Signs of a stock market crash can sneak up like a thief in the night. But here, we shine a light on those shadowy red flags. I’ve seen markets soar and plummet, and I know that recognizing the signals early on is key to safeguarding your portfolio. This guide zeroes in on the crux, turning complex market patterns into simple, actionable insights. We’ll unpack market downturn indicators, decode bear market signals, and help you stay ahead of the game. Dive in as we dissect economic warning signs, from quiet whispers of impending crashes to the loud alarms of bubble symptoms. Stay with me, and together, we’ll navigate the tricky currents of interest rate effects and shifts in investor sentiment. They say knowledge is power — and in the market’s ebb and flow, it’s your best defense.

Understanding Market Downturn Indicators and Bear Market Signals

Recognizing Patterns in Market Downturn Indicators

Money talks. It gets loud before a market crash. You must listen close. Sharp eyes spot trouble first. Market downturn indicators flash red when risk is high. High market valuations are a clear yell. Overheated stock prices scream caution.

Watch trading volume closely. It shows if big money moves out. It’s a tell-tale sign. When volumes spike but prices drop, it’s a clue. Market volatility spikes are noisy. They warn us that prices may fall hard.

Always check the credit markets. Credit is like market fuel. Trouble there can mean a lot. It slows down everything. That’s a sure sign. Things might go south. Recall 2008? Credit markets dried up. Stocks took a big hit.

Look at earnings reports. If companies earn less, stocks may drop. A string of bad reports is a red flag. This means less money is made. Or it’s getting hard to make money. It catches investors off guard. So, share prices can fall.

Decoding Bear Market Signals for Timely Intervention

Bear markets don’t jump without a growl. They show signs. Knowing them can save your money. A bear market means stocks drop 20% from their high. It’s tough out there when this happens.

Interest rate hikes tighten the money flow. Stocks often don’t like that. The cost to borrow bites. It eats into profits. Investors get nervous. They might sell. Remember, high rates can cool down a hot market.

A shift in investor sentiment moves markets. If investors think things look bad, they sell. Stocks fall faster. Keep an ear out for their mood.

Lastly, watch for hard-to-see risks. Excessive leverage in stocks hides in plain sight. It’s risky. Too much borrowing can lead to a big sell-off. It’s like a stack of dominoes. One falls, they all might.

Stay sharp. Spot these signs. Keep your money safe. Remember, a wise investor always watches carefully.

Analyzing Economic Warning Signs and Stock Market Bubble Symptoms

Interpreting Economic Data for Predictive Clues

Let’s talk about understanding our economy. It’s like a sneak peek into the future. When we see unemployment rates go up, it often means trouble. More people without jobs can lead to fewer folks buying things. If GDP growth slows down, that’s another sign that our economic engine is not running full speed.

Why does this matter to us? Think of it like this: if the economy slows, businesses might not sell as much. This can hurt their profits, and that’s not good for stocks. Now, if you hear about inflation, that means things cost more. High inflation can be a warning sign too. It tells us that our money may not go as far.

We also need to watch the Federal Reserve, the group that decides interest rates. If they raise rates, it can cost more to borrow money. This can slow down spending and investment. And that can be tough on stocks! All these signs make up our economic warning list.

