Security of Digital Payment Platforms: Are Your Transactions Truly Safe?

In the tap of a button or the swipe of a screen, money zips across the globe in seconds. But is it safe? Every day, millions trust digital payment platforms with their hard-earned cash, yet few consider the cogs and gears whirring behind each transaction.

Can we rely on the security of digital payment platforms as hackers grow smarter by the second? It’s not just about convenience; it’s the peace of mind that your financial details are locked down tight. Join me, as we delve deep into the world of digital transactions, from how they lock down your details, to what risks lie in wait.

We’ll unravel how encryption is the secret agent of security, why having multiple checks is not just for banks, and how you can make sure the only thing that’s mobile is your money. Whether you tap, swipe, or click to pay, let’s make sure it’s not just your coffee that’s safe, but every cent, too.

Understanding the Fundamentals of Digital Payment Security

The Role of Encryption in Safeguarding Transactions

Encryption is like a secret code. It scrambles data so bad guys can’t read it. When you pay with your phone or online, encryption keeps your info safe. Big words like “cryptography” may sound scary, but it’s all about making sure no one can steal your credit card number when you buy something.

Imagine writing a note that only your best friend can read. That’s what encryption does for your online buys. It changes your payment details into a code. Only the right person with the right key can read it. Cool, right?

We need strong codes to be really safe. These codes make sure your money goes to the right place. And don’t let anyone else see it. Banks and shops use special math to lock and unlock these codes. This math is part of what we call ‘transaction encryption methods’.

My job is to make these methods even better. So when you tap “buy”, you can smile, knowing it’s safe. I check different ways to make payments super secure online. Like that code, I make sure every ‘t’ is crossed to protect you.

Implementing Multifactor Authentication for Enhanced Security

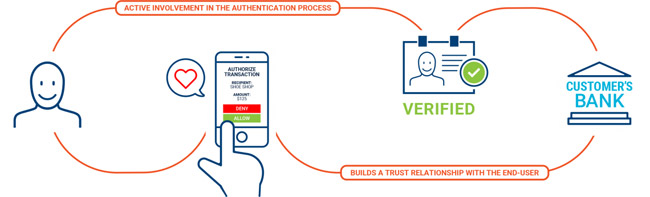

Have you ever used a lock with two keys? That’s what Two-factor authentication (2FA) is like. It adds an extra step to check if it’s really you who’s paying.

First, you enter your password. That’s key one. Then, key two could be a code sent to your phone or even your fingerprint. This two-key system makes it hard for hackers to get in.

When we add this to mobile payment security, we’re adding a big guard dog. It keeps watch and barks if a stranger tries to get your money. I work to put this guard dog at every door. Your online banking and digital wallet need the best guards.

I also teach people about ‘biometric authentication payments’. This is a fancy term for using your face or finger to approve buys. It’s more personal. No two faces or fingers are the same. This means better protection for you.

Protecting your payments is like being a cyber superhero. We use tools like SSL certificates and HTTPS protocol. They are like our capes and shields. They keep your money moves hidden from villains.

So, when you tap to pay, you’re safe. I’m always here, working to keep the bad guys out. You keep shopping, gaming, and doing your thing. Let me worry about making sure those payments are bulletproof.

Evaluating Mobile and Contactless Payment Risks

Securing Mobile Payment Applications Against Cyber Threats

When you use your phone to pay, you want it to be safe, right? Think of your mobile payment app like a digital wallet. Just as you wouldn’t want a hole in your physical wallet, you don’t want gaps in your mobile payment security. Hackers are always looking for ways to sneak in. That’s why encryption is so key. It scrambles your payment info, making it tough for bad guys to read. With strong encryption, even if cyber thieves get your data, they can’t use it.

Mobile payment apps must use tough security, like two-factor authentication. This means you need two proofs to show it’s really you — maybe a password and a fingerprint. And just like your home has locks, mobile apps need digital locks too. Secure Sockets Layer, or SSL, helps make sure your data travels safely.

With credit cards, tokenization adds another safety layer. Instead of sending your real card number, it sends a one-time code. Think of it as a secret messenger that carries your payment safely without revealing your card details.

But security isn’t just the app’s job. You also play a part. Always keep your app updated. Updates often fix security holes that hackers could use. Be aware, and don’t click on dodgy links or share your PIN.

Strengthening Contactless Payment Methods and NFC

Now let’s talk about waving or tapping your phone to pay. That’s using NFC, or Near Field Communication. It’s super handy but also attracts cyber snoops. Just like mobile apps, contactless payments need tough security. NFC payment risks are real, but with the right tech, like EMV chip technology, your payment info changes every time. So even if someone grabs your info from one transaction, they can’t use it again.

