Monetary policy impact is not just a buzzword; it shapes your day-to-day life and your long-term financial stability. Imagine a puppeteer—the central bank—and their strings are the interest rates that make the economy’s limbs dance. With each move, they pull rates up or down, and like magic, your savings and loans follow suit. It’s a power that reaches into your wallet and savings, guiding how much you earn on deposits and pay on debts. Dive into the nitty-gritty with me as we explore how these high-level decisions trickle down, influencing everything from stock prices to the cash in your pocket. Get ready; understanding this force is your first step toward mastering your financial future.

Understanding the Monetary Policy Landscape

The Relationship between Economic Growth and Interest Rates

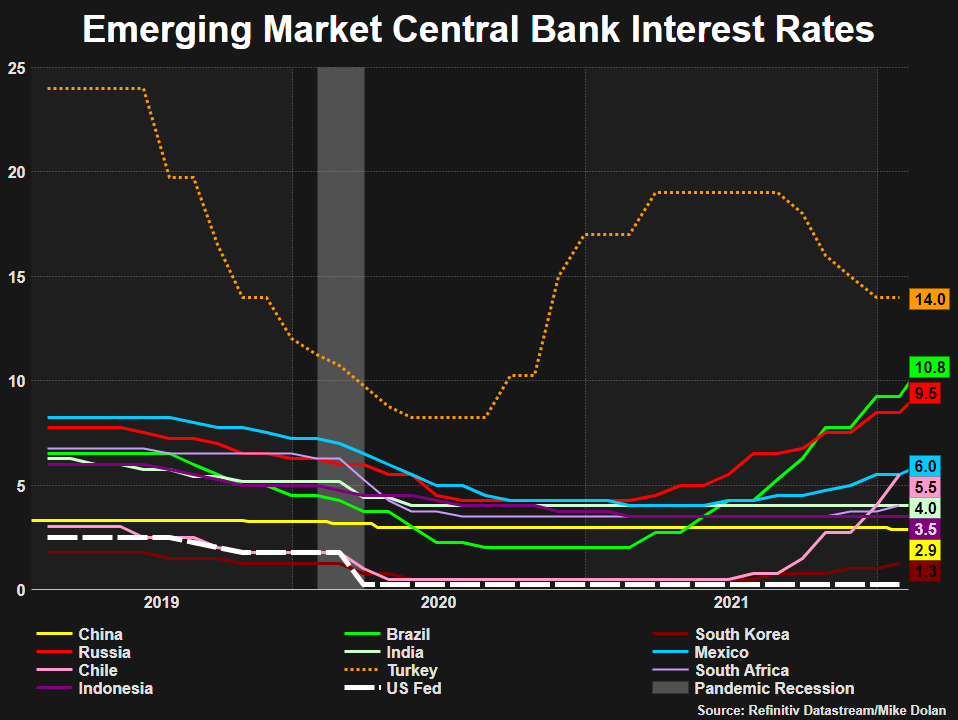

Interest rates and economic growth are tied closely. When a central bank changes the interest rate, it aims to manage growth. Higher rates can slow growth. This happens because loans become more costly. People and businesses then borrow less and spend less.

Central Bank Decisions and Their Immediate Effects

Central bank decisions shape our daily lives quickly. They control how much it costs to borrow money. With a hike in rates, your car loan might cost more. Or your mortgage payment could climb. These decisions also affect how much we earn on savings. If rates go up, you might see more money on your deposited cash. It’s a balancing act for the banks.

Each choice they make affects many things. It changes stock prices, the worth of our money, and more. When central banks act, they weigh the good and bad outcomes for us all. They check on prices, how much we buy and sell, and jobs. Then, they pick the best path to help everyone. They use tools like setting the rate banks lend to each other at. Or they buy assets from banks to add more money into the system.

Deciding the best move takes skill and knowledge. Central banks aim to keep the economy stable. They want us to have jobs and to contain prices. But their actions might take time to work through the economy. This is what we call the monetary transmission mechanism. It means the steps from bank actions to changes in the real world. Changes don’t happen at once. It might take months for us to feel the full effects.

Central banks also work to bolster trust in our money. They make it so we don’t worry about prices jumping too high or falling too low. With steady prices, we can plan things like trips or buying a home. As they make these choices, banks look far ahead. They try to figure out how their moves will shape our future.

In short, central bank decisions touch our wallets and dreams. They keep the economy on track. They use interest rates to guide wealth and growth. Their choices foster jobs, shape prices, and more. It’s all to build a stable place for us to live and work.

Deciphering Central Bank Policy Moves

The Mechanics of Interest Rate Changes and the Economy

When you hear that the central bank changes interest rates, it means a lot for your wallet. Interest rate changes affect loans, savings, and how much things cost. Let’s look at how this works.

When rates go up, borrowing money gets costly. Less borrowing can slow down spending and cool off a hot economy. This can be good to fight high prices but tough if you want a loan. High rates also mean you earn more on savings, which is great for savers.