Identifying Stock Market Bubble Symptoms Before They Burst

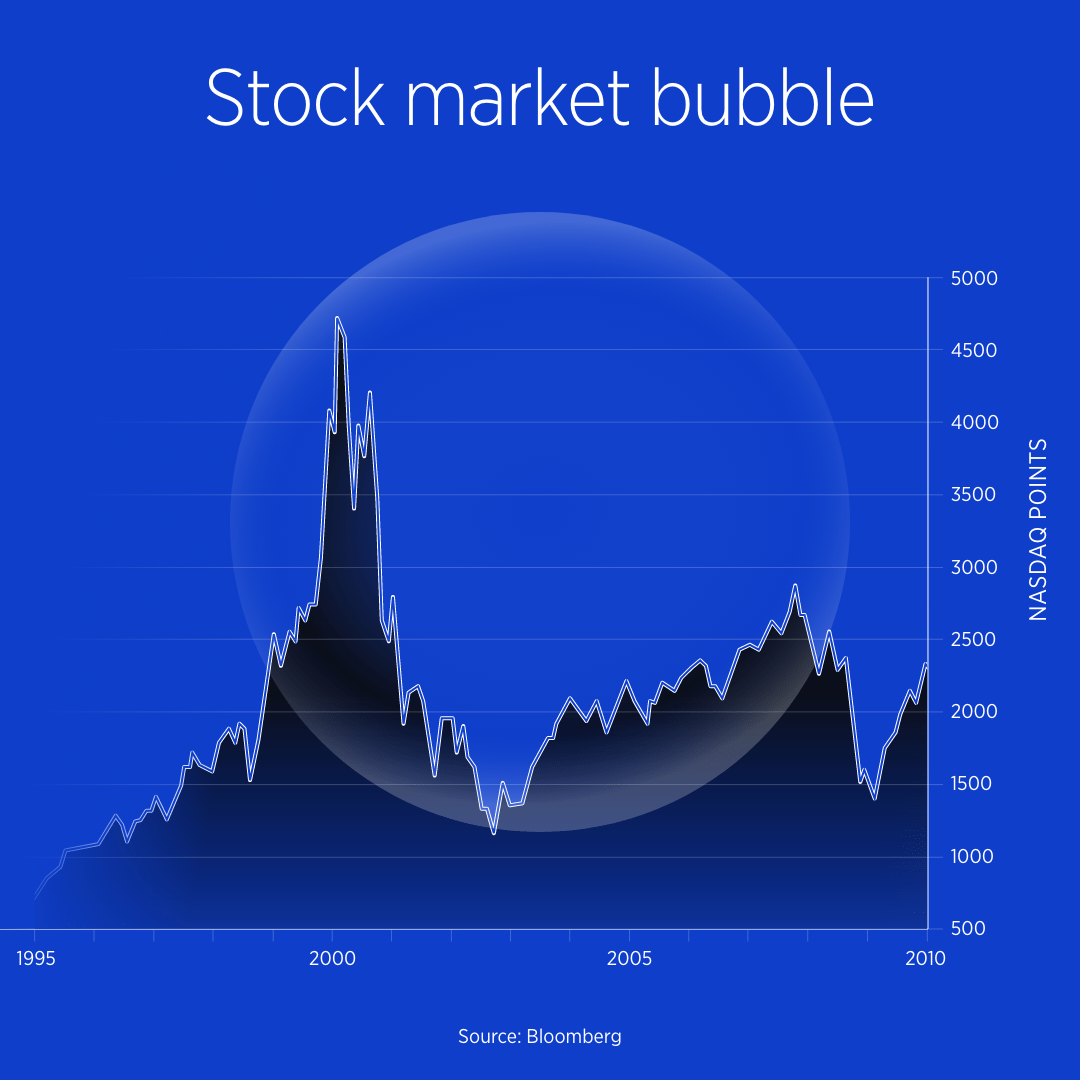

Next, let’s find those sneaky bubbles. Stock market bubbles are like balloons. They get too big and then pop! When stock prices go way up without good reason, watch out. We call this overheated prices.

How do you spot them? Look for stocks or sectors that blast off in price while the rest of the market doesn’t. This can smell like a bubble. Also, if everyone and their dog is investing in the same hot stock, caution!

Keep an eye on what the big money players are doing too. Hedge funds and big investors can push prices up, but when they start selling, be ready. If you see lots of people using borrowed money (leverage) to buy stocks, it’s a risk. Too much borrowing can lead to big trouble if prices drop.

Sometimes everyone wants to sell their stocks at once, which we call a sell-off. This can push prices down fast. PE ratios can also give us clues. If the PE ratio is super high compared to history, stocks might be too pricey.

So friends, to stay safe, we need to learn these signs. It’s like knowing the weather before a storm. You wouldn’t go out on a boat without checking the forecast, right? Treat your investments the same way. Watch the signs, be smart, and you can keep your money safe when the sky gets dark on Wall Street.

