial disintermediation means we cut the middleman out of our money affairs. It’s where you and I step past banks to handle our own financial needs. Imagine lending and borrowing money without any bank saying how it’s done. This is now real for many thanks to tech. When we talk ‘disintermediation’, we’re really talking freedom and savings.

Using websites for peer-to-peer loans or crowdfunding, we get to invest or borrow directly. Direct investing lets you put money into stocks or bonds by yourself. You pick, you control, you earn the rewards. It’s a power shift back to you, with no hidden fees eating your money.

How Direct Investing Benefits Consumers

Putting money into what we choose, like stocks or real estate, often earns us more. With direct investing, consumer savings increase because fewer fees are taken out. We find we can earn higher interest returns than banks usually offer us.

When we use online platforms, we bypass traditional banks. This makes things cheaper, faster, and often, a bit easier. With direct loans savings, we’re talking about more money in our pockets. And we’ve got to like that.

Lower transaction fees? Yes, please! Thanks to companies cutting out financial intermediaries, we’re keeping more of our cash. Also, decentralized finance is changing the game by using blockchain. It means our money works for us, without banks slowing things down.

People are eager to find the next big thing. They’re turning to fintech for answers. It’s all about efficient, cheaper services that make our dollars stretch further. Fintech and consumer empowerment grow together. It’s like finding a key to a cash-saving kingdom.

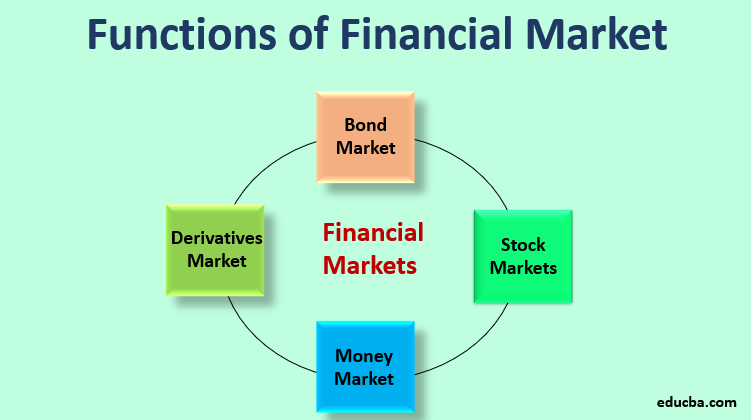

Investment apps let us play the financial markets without needing a degree in finance. They open up the world of investing to pretty much everyone. Imagine accessing the bond market from your phone. It’s real, and it’s here!

Giving power back to folks who have never had it before is huge. Especially for unbanked consumers benefits are massive. No bank account? No problem. With digital wallets, they’re saving money and joining in the wealth-building fun.

Taking away costly bank fees and removing financial gatekeepers is our ‘now’. We’re at the start of something big. Join me as we figure out this new world where our money is finally in our hands – where it’s always belonged.

Remember, the best part is not just the saving but the control. It’s about making choices that fit our life and pocket. It’s not just a trend. It truly is a smarter way to manage our personal finance. Welcome to a brighter financial future – where we’re in charge!

Increased Savings and Investment Returns for Consumers

Leveraging Peer-to-Peer Lending Advantages

Imagine scoring a sweet deal on something you want. Feels good, right? Now, peer-to-peer lending lets you get that same buzz but with loans. Cutting out banks means you often pay less in fees. So, more money stays in your pocket. Plus, you get to chat directly with the person who lends you cash.

The Appeal of Higher Interest Returns through Direct Loans

Ever wished your savings grew faster? By skipping banks and going for direct loans, you can earn more. You’re the boss of your money, picking where it goes and growing it better. It’s like planting a garden and watching it bloom, but with cash.

With less cash spent on fees, more lands in your hands. It’s like a game where cutting corners boosts your score. Peer-to-peer spots often charge you less than banks. They work online, which keeps their costs down. This is great because less cost for them means fewer fees for you. It’s smart money moves for smarter savings.

