Monetary policy and inflation are like oil and water; they don’t mix well, but with the right moves, we can achieve harmony. As an expert diving into the gritty details, I’ll show you just how central banks can cleverly dodge the curveballs inflation throws their way. It’s like having the playbook to a complex game where the stakes are high, and the audience is the entire economy. Ditch the confusion, it’s time to master the strategies that keep prices steady and your wallet happy. Buckle up; we’re taking the wheel to steer clear of inflation’s bumpiest rides.

Understanding the Role of Central Bank Strategies in Inflation Control

Assessing Central Bank Tactics: Inflation Targeting and Price Stability

Central bank strategies are key in guiding economies. These banks aim for stable prices. They target inflation rates to keep life affordable. Inflation targeting means banks work to keep inflation low and steady. Steady prices help people plan spending and saving. They can feel safe about their money’s value over time.

Inflation makes things cost more. So, central banks use special tools to keep it in check. They change interest rates to control spending and borrowing. High rates often mean less spending. It cools down a hot economy. But if rates drop, spending often goes up. This can help a slow economy wake up again.

The Balance of Expansionary and Contractionary Policies

Central banks have a tough job. They must pick the right policy at the right time. Expansionary policies are like stepping on the gas. These policies drop interest rates and can add money to the economy. Banks want more spending and lending this way. This helps when the economy is too slow.

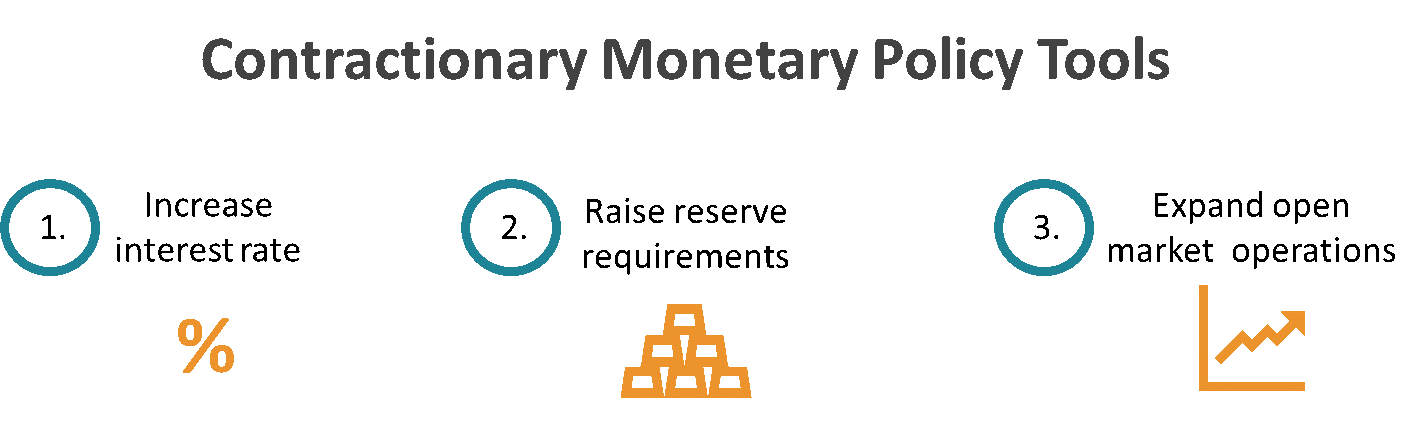

Yet, sometimes the economy is too hot. Prices may rise too fast. Then banks use contractionary policies, which is like hitting the brakes. They raise interest rates and may remove some money from the market. This aims to slow spending and borrowing. It’s tricky, but when done right, it keeps prices stable.