Assessing the Impacts of Interest Rate Hikes and Investor Sentiment Shifts

Interest Rate Hike Implications on Equity Valuations

When interest rates rise, stocks may lose steam. Why? Well, borrowing cash gets pricey. Firms can’t invest or grow as easy. This cost creeps into their profits. And when profits dip, so can stock prices. Higher rates can mean lower stock demand too. This can lead to a wider market drop. People fear losing money, so they sell.

We also watch the PE ratio warnings. A high PE ratio suggests stocks are costly. It means you pay a lot for each dollar of profit. When rates climb, these high PE stocks often fall hard. They’re built on hope, not solid results. Hope fades when cash costs more.

But high rates hit your wallet too, not just firms. Loans for homes and cars cost more. You may spend less on other things. Less spending can slow down the economy. Slow growth scares investors. It makes them think twice about buying stocks.

The Role of Investor Sentiment in Market Volatility

Investor mood swings matter a lot. It’s like a big crowd at a game. If fans are happy, the noise is good. But when the mood flips, fear spreads fast. One bad news piece can start a panic. This can spark a quick sell-off in stocks. Prices can drop hard and fast.

We see this in market volatility spikes. These are sudden, big swings in stock prices. Up and down, sharp and scary. It happens when investors all rush to sell. This rush can echo bigger troubles. It’s like many people running to the bank to pull out cash at once. It’s a sign they don’t trust the bank, or in our case, the market.

Investor sentiment shift shows in trading volume too. It’s like a store counting customers. More customers usually means good business. In stocks, busy trading can signal big interest. But watch for the odd days. If everyone’s selling but no one’s buying, it can mean trouble. It points to a dive in trust and a possible crash.

Market drops can be like weather changes. Quick gusts can signal a storm coming. In markets, these gusts are quick price drops. A storm in markets can clear out cash fast. It can turn a sunny economy cloudy in no time.

Remember, knowing is half the battle. Seeing these signs early can help you. You can get to safe ground before the storm hits. Be smart, keep an eye on rates and mood swings. Be ready to act when these signs show up. Your money will thank you for it.

Evaluating Advanced Indicators: Margin Debt Levels and Yield Curve Inversions

The Significance of Margin Debt Levels in Market Dynamics

Let’s talk about margin debt. It’s money people borrow to buy stocks. When it’s high, it means lots of borrowing. If prices drop, those people might have to sell fast. This can push prices down even more. It’s a cycle that may cause big problems in the stock market. It’s like when your friend borrows money to buy something big. If they have to pay it back quickly, they might have to sell it fast for less money. That’s not good for anyone. Watching margin debt is smart. It’s like keeping an eye on the playground. When too many kids play rough, someone might get hurt. It’s a sign the market might take a tumble.

Yield Curve Inversion: A Precursor to Economic Downturns

Now, let’s talk about yield curves. This happens when short-term investments pay more than long-term ones. This is not normal. It’s a warning that people expect less money in the future. It can mean a big problem is coming, like an economic downturn. Think of it like this: You have two candy bars. You say, “I’ll give you one candy now or two candies if you wait.” Usually, waiting is better because you get more. But if people take the one candy now, they might think something’s up. Maybe they think there won’t be any candy later. It’s like that with money in the economy too. People getting more money now than later—that’s a yield curve inversion. It has a history of coming before recessions, those times when the economy does not do well. If you hear about an inverted yield curve, pay attention. It’s like when you see clouds getting dark. Rain might be on the way. Keep that umbrella close, just in case, you know?

By watching things like margin debt and yield curve, we can spot trouble early. It lets us get ready and maybe stop a little fall from becoming a big crash. It’s all about staying safe and making smart moves.

In this post, we’ve tackled key signs pointing to market downturns and bear markets, including pattern recognition and decoding signals for smart moves. We’ve also dived into economic warning signs and the telltale symptoms of stock market bubbles. Plus, we’ve explored how interest rate hikes and shifts in investor feelings stir the pot in market values and volatility.