Loan seekers dig this too. They get money without hefty bank charges. It’s a win-win. They nab the funds for their needs, and you snag a better return. Peer-to-peer lending is a team sport where everyone can score big.

Direct loans work out better for your piggy bank. They offer higher interest returns than what you’d usually get. It’s like trading a small apple for a bigger one each day. Over time, you end up with a whole bunch of apples. And who doesn’t want that? Direct loans can turn your money into more money. And that’s a sweet deal in anyone’s book.

Picture this: you get to drive your cash where you want it to go. No backseat drivers like banks telling you what to do. It feels pretty awesome to call the shots. It’s like playing a video game with the best gear. You’re in control, ready to take on any challenge. And best of all, you’re set to win more coins (or in this case, dollars) as you play.

In the world of finance, cutting out middlemen is called financial disintermediation. It’s a fancy way of saying you bypass traditional banks. Now, with online platforms, you’ve got the power right at your fingertips. From your couch, you can lend or invest your money. It’s like having a bank in your pocket, but you’re the boss.

Think of peer-to-peer lending as a team game. You team up with others looking to lend or borrow. No need for players wearing suits (bankers, we’re looking at you). You play the game with less stress and confusion. It’s the financial game where the rules are clear, the fees are low, and the rewards can be high.

These days, fintech is a game changer. It’s turning the finance world into a playground where everyone gets a turn. Gone are the days when only the big shots play the game. Now, it’s your turn. With these tools, like peer-to-peer lending and direct loans, you save more, earn more, and keep control. What’s not to love?

Remember, your money should work for you, not the other way around. Lending and investing directly hand you the reins. So take them, drive your financial future forward, and enjoy the ride (and the returns!).

Enhanced Consumer Empowerment and Control

Autonomy in Personal Finance with Fintech Solutions

Fintech has changed how we handle money for good. Now, we can take charge of our own finances without having to deal with banks. Apps and online tools let us save, invest, and lend all on our own. It’s like having a bank in our pocket!

For starters, think about direct investing. This is where we can grow our money without a middleman taking a chunk. We can buy stocks or lend cash directly to others. This way, we save on fees and might even get better returns for our hard-earned cash.

Navigating the Benefits and Risks of Bypassing Traditional Banks

Cutting out banks sounds great, doesn’t it? More money in our pockets, more control in our hands. Yet, we must stay sharp. Not all that glitters is gold.

Peer-to-peer lending is a prime example. We can loan money to someone right across the screen. No banks to say ‘yes’ or ‘no’. Just us calling the shots. But we need to watch who we lend to. Some might not pay back. That’s a risk we take for the chance of higher returns.

Each step we take away from banks leads to savings on fees and more control. But we’ve got to understand the ropes. That’s how we make the most out of this new finance world. It isn’t just about chasing higher interest. It’s about smart choices that protect and grow our money.

By fully understanding the impact of financial technology, we give power to ourselves. We are in command of our financial futures. Each app and online platform offers a chance to do more with our money. It’s all about how we use these new tools to our advantage.

Online investment platforms have made the stock and bond markets easy to join. Ever dreamed of being part investor in a startup? Crowdfunding makes it possible. With a few clicks, we can help launch the next big thing and maybe, just maybe, share in their success.

Fintech isn’t just for the big spenders. Those without bank accounts, the ‘unbanked’, find doors opening too. They can now save money, pay bills, and even invest with digital wallets. No bank account needed. That’s what I call financial freedom!

As we cut out the cost of bank buildings and staff, we also slice our own costs. We’re not paying for their lights to stay on. Instead, we keep more of our money. However, we always have to balance the thrill of these benefits with staying safe.

So, as we march forward, let’s embrace the savings and control that fintech brings. Let’s use online tools, apps, and platforms to take the reins of our finances. By keeping an eye on the risks and the rewards, we can confidently bypass traditional banks and make financial services our own.