If rates go down, it gets cheaper to borrow money. People and businesses can spend and invest more. This can help when the economy is slow. But, if rates are too low for too long, prices for everything can climb too high, which is not so good for your pocket.

Central banks use this power to keep a balance in the economy. They aim for steady growth, where prices are not too high or low. This helps make sure we have jobs and money doesn’t lose its value.

Quantitative Easing and Inflation Targeting: Balancing Act of Central Banks

Now, let’s throw in two big terms: quantitative easing and inflation targeting. These are tools used by central banks, like the Federal Reserve, to manage the economy.

Quantitative easing is when a central bank buys stuff like government bonds to pump money into the banking system. This makes borrowing easier and can help when the economy is stuck. More money can lead to more spending and jobs, but too much can make prices jump.

Inflation targeting is when central banks aim to keep price rises at just the right level, not too high or low. Sticking to a set inflation rate, say 2%, helps keep things stable. It makes sure money keeps its buying power over time.

These tools give central banks ways to tackle tough times. When they buy assets or set clear targets for prices, they try to keep the economy smooth. This helps your money keep its value and supports jobs and growth.

Understanding these moves is key to get how the economy might shape your future. When central banks shift gears, it can signal changes in the cost of living, jobs, and how much your money will be worth.engkap the financial news often seems like a puzzle. Central banks change rates and the economy dances along. But why do they do it? And how does it all work?

Let’s crack it to its core. Think of central banks as the DJs of the economy. They control the beat with something called the policy rate. Picture the rate like music volume – it can make the party slow down or heat up. When the volume is high, the beat slows down and so does spending and borrowing. When it’s low, the pace picks up and so does the money flow.

Central banks, like the Federal Reserve, have big goals. They want prices steady, so when we shop, costs aren’t bouncing up and down. Stable prices mean we know what to expect, and that’s good for planning life. They also want lots of people working, so they nudge rates to help that happen.

Now, these central bank moves shape what happens to your cash. High rates might mean your savings grow faster but also that loans cost more. Low rates are great for getting a cheap mortgage but could hurt your savings growth.

And that’s just the start. Central banks can get fancy, with things like buying bonds (think of it as a mega-money move). This boosts spending and can help when things look gloomy. They also set inflation targets, aiming for just the right amount of price rise.

Why should you care? Because what central banks do touches everything – from your daily coffee to your dream home. Smart moves can mean a roaring economy and jobs for all. Mistakes, though, can mean trouble. And in this big economic party, we all have a stake.

The Ripple Effects of Monetary Policy on Markets and Individuals

How Expansionary and Contractionary Policies Alter Investment Decisions

Imagine a giant seesaw. On one side, there’s expansionary monetary policy. Think of this like a money flood. It’s when central banks cut rates, make it cheap to borrow, and maybe buy assets to pump cash into the banking system. Why do they do this? To kick-start the economy, like pressing the gas in a slow car.

When this happens, you might think about stocks or property. Why? Cheap loans mean more spending by folks and businesses. This often pushes up prices for things like houses and shares. The key is the boost in cash from central banks makes it tempting to invest. Smart money chases higher returns.

Now, flip the seesaw. Enter contractionary policy. This is like pulling the plug on the money bath. Central banks hike up interest rates and it costs more to borrow. Sometimes, they sell off assets. It’s like a brake on the economy to keep it from getting too hot and causing inflation—a rise in prices that can eat up your cash’s value.

So when rates go up, what happens? Savings accounts might look good again. But loans cost more. Folks spend less, they save more, and businesses slow down on big buys. It’s tougher for risky investments, like some stocks, to do well because people play it safe. They don’t want to lose their hard-earned money if the economy cools.

Currency Value and Exchange Rate Dynamics Post-Policy Adjustments

Central bank moves can swing a currency’s value like a dance. Picture two countries, each with their own money dance. If one’s central bank hikes rates while the other doesn’t, the first country’s currency might become the star, rising up. Why does this matter to you? Well, it changes the game for buying things from abroad or traveling overseas.

Say the US Federal Reserve raises rates. The US dollar might climb because more people want it. They get more bang for their buck in interest. This can make importing stuff cheaper but selling abroad tougher. It’s a balance. Like a teeter-totter, there’s always a high and low side when money’s value changes.

For folks dealing with money from different places, this is big news. Investors and companies have to stay on their toes. Exchange rates can shift profits or losses in a blink. It makes the financial world a wild ride at times. And it’s not just about goods but also ideas and investments that zoom across borders.

Central banks’ steps can leave big footprints in your wallet and the world’s markets. Every rate tweak, every asset buy or sell-off, stirs ripples that touch stocks, housing, and even how much stuff costs. It’s like a financial butterfly effect. One flap from the central bank can make a storm—or sunshine—in your financial future.