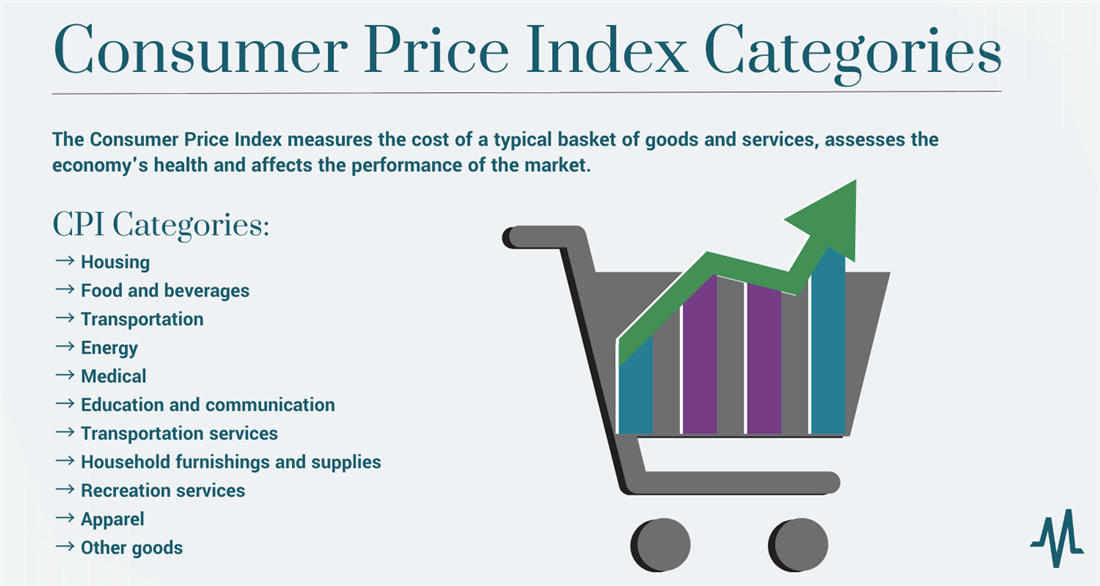

The consumer price index, or CPI, helps measure inflation. The CPI looks at the cost of everyday items. It tells us how much prices have changed over time. Banks watch the CPI closely. It guides them when they tweak policies to manage how the economy grows.

We see that expansionary and contractionary policies are like two sides of a coin. One revs up the economy, the other slows it down. The goal is always steady, manageable growth. What quite a balancing act, right?

It’s not just domestic policies that matter, though. The whole world is linked. So, banks also watch what happens globally. Events far away can touch our economy. By keeping their hands on the wheel, central banks steer us towards calm waters. We trust them to keep the economy safe and steady. They use rich experience and rigorous analysis. With these tools, they nip inflation threats in the bud.

Banks also work to avoid hyperinflation, when prices soar out of control. Keeping inflation just right protects jobs and savings. It also helps keep our future secure. If prices were to shoot up, it could hurt everyone.

Alright, let’s wrap our heads around this. Picture a juggler, with balls in the air. That’s like central banks managing the economy. They must keep all balls flying smoothly – inflation, interest rates, growth. If they drop one, it could mean trouble. But with skill, they keep everything moving just right. Now that’s some serious mastery, wouldn’t you agree?

Dissecting Interest Rate Policy and Quantitative Easing

Interest Rates as a Tool for Economic Adjustment

Let’s break down how interest rates work. Imagine it’s like a video game where the central bank controls the economy with a magic lever. That magic lever is the interest rate. When the central bank raises rates, it’s like telling everyone, “Hold on to your money, don’t spend too much!” This is called contractionary monetary policy. It helps cool things down when prices rise too fast.

What happens when rates drop? It’s like a huge sale at your favorite store – you want to spend more, right? This expansionary monetary policy encourages people and businesses to borrow and spend. That helps the economy grow but be careful! If we overdo it, too much money chases too few goods, and prices may shoot up. Not fun for your wallet.

Quantitative Easing: Stimulus Effects and Aftermath

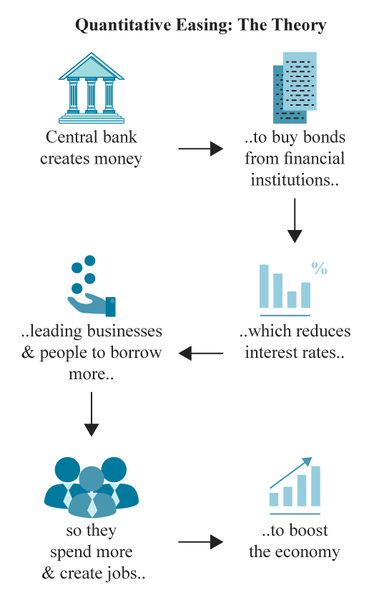

Now let’s talk about a big hitter called quantitative easing, or QE for short. It’s when the central bank buys tons of assets, like government bonds, to pump money into the economy. Think of it as an emergency energy drink for the economy when it’s snoozing and won’t wake up.

QE’s effects are huge. It can lower borrowing costs and make more money available for people to spend and invest. But, like a sugar rush, the aftermath can be tricky to deal with, lots of extra money floating around can mean higher prices later on.

QE is a tool we use when the normal stuff, like adjusting interest rates, isn’t enough to get the economy back on track. But once the economy is running again, it’s crucial to scale back or stop QE. If not? We risk too much inflation, which is when your money buys less pizza or ice cream than before – and that’s a bummer.

So, as you can see, central banks have a few cool tools to manage the economy. They play a balancing act with interest rates and QE to help keep prices stable, avoid big swings in inflation, and keep the economic gears turning smoothly. It’s not an easy job, but it’s super important to make sure we all can buy the things we need and enjoy without prices going wild.

Mechanisms for Regulating Inflation and Liquidity

Open Market Operations and Discount Rate Dynamics

Let’s talk about how we keep inflation in check. We use tools like open market operations. This is when we buy or sell government bonds. When we buy a lot, it puts more money out there. This can help when the economy is slow.

But, we sell bonds too. This takes in cash, slowing down money flow. This is part of what we call contractionary monetary policy. It’s a tap we can control. Using it, we can influence things like the inflation rate and how much stuff costs.

Another tool is the discount rate. It’s interest that banks pay to borrow money from central banks. When we change this rate, it can influence how much it costs to borrow money. This can make loans more or less attractive. It can also affect your ability to get a loan for a house or a car. We lower the rate to get things moving or raise it to cool things down. It’s all about balance.