Technology has given us a path to more savings, greater returns, and, most importantly, the power to make our own financial decisions. With every new innovation, we’re not just following the tide. We’re setting sail for uncharted waters, where our choices and savvy lead to brighter financial shores.

The Transformative Impact of Tech on Consumer Finance

How Blockchain and Decentralized Finance are Reshaping Access

Wonder how tech changes the money game for you? Let’s talk blockchain and decentralized finance, or DeFi for short. They’re making waves, big ones. DeFi lets folks tap into financial services without a middleman. No banks. Imagine you, planting money into ventures or loans, straight from your smartphone.

Sounds like a dream? That’s the power of blockchain. It’s a trusty ledger that can’t be fooled, keeping your deals safe and sound. You get access that before, only big players had. With DeFi, you join a huge market for trades, loans, and more.

The Role of Digital Wallets and Investment Apps in Democratizing Finance

Investment apps and digital wallets, ever heard of them? They’re the new keys to the kingdom of finance. Before, you needed a bulky wallet and an appointment at the bank. Now your phone’s the wallet, and the bank too!

You download an app, and boom, you’re in the driver’s seat. Investing your cash in stocks? Easy. Holding onto crypto coins? No sweat. These apps give you the tools to grow your savings like a pro, and without the costly fees.

Now, everyone gets a shot at making their money work harder. That’s what we mean by ‘democratizing finance.’ We’re talking fairness, opportunities, and control back in your hands. With these tools, folks from all walks of life can soar in the financial sky.

We dove deep into financial disintermediation, seeing how it shakes up traditional banking. This trend is changing how we save, invest, and manage money. It’s clear that cutting out the middleman can pay off, with more control and possibly higher returns. Tools like peer-to-peer lending and digital wallets help us do just that, blowing the doors wide open to personal freedom in finance.

But it’s not all sunny skies. With great control comes responsibility. Assessing risks is key, especially when traditional banks are out of the picture. Still, the power of tech like blockchain is huge, giving everyone a fair chance to grow their cash.

In all, this money shift puts you in the driver’s seat. Smart moves can lead to big wins. It’s thrilling, a bit risky, but truly a game-changer for your wallet. Stay sharp and informed – that’s the way to thrive in this bold new financial world.

Q&A :

What is financial disintermediation and how does it benefit consumers?

Financial disintermediation refers to the process where consumers bypass traditional financial intermediaries like banks and directly access financial services or products. This often leads to several benefits for consumers, including lowered transaction costs, improved interest rates on savings and loans, and increased access to a variety of investment products. By cutting out the middleman, consumers can also enjoy a greater degree of control over their financial decisions.

How does disintermediation affect consumer access to financial services?

Disintermediation typically enhances consumer access to financial services by simplifying the process and providing more direct routes to financial markets. With the advancements in technology, such as online platforms and peer-to-peer lending, consumers have more options available that are often more convenient and less time-consuming than dealing with traditional financial institutions.

Can disintermediation lead to better interest rates for consumers?

Yes, disintermediation can frequently result in better interest rates for consumers. By eliminating intermediaries, the savings from reduced overhead costs can often be passed down to consumers in the form of higher savings rates and lower borrowing costs. This is especially true for online savings accounts and peer-to-peer lending services, where the lack of physical infrastructure allows for more competitive rates.

What kind of financial products are available through disintermediation?

A wide range of financial products can become accessible through disintermediation. This includes peer-to-peer loans, crowdfunded investments, direct stocks and bonds purchasing platforms, and cryptocurrencies. These products can offer consumers diverse ways to manage and invest their money outside of traditional banking systems.

Are there any risks to consumers associated with financial disintermediation?

While there are many benefits, there are also risks associated with financial disintermediation. Because traditional financial institutions are highly regulated, consumers may be more exposed to fraud and credit risk when dealing with less regulated entities. Additionally, they might lack the financial advice and consumer protection typically provided by conventional banks. It is crucial for consumers to perform due diligence before engaging in financial activities with non-traditional firms.