Biometric authentication for payments, like a fingerprint or face scan, also helps. It’s like a high-tech guard that only lets you in. And we can’t forget about strong customer authentication. It’s a new rule saying that online payments need multiple checks to prove it’s you.

Contactless payment protection also depends on things like digital wallet safeguards. These are built-in defenses in your phone that help keep your money safe. Think of it as a digital bodyguard for your transactions.

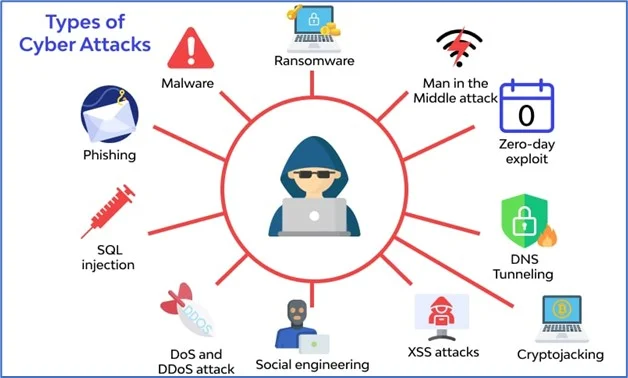

In the fight against cyber threats in e-commerce, we also need to look out for signs of phishing. Say no to emails or texts asking for your bank details or PIN. No real company will do that.

And if something seems off, trust your gut. Better to be safe and double-check, right? If we all stay sharp, we can keep our digital dollars secure and make paying with a tap or a click not just easy, but secure too.

Defending Against E-Commerce Cybersecurity Threats

Identifying and Protecting Against Payment Gateway Vulnerabilities

When you shop online, you trust the site to keep your pay details safe. But even the best sites can have weak spots, called payment gateway vulnerabilities. Hackers hunt for these to steal your data. So, how do you stay safe?

First, look for signs that the site is secure. One good sign is if the web address starts with HTTPS. This means they’re using a protocol that protects data as it travels from your computer to their server.

Next, think about how the site handles your pay card details. Do they keep it stored or do they use a method like credit card tokenization? This method swaps your real pay card numbers for a unique set of numbers. It keeps your card info hidden and makes it much harder for thieves to get.

Also, check if the site uses SSL certificates. These are like digital passports that prove a site’s identity and keep your data scrambled and unreadable to snoops. Remember, a protected payment process is your first shield against online threats.

Strategies for Robust E-Commerce Fraud Detection Systems

Now, let’s dive into keeping cyber thieves at bay with top-notch fraud detection systems. E-commerce sites must be smart and use systems that can tell if a buy is legit or fishy.

The best fraud systems watch for strange behavior, like a sudden big buy or a new shipping address. This helps them spot fraud before it happens. By doing this, they protect you and the business from losing money to scammers.

Using biometric authentication for payments is another strong move. This could mean scanning a finger or face before the buy goes through. It’s a personal lock that’s tough for imposters to break.

We also can’t forget about anti-phishing strategies. Be very careful with emails or messages that ask for your pay details. Phishing is like fishing; scammers lure you with fake messages to steal your info.

Always make sure you’re at the real site or app before you enter any personal data. Double-check the site’s address and look out for little mistakes that could mean it’s a fake.

Lastly, a multi-layer security approach is key. This means not just relying on one way to keep safe but having a mix of tactics. Think of it as having both a lock and an alarm on your house.

Remember, in the world of online shopping, threats are always changing. Keep your eyes open, use sites you trust, and check they take the right steps to keep your shopping trips safe and fun.

Ensuring Compliance and Preventing Fraud in Digital Payments

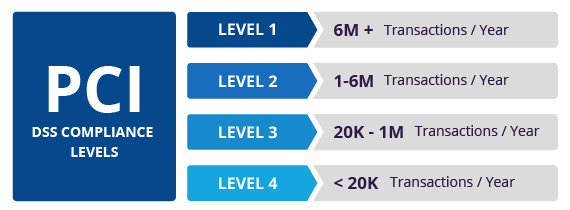

Compliance with PCI Standards and Data Protection Regulations

We keep our cash in banks for a good reason. It’s safe there, right? The same goes for digital payment safety. We must follow strict rules to keep our online cash safe too. One big rule is PCI compliance. PCI stands for Payment Card Industry. It’s a bunch of standards to protect card info. Think of it as a guard that watches over all card payments online.