To cap it off, we examined margin debt and yield curve inversions—two advanced indicators savvy investors watch closely. These can signal a need to adjust your strategies. Keep an eye on these elements. They could save your portfolio when the financial weather turns stormy.

Remember, the market sends hints before it takes a dive. Learn the signs, stay alert, and be ready to act. That’s the smart way to tackle investing in a world where change is the only constant. Happy investing!

Q&A :

What are the typical warning signs of an impending stock market crash?

There are several indicators that investors and analysts look out for as potential warning signs of a market downturn. These can include significant overvaluations of stocks, where share prices are not in line with the underlying company earnings, often represented by a high price-to-earnings (P/E) ratio. Other signs may include a widespread speculative investment behavior, high levels of market margin debt, and sudden sharp drops in market-leading stocks. Economic factors such as rising interest rates, inverted yield curves on government bonds, and excessive borrowing can also serve as precursors to a stock market crash.

How can I protect my investment portfolio from a stock market crash?

To safeguard your investments against a market crash, diversification is key. This means spreading your investment across various asset classes such as stocks, bonds, commodities, and real estate. Additionally, investors should consider having a portion of their portfolio in defensive stocks, which tend to be less volatile during economic downturns – such sectors include utilities, healthcare, and consumer staples. Setting stop-loss orders can also help to limit potential losses. Lastly, maintaining a long-term perspective and resisting the urge to make impulsive decisions based on short-term market movements is often advised by financial experts.

Can economic indicators predict a stock market crash?

Economic indicators can provide insight into the health of the economy, which in turn can impact the stock market. Indicators such as GDP growth rates, unemployment rates, consumer confidence indices, and inflation rates all paint a picture of economic conditions. While no single indicator can predict a stock market crash with certainty, a combination of negative economic data can suggest increased risk. For example, a significant decline in GDP, coupled with rising unemployment rates and low consumer confidence, may indicate an economic recession that could precipitate a stock market crash.

What was the impact of previous stock market crashes on the economy?

Historical stock market crashes have often led to or exacerbated already challenging economic conditions. The infamous Great Depression was in part triggered by the 1929 stock market crash. The 1987 Black Monday crash, while not causing a significant depression, still impacted investor confidence and market liquidity. The dot-com bubble burst in the early 2000s, and the 2008 financial crisis led to deep recessions, massive unemployment, and a global financial turmoil. These events underscore the profound impact that stock market crashes can have on the wider economy, affecting both businesses and consumers.

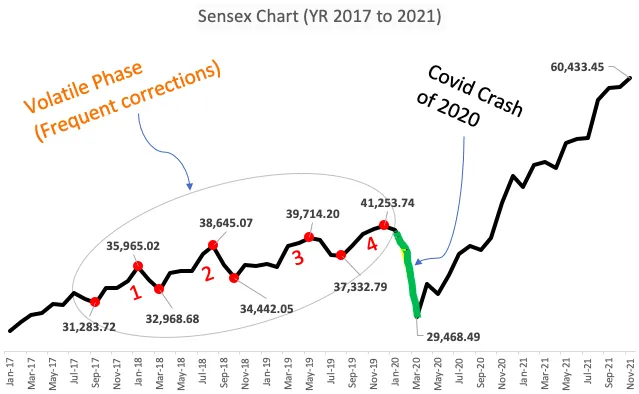

Are there historical patterns in stock market crashes that investors should be aware of?

Although each stock market crash has unique triggers and circumstances, some historical patterns and cycles have been identified. For instance, bull markets often precede crashes, as over-optimism and speculative trading inflate stock valuations. Similarly, new technology or financial instruments may lead to rapid market expansion followed by a collapse, as was seen in the dot-com bubble and the subprime mortgage crisis. Market psychology and behavior also tend to follow certain cycles of optimism and pessimism, known as investor sentiment. Nonetheless, it is important to remember that history does not predict future events with certainty, and patterns should be considered alongside current market conditions.