Preparing for Financial Futures in Changing Monetary Climates

Strategies to Mitigate the Impact of Interest Rate Hikes

Think about times when you save cash. You want your savings to grow, right? But when central banks hike interest rates, loans cost more. Suddenly, it’s pricier to borrow for a house or a new car. This is just one effect of interest rate changes. Shops may raise prices, too. Shop owners face higher loan costs, which can lead to more costly goods for you.

Interest rate hikes can slow economic growth. People spend less because items cost more. Higher rates mean higher savings returns. Yet, people might not spend more despite saving more. They’re preparing for the higher costs ahead. This is a glimpse into the central bank policy outcomes that shape our daily lives.

Now, what can you do to shield your finances from these hikes? First, if you own a home and have a mortgage, think about refinancing. Do it before rates climb too high. This way, you lock in a lower rate. You avoid the spike and save money over time. Also, cut down on borrowing. Use cash or savings for big buys. This way, you avoid high interest from loans and credit cards.

Before a hike, some tend to invest in stable things. Those things don’t lose value quickly when rates go up. Think about bonds or savings accounts. These might not be exciting, but they’re safe. They can protect your money from the wild moves of a changing economy.

Understanding the Influence of Policy Rate Adjustments on Personal Finance

Now let’s talk about personal finance. Wonder how policy rate adjustments hit your wallet? Let’s say the central bank cuts the discount rate. Banks borrow money for less. They might let you borrow for less too. This means cheaper loans for homes or businesses. Sounds great! More money to spend or invest.

What happens when you have more cash? You can invest it. Maybe you buy property or shares in a company. If a lot of people do this, demand rises. Prices for homes and stocks can go up. It’s all connected to the central bank’s decisions.

Yet, not all rate adjustments are cuts. When rates climb, borrowing gets hard. You might get less money for your big plans. You may save more and wait for a better time to invest. This all ties back to inflation targeting results. Central banks use it to protect the value of money over time.

By understanding these basics, you can plan better for your future. You can adapt to rate changes, so they don’t catch you off guard. You stay in control of your money and your dreams. Always watch the news for decisions made by people like the Federal Reserve. They have a big say in what happens to your money. Remember, your financial well-being is in your hands. With a bit of knowledge and planning, you can stand strong, no matter the weather in the world of money.

We’ve walked through how money rules can shape our economy and your wallet. We learned how growth and rates are linked, and how big bank choices can ripple out fast. We peeled back layers on what happens when these banks twist the rate knob or play with big money flows.

Seeing how these policies move through markets and shift what your dollar can do is key. We also saw what it means to save or spend when financial winds change.

For your own money road ahead, knowing how to lessen rate hike hits matters. Your personal cash plans should flex with policy rate changes.

In closing, keep a keen eye on these economic cues. They guide your financial choices in powerful ways. Stay informed, stay ready, and make smart moves!

Q&A :

How does monetary policy influence economic growth?

Monetary policy plays a significant role in impacting economic growth by controlling the supply of money and interest rates. When a central bank, such as the Federal Reserve in the United States, lowers interest rates, it becomes cheaper to borrow money, which can stimulate investment and spending. Conversely, when interest rates are raised, borrowing costs increase, potentially slowing down economic activity. Adjustments to monetary policy can thus encourage spending and investment during economic downturns or cool off an overheating economy.

What are the main tools of monetary policy?

The primary tools of monetary policy include open market operations, the discount rate, and reserve requirements. Open market operations involve the buying and selling of government securities to influence the level of bank reserves and the overall money supply. The discount rate is the interest rate at which banks can borrow funds directly from the central bank, influencing lending rates across the economy. Reserve requirements refer to the amount of funds that banks must hold in reserve against deposits, which affects their capacity to create loans.

Can monetary policy affect unemployment levels?

Yes, monetary policy can have a significant effect on unemployment levels. When a central bank implements expansionary monetary policy, such as lowering interest rates or increasing the money supply, it can lead to greater demand for goods and services. This increased demand may prompt businesses to hire more workers, thereby reducing unemployment. On the other hand, contractionary monetary policy, aimed at reducing inflation by limiting spending and borrowing, could increase unemployment rates as economic activity slows and companies reduce their workforce.

Why is monitoring monetary policy impact important for investors?

Monitoring monetary policy impact is crucial for investors as it can influence a wide range of economic factors, including inflation rates, asset prices, and the overall business cycle. Changes in monetary policy can affect the yield on bonds, the return on savings accounts, and the performance of the stock market. By understanding the direction and implications of monetary policy changes, investors can make more informed decisions regarding their portfolios and adjust their investment strategies to manage risk and seize potential opportunities.

How do changes in monetary policy impact the exchange rate?

Changes in monetary policy can have a profound effect on a country’s exchange rate. If a central bank raises interest rates, it can lead to an appreciation of the nation’s currency, as higher rates may attract foreign investors seeking better returns on their investments. Conversely, if the central bank lowers interest rates, the currency may depreciate as investors look for higher yields elsewhere. Exchange rate fluctuations can affect the competitiveness of a country’s exports and the cost of imports, influencing the overall balance of trade.