Every business that takes card payments must follow PCI rules. If they don’t, they’re not safe to use. You wouldn’t leave your house door open, would you? Not following PCI rules is like leaving the digital door open for thieves.

To be PCI compliant, businesses need to keep up with security updates. It’s like getting a stronger lock for your door. They must also protect the card info they have. This means only people who need to see it, can. That’s like having a safe in your house.

Best Practices in Implementing Online Payment Fraud Prevention Techniques

Fraud is a tricky thing. It can come from anywhere at any time. That’s scary, right? But don’t worry. There are ways to fight fraud. One good move is using online payment fraud prevention techniques. These are like special moves that help keep your money safe. Like in games, when you have shields or special powers to protect your character.

First, there’s something called transaction encryption. This is like turning the money you send into a secret code. Only the person you’re sending money to can understand this code. This way, even if a thief sees the code, it’s no use to them.

Then, there’s two-factor authentication. Think of this like having two keys for one lock. Even if someone steals one key, they can’t open the lock without the second one. This makes it much harder for thieves to get to your money.

Using SSL certificates is also key. SSL stands for Secure Sockets Layer. This is a way to make sure the info sent between you and the website is safe. It’s like having a bodyguard for your info as it travels across the internet.

Lastly, we have credit card tokenization. This means turning your card details into random letters and numbers. It’s your card wearing a disguise so that fraudsters can’t recognize it.

All these are ways businesses keep your digital money safe. Think of them like heroes fighting to protect your treasure. They use shields, secret codes, and disguises. And they never stop getting better at defending against the bad guys. So you can trust that your transactions are truly safe.

Each method we use is a piece of a big puzzle. When put together, they make a shield that’s tough to break. That’s what we need in a world where digital payments are like the new cash. Keep these details in mind when you shop or pay online. It helps to know how your money stays safe out there!

In this blog, we dove into keeping digital payments safe. We checked out how encryption keeps our money talks secret and why using several checks gives better safety. We also eyed risks with tapping and clicking to pay. We learned to guard our phone pay apps and make tap payments firm.

Shopping online brings more threat-wary eyes on our cash flow. We got smart on finding weak spots in payment doors and rigged our systems to spot fake moves before they hit. Lastly, we tackled the rules. We now know how to play by payment laws and block the cheats.

Let’s keep our money talks locked down. Use these tips and stay one step ahead. Keep your eyes open, stay sharp, and pay smart. Together, we can beat the bad guys at their game.

Q&A :

Sure, here are the FAQ entries for the keyword “Security of digital payment platforms” designed for SEO optimization:

How do digital payment platforms protect my financial information?

Digital payment platforms typically use a variety of security measures to ensure that your financial information is kept safe. These measures include end-to-end encryption, which scrambles your data so it can’t be read by unauthorized parties, and tokenization, which replaces sensitive account details with a unique code during transactions. Additionally, they often require multi-factor authentication to verify your identity, and they use anti-fraud algorithms to monitor for suspicious activity. It’s important to check the specific security features offered by each platform.

What should I do if I suspect a security breach on a digital payment platform?

If you suspect that your account on a digital payment platform has been compromised, it’s crucial to act quickly. Immediately change your password and notify the payment platform’s customer service. It’s also recommended to monitor your financial statements closely for any unauthorized transactions. The platform itself likely has protocols in place to address breaches, so cooperating with their investigation can facilitate a quicker resolution.

Are contactless payment methods like Apple Pay and Google Wallet secure?

Contactless payment methods such as Apple Pay and Google Wallet utilize advanced security features to protect your information. They employ near-field communication (NFC) technology along with hardware-based security, such as Secure Elements, to store your payment information securely. Moreover, every transaction uses a one-time unique dynamic security code, adding an extra layer of security. In many ways, contactless payments can be even more secure than traditional magnetic stripe cards.

What is the role of PCI DSS in securing digital payment platforms?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. Digital payment platforms that adhere to PCI DSS guidelines are held to multiple stringent security measures, which include maintaining a secure network, protecting cardholder data, regularly monitoring and testing networks, and implementing strong access control measures.

How can I ensure my own security when using digital payment platforms?

To enhance your security when using digital payment platforms, always use strong, unique passwords for your accounts and enable two-factor authentication if available. Be wary of phishing scams and never click on suspicious links or provide your personal and financial information through unsecured channels. Make sure your devices are up-to-date with the latest security patches, and only use trusted networks when carrying out transactions. Being proactive about your own security practices goes a long way in protecting your digital financial dealings.