Implementing Reserve Requirements and Asset Purchases

We also set rules for how much banks need to keep in hand. It’s called the reserve requirement ratio. When banks need to keep more cash, they have less to lend out. This can slow inflation and manages liquidity.

Then there’s quantitative easing. That’s when we buy assets, usually bonds, from banks. It pumps money directly into the banking system. This helps banks have more to lend. The goal is to boost spending and investment when usual methods fall short.

Asset purchases are big guns. We use them in tough times. They can kickstart things when interest rates are already low. This is worth remembering: too much easing, and we risk high inflation, maybe even hyperinflation. That’s too much money chasing too few goods.

Our end game is always price stability and a well-oiled economy. Each move we make is a step to get there. I hope this paints a clearer picture of what we do and why we do it. With these tools, we aim to keep inflation just right – not too hot, not too cold.

Forecasting and Managing Economic Health Amidst Inflationary Trends

The Interplay Between Inflation Forecasts and Unemployment Rates

Inflation can be a tricky beast to tame. Economists watch the consumer price index (CPI) like hawks. The CPI measures changes in the price of goods and services over time. But here’s the thing: inflation also hints at job numbers. When inflation goes up, it can mean more people are buying stuff. This could result in businesses hiring more workers. So, lower unemployment rates often follow.

But it’s not all high-fives and victory dances. If inflation jumps too high, too fast, everyone’s wallet feels the pinch. Prices on everything from apples to zoo tickets go up. Workers then want higher wages to keep pace. This can lead to what’s called a wage-price spiral. Imagine workers getting higher pay but still not being able to buy more because prices soar too. It’s a tough cycle to break.

To keep this dance between inflation and jobs in rhythm, central banks use different strategies. These include tweaking interest rates or scooping up assets to pump money into the economy, which is known as quantitative easing. The goal is to find that sweet spot. It’s where prices are stable enough for folks to plan their spending and save without fear.

Strategies to Hedge Against Inflation and Protect Economic Stability

Now let’s dig into protecting our cash from inflation. Think of inflation hedging like a big, sturdy umbrella in a rainstorm. One smart move is for a central bank to adjust interest rates. If inflation is too high, they bump up the rates. This cools people’s spending and borrowing. When rates are low, it’s the other way around. People are more likely to spend and invest.

Next up are bonds. Long-term treasury yields give us a hint about what folks think will happen with inflation. If yields are up, investors might be betting that inflation will rise. Remember, when inflation goes up, the value of money drops over time. Bonds with higher yields can help investors keep ahead of inflation.

But rates and bonds are just two pieces of the puzzle. Central banks also play around with how much money banks need to keep on hand, called the reserve requirement ratio. This way, they control how much money is zooming around in the economy.

Of course, they can’t just wing it. Ce

When it comes to money smarts, it’s about keeping our economy’s health in check. Mix smart strategies with a dash of planning, and we can keep inflation from raining on our parade.

We’ve dug into how central banks manage money stuff like inflation. From targeting stable prices to tweaking how much money flows in the economy, they’ve got a bunch of tools. They’ll shift interest rates to keep us on track, and sometimes they buy stuff in a big way to pump cash in when needed.

We peeked at how these big banks use rates and this thing called quantitative easing to tweak economic gears. Then there’s the daily moves they make, like trading stuff to keep cash levels just right or changing how much banks need to stash as backup.

Lastly, we looked ahead. How do these money heads figure out what’s coming? They mix stats like job numbers with guesses on price hikes to keep our wallets safe.

To cap it off, central banks have a hefty job keeping our cash from bouncing around too much. They’re like DJs, mixing the right tracks to keep the economy’s party jumping without a crash. Keep your eye on them; they’re doing big things to make sure our money stays cool, even when things get hot.

Q&A :

How does monetary policy affect inflation?

Monetary policy, which includes the management of interest rates and the total supply of money in circulation, is a critical lever that central banks use to control inflation. By adjusting these levers, a central bank can either encourage spending and investment to spur the economy or restrain it to cool down inflation.

What are the tools of monetary policy used to control inflation?

The main tools of monetary policy used to control inflation include adjusting the policy interest rate (such as the federal funds rate in the US), conducting open market operations, modifying reserve requirements for banks, and implementing unconventional policies like quantitative easing. These tools influence the rate of economic growth and the rate of inflation.

Can expansive monetary policy lead to higher inflation?

Expansive or expansionary monetary policy, which typically involves lowering interest rates and/or increasing the money supply, can lead to higher inflation if it results in an economy operating beyond its productive capacity. When demand outstrips supply, prices can rise, leading to inflation.

How does contractionary monetary policy help reduce inflation?

Contractionary monetary policy aims to decrease the money supply and increase interest rates to reduce economic activity. By doing so, it can help reduce consumer spending and investment, lower the pressure on prices, and ultimately bring down inflation rates.

What is the relationship between monetary policy and inflation targeting?

Inflation targeting is a monetary policy strategy where a central bank sets an explicit inflation rate goal. The relationship between monetary policy and inflation targeting involves adjusting interest rates and other monetary tools to steer the economy towards the desired inflation rate. This practice aims to maintain price stability and manage public expectations regarding